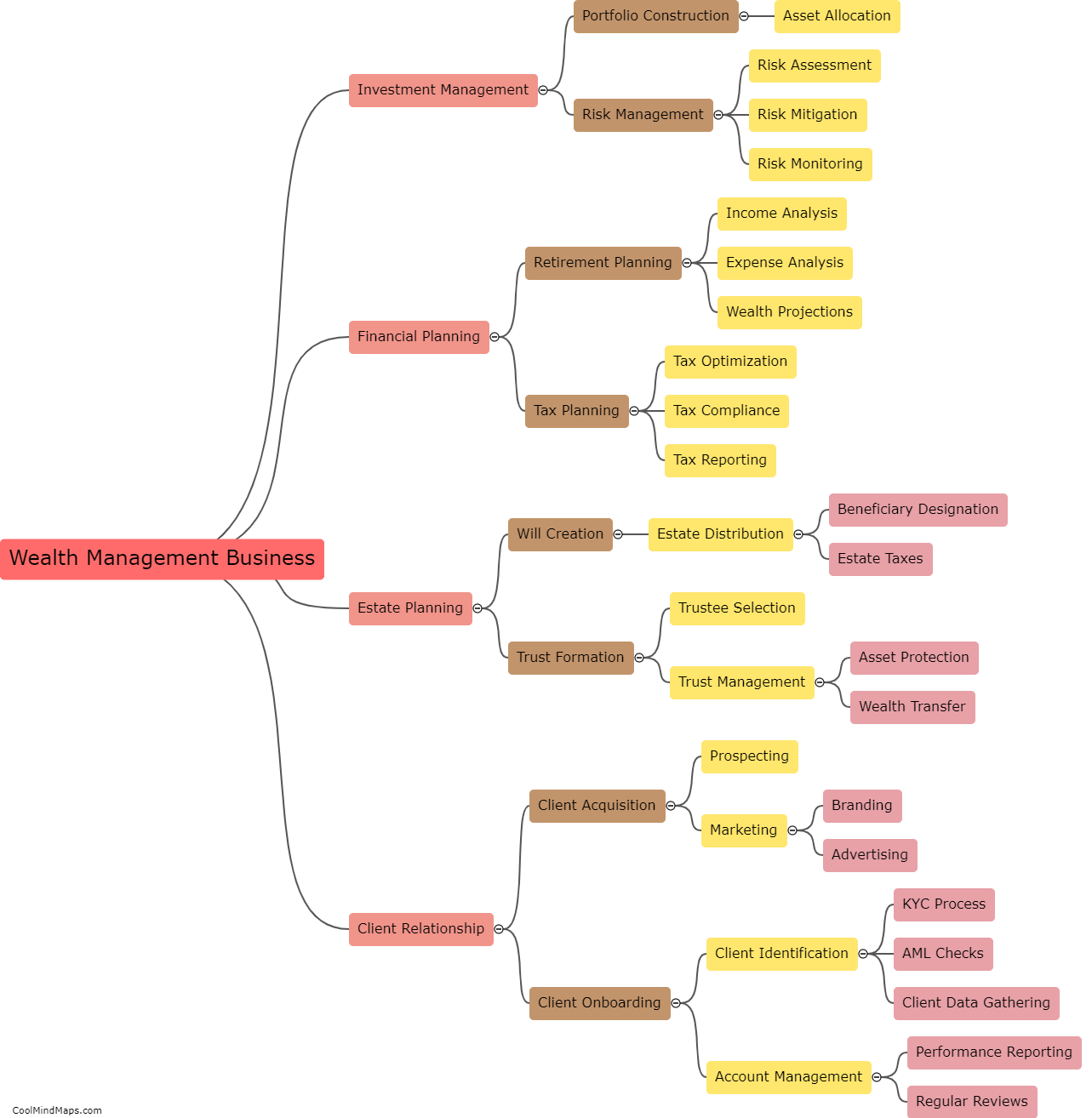

What are the key components of a wealth management business?

The key components of a wealth management business typically revolve around the core pillars of financial planning, investment management, and estate planning. Financial planning involves assessing a client's current financial situation, setting goals, and creating a strategic roadmap to achieve those goals, considering factors like retirement planning, budgeting, risk management, and tax planning. Investment management focuses on developing personalized investment strategies that align with the client's risk tolerance, time horizon, and financial objectives. This may include portfolio design, asset allocation, diversification, and ongoing monitoring and rebalancing. Lastly, estate planning encompasses helping clients with transferring their assets to future generations efficiently by establishing wills, trusts, and tax-minimization strategies. Additionally, other components such as philanthropy, insurance planning, business succession planning, and specialized services for high-net-worth individuals may also be part of a comprehensive wealth management offering.

This mind map was published on 19 August 2023 and has been viewed 113 times.