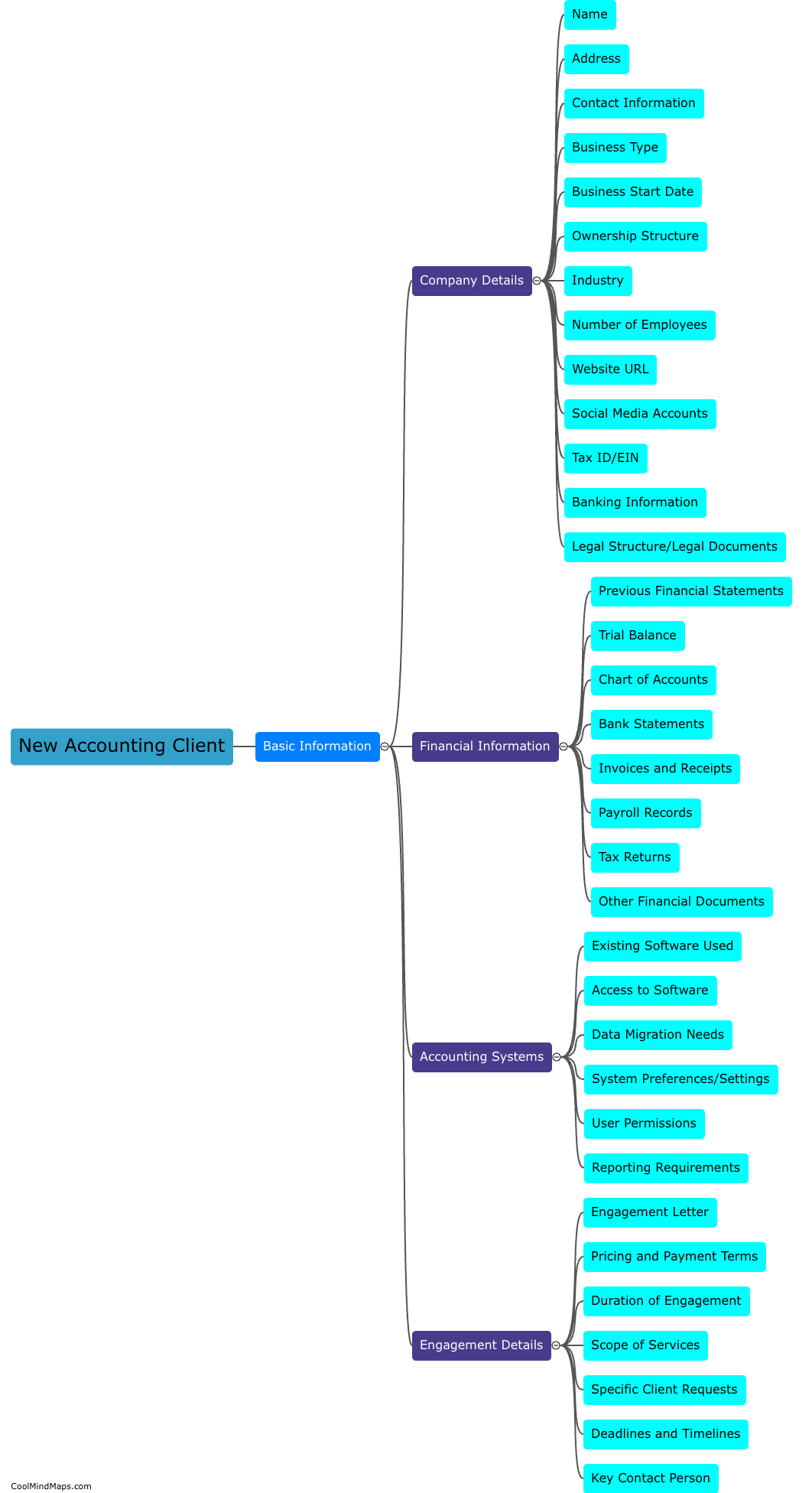

What information is needed to set up a new accounting client?

Setting up a new accounting client requires gathering specific information to establish an accurate and comprehensive financial record. First and foremost, the client's basic details such as their name, address, and contact information are necessary. Additionally, their business structure and incorporation documents, if applicable, should be obtained. Important financial information includes previous tax returns, current balance sheets, income statements, and bank statements, which assist in assessing the client's financial health. Furthermore, access to the client's accounting software, passwords, and relevant login credentials are vital for efficient collaboration and data sharing. Understanding the client's specific industry, services, or products is also essential to tailor the accounting services accordingly. By acquiring these essential pieces of information, an accounting professional can begin to establish a strong foundation for their client's financial management and advisory needs.

This mind map was published on 8 August 2023 and has been viewed 127 times.