What are the main mathematical concepts in quantitative finance?

Quantitative finance combines mathematical tools and concepts with financial modeling to analyze and manage risks in financial markets. There are several key mathematical concepts that underpin this field. First is probability theory, which helps in understanding and quantifying uncertainty and randomness in financial markets. This is crucial for pricing and hedging derivatives. Stochastic calculus is another important concept, which uses calculus techniques to model the evolution of financial variables over time. It is particularly valuable in building models for option pricing and risk management. Linear algebra and optimization play a vital role in portfolio theory and asset allocation, helping to solve complex optimization problems and analyze the relationships between different assets. Lastly, time series analysis and statistical modeling are essential for understanding and forecasting market trends and volatility patterns. Overall, a strong foundation in mathematical concepts is essential for successfully navigating the complex and ever-changing landscape of quantitative finance.

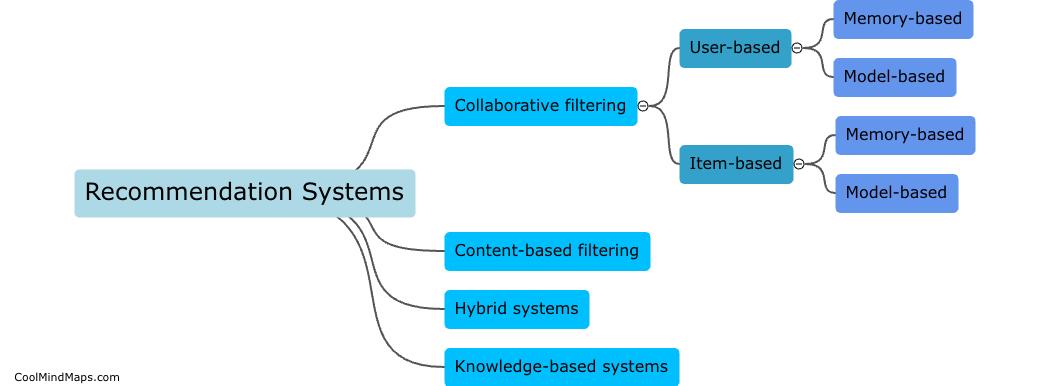

This mind map was published on 3 February 2024 and has been viewed 88 times.