What is the definition of the Houlihan effect?

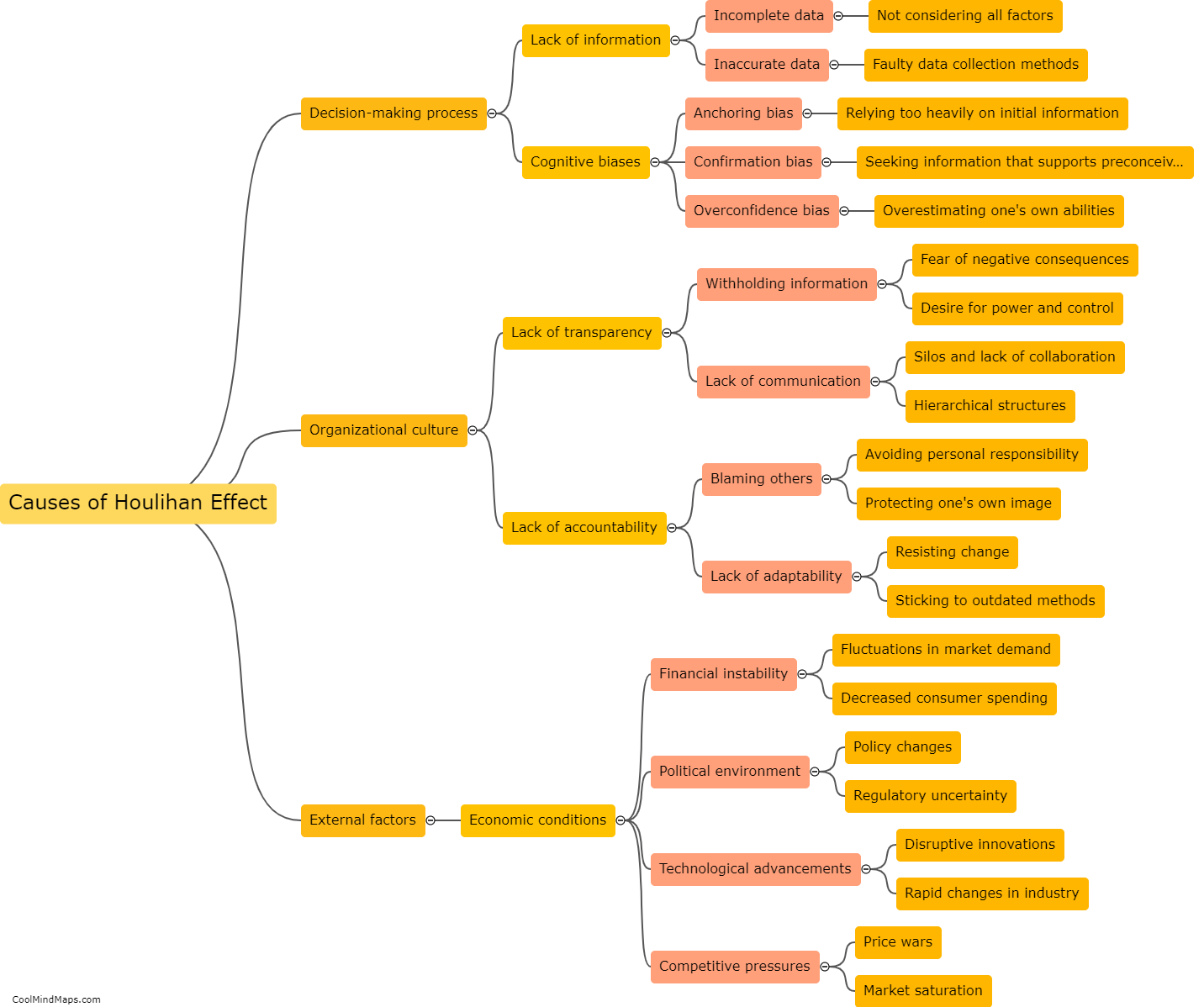

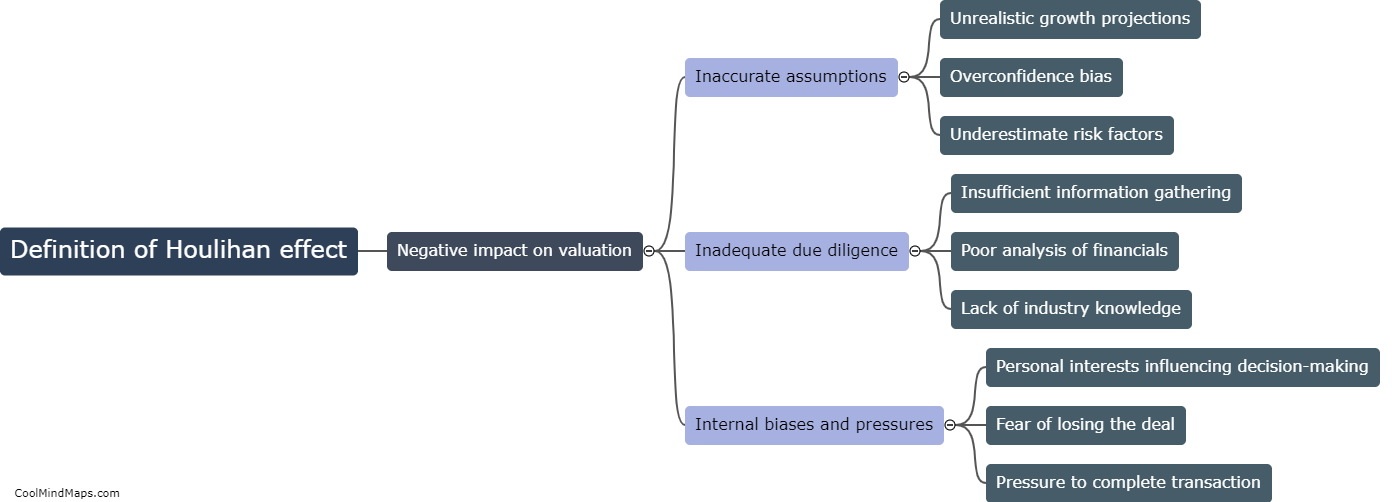

The Houlihan effect, also known as the Houlihan Lokey effect, refers to a phenomenon in financial markets where the stock price of a company experiences a sudden and drastic decline following the announcement of an engagement with the investment bank Houlihan Lokey. This effect gained recognition due to a series of incidents where companies saw their share prices drop significantly upon disclosing that they had hired Houlihan Lokey as their financial advisor. The Houlihan effect is often considered a curious anomaly as it contradicts the conventional expectation that the appointment of a reputable investment bank should actually boost a company's stock price. While the exact reasons behind this phenomenon remain unclear, some suggestions include concerns about companies with deteriorating financial health turning to Houlihan Lokey for assistance or market participants speculating about potentially negative news being revealed as a result of the engagement.

This mind map was published on 15 November 2023 and has been viewed 83 times.