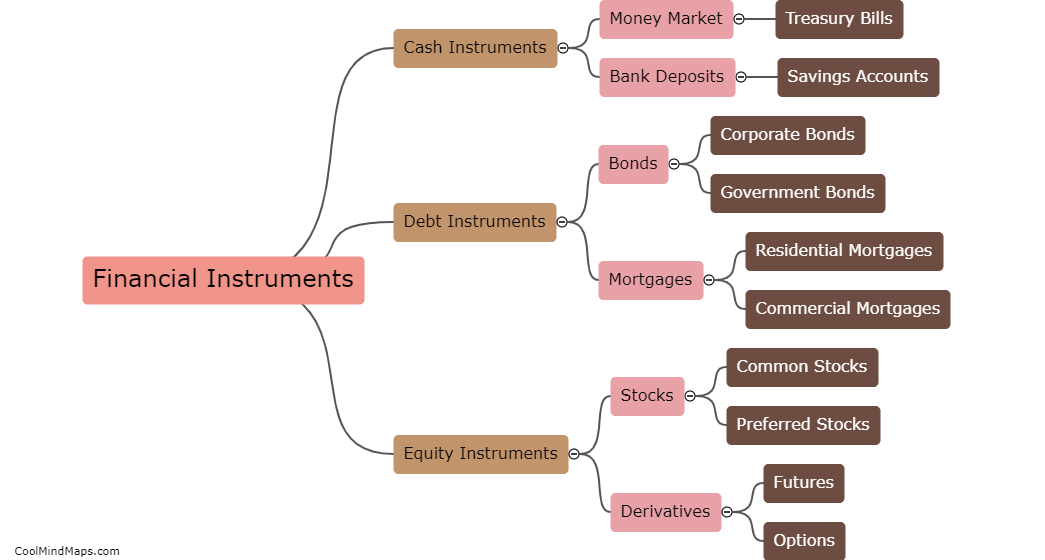

Types of financial instruments

Financial instruments are assets that can be traded or used for investment purposes. They can be divided into two main categories: debt securities and equity securities. Debt securities include bonds, certificates of deposit and treasury bills, which represent a loan that is paid back with interest. Equity securities, on the other hand, includes stocks and mutual funds, which represent ownership in a company. Within each category, financial instruments can be further classified as fixed or variable, derivative or non-derivative, or secured or unsecured. Each type of financial instrument has unique properties that make them suitable for different investment strategies and goals. As such, investors are advised to have a clear understanding of the various types of financial instruments and their associated risks before making an investment decision.

This mind map was published on 2 June 2023 and has been viewed 153 times.