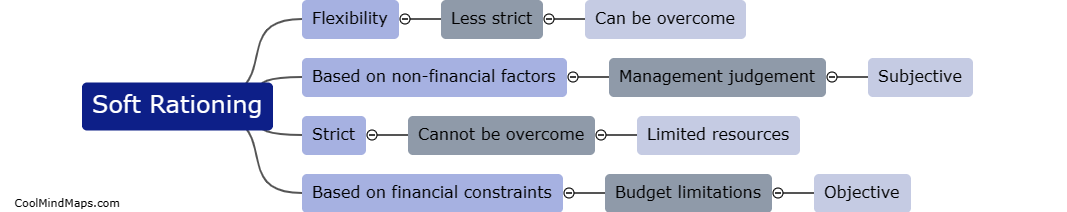

What is capital rationing?

Capital rationing refers to the practice of limiting the amount of funds allocated for capital expenditures or investment projects within a company. It involves setting a maximum budget or restriction on the amount of capital that can be allocated to various projects to ensure optimal utilization of available resources. Capital rationing is often done when a company has limited funds or when management wants to prioritize specific projects with higher potential returns. By implementing capital rationing, organizations can carefully select and allocate resources to projects that align with their strategic goals and offer the best return on investment, thereby maximizing the overall value of their capital investments.

This mind map was published on 14 November 2023 and has been viewed 91 times.