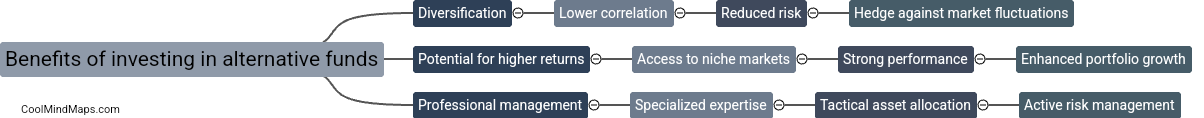

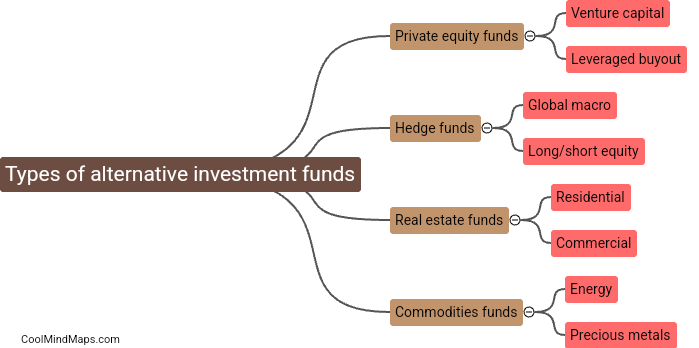

Types of alternative investment funds

Alternative investment funds encompass a wide range of investment strategies and asset classes outside of traditional stocks and bonds. Some common types of alternative investment funds include hedge funds, private equity funds, real estate investment trusts (REITs), and commodities funds. Each of these funds presents unique opportunities for diversification, potentially higher returns, and tailored investment strategies to meet specific investor objectives. Alternative investment funds often have higher fees and minimum investment requirements compared to traditional investment options, but for those willing to take on additional risk, they can offer the potential for greater rewards.

This mind map was published on 3 April 2024 and has been viewed 81 times.