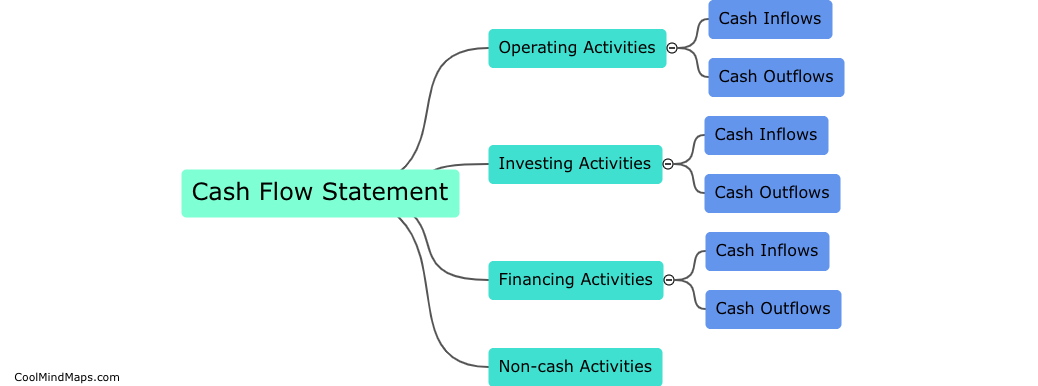

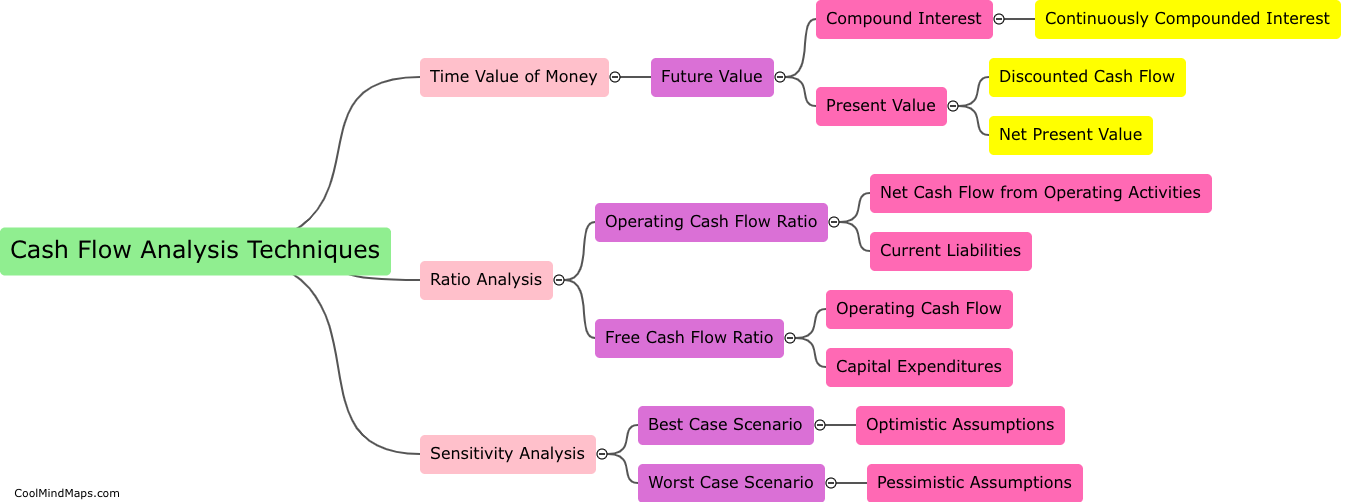

Cash Flow Analysis Techniques

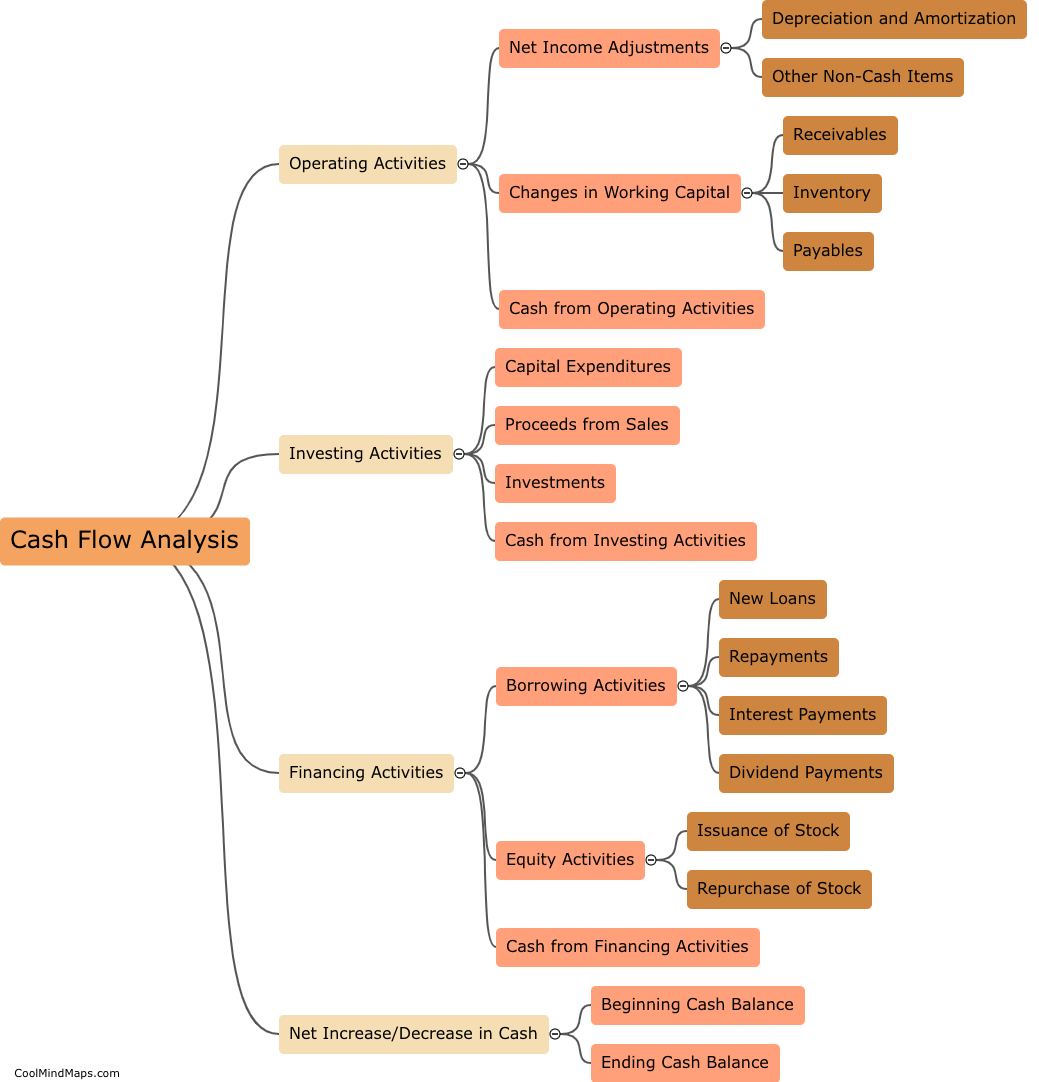

Cash flow analysis techniques are used by businesses to evaluate their cash inflows and outflows, helping them to better manage their finances. These techniques can include creating cash flow projections, analyzing historical cash flows, assessing working capital, and determining the cash conversion cycle. By using these techniques, businesses can gain insights into their financial health and make more informed decisions about their operations, such as identifying areas where they can reduce expenses or improve cash inflows. Overall, cash flow analysis techniques are essential tools for businesses seeking to optimize their financial performance and maintain steady cash flows.

This mind map was published on 24 April 2023 and has been viewed 103 times.