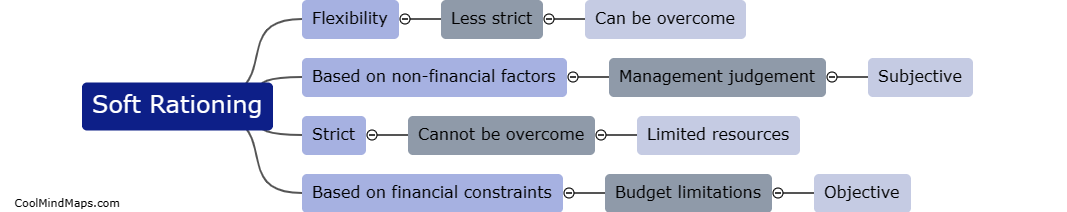

What are the differences between soft and hard capital rationing?

Soft capital rationing refers to a situation where a company voluntarily imposes restrictions on its capital budgeting process, despite having access to funds from internal and external sources. This decision can be based on factors such as risk aversion, uncertainty in the market, or a desire to maintain financial flexibility. This approach allows the company to carefully allocate its resources and prioritize its projects based on their potential return on investment. In contrast, hard capital rationing occurs when a company faces external constraints, such as limited availability of funds from external sources or strict borrowing limits set by financial institutions. In such cases, the company may be forced to reject viable investment opportunities due to a lack of financial resources. Hard capital rationing can significantly impact a company's growth potential and ability to undertake profitable projects.

This mind map was published on 14 November 2023 and has been viewed 116 times.