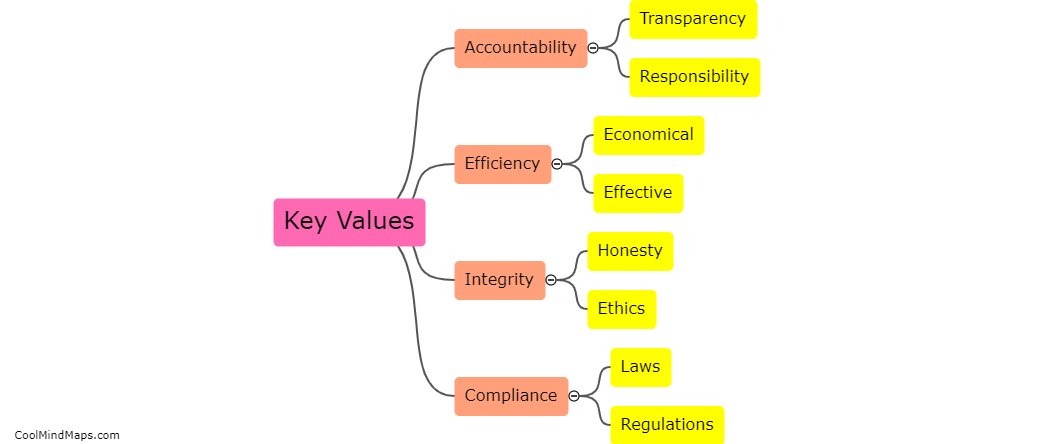

What are the penalties for non-compliance with the Fiscal Procedures & Financial Accountability Act?

The penalties for non-compliance with the Fiscal Procedures & Financial Accountability Act can vary depending on the jurisdiction and the severity of the violation. Typically, these penalties aim to deter and punish individuals or organizations that fail to adhere to the established fiscal procedures and financial accountability standards. Penalties can include fines, monetary sanctions, revocation of licenses or permits, probation, and even imprisonment in some cases. Additionally, non-compliance can lead to reputational damage, loss of business opportunities, and limited access to government contracts or funding. The objective of these penalties is to ensure responsible financial management and promote transparency, accountability, and integrity in public financial matters.

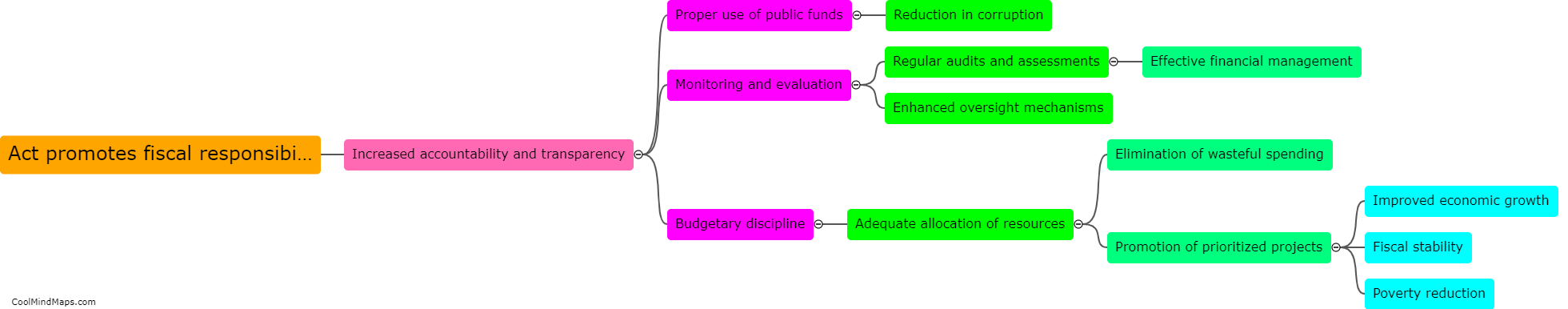

This mind map was published on 28 November 2023 and has been viewed 41 times.