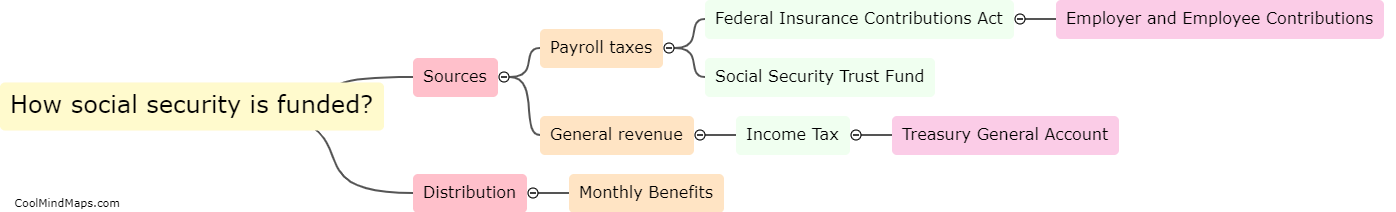

How social security is funded?

Social security is funded through a combination of payroll taxes and general revenues. Employees and employers each contribute a percentage of the employee's salary to the Social Security trust fund, which is used to fund retirement, disability, and survivor benefits. The tax rate for Social Security is currently 6.2% of earnings for employees and 6.2% for employers, for a total of 12.4% of wages. Additionally, Social Security is funded through general revenue sources, such as income taxes and interest earned on the trust fund's investments. These funds are used to cover any shortfalls in the program and support the Social Security system.

This mind map was published on 2 June 2023 and has been viewed 148 times.