What financial considerations should be taken into account when planning for retirement?

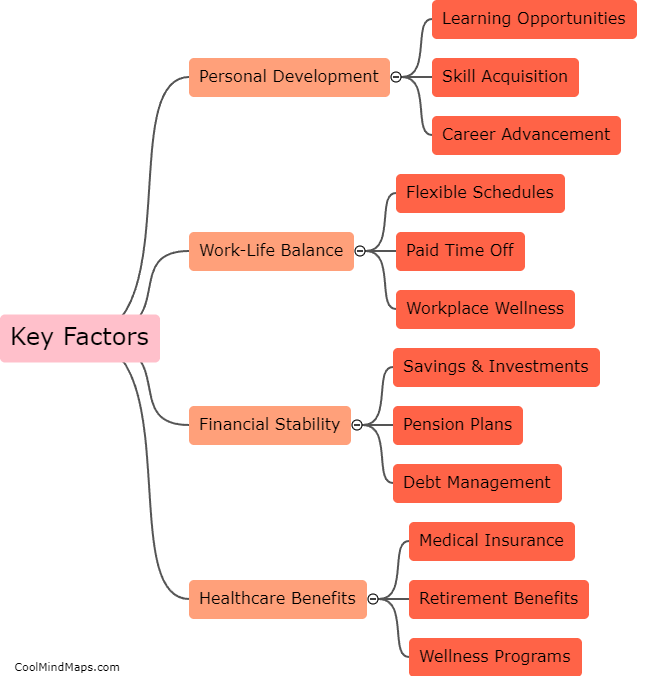

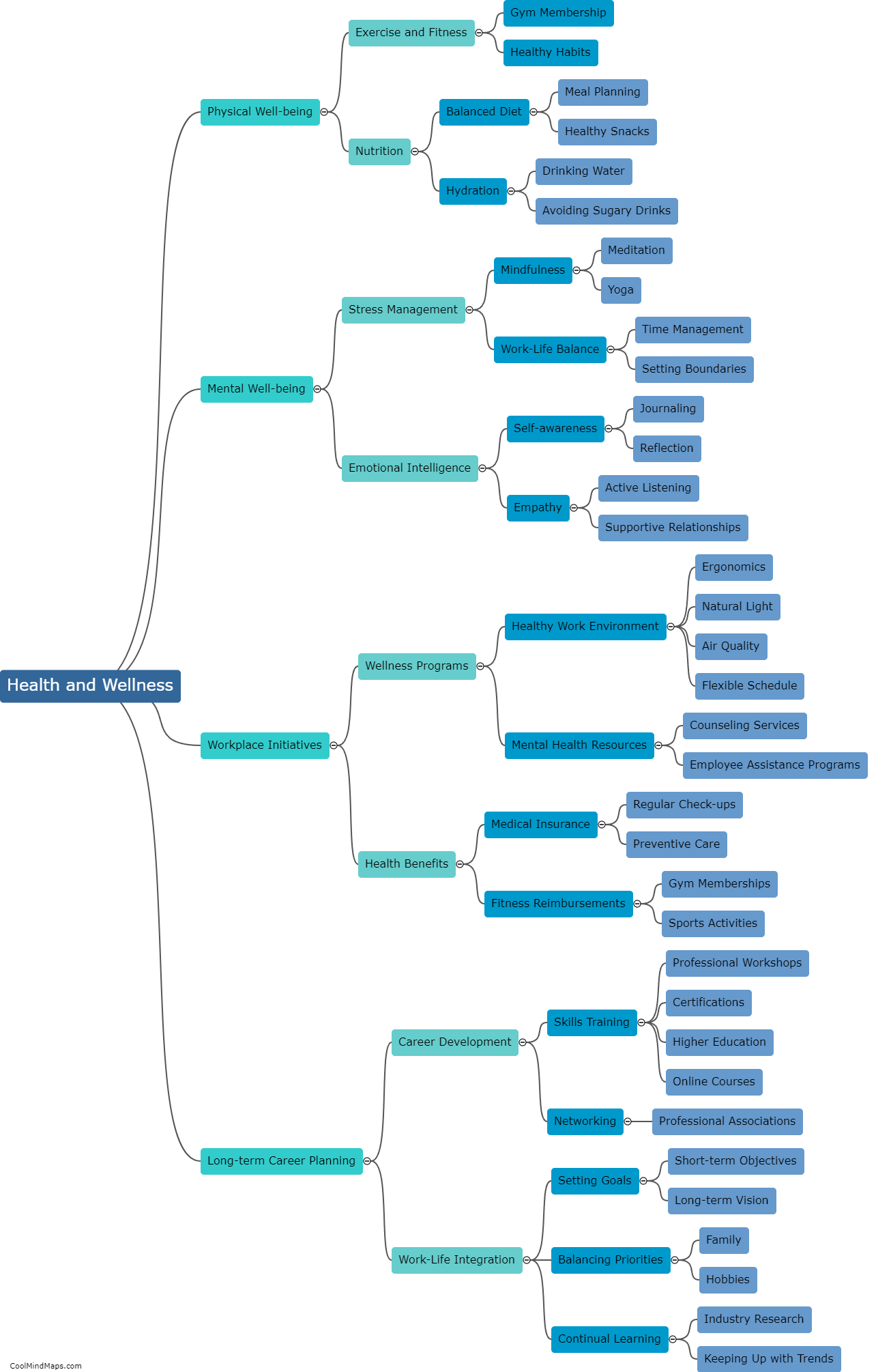

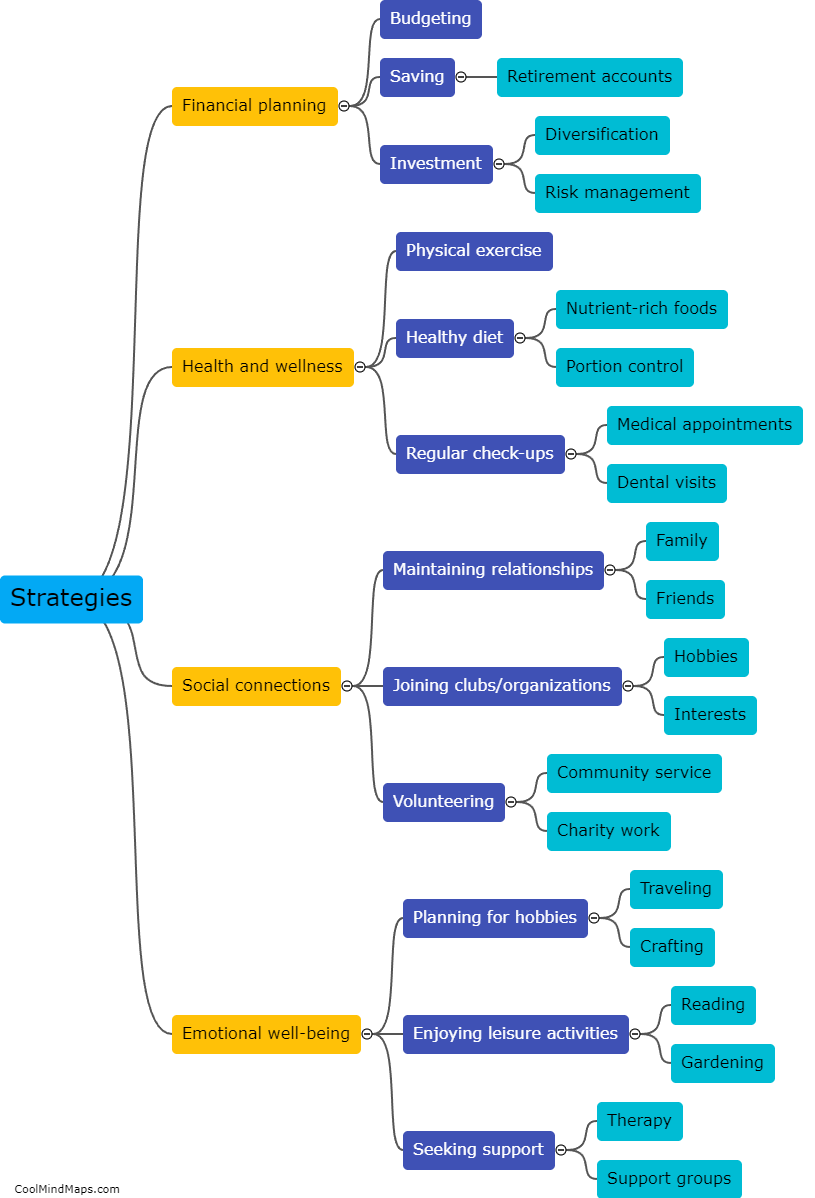

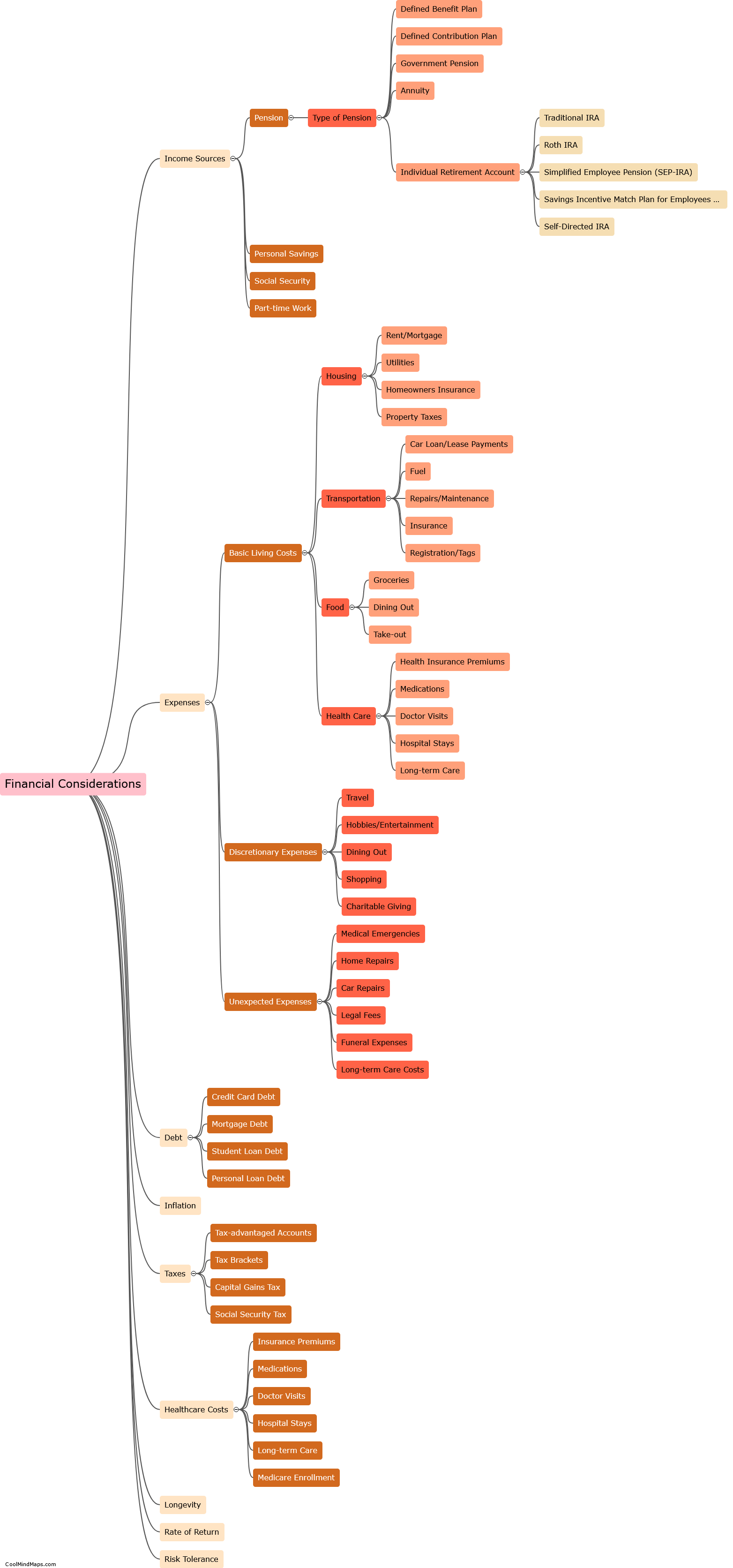

When planning for retirement, there are several important financial considerations that need to be taken into account. Firstly, individuals should evaluate their current savings and investments to determine if they are on track to meet their retirement goals. This involves assessing the size of their retirement nest egg and considering factors such as inflation and the length of retirement. Additionally, individuals should consider their expected sources of income during retirement, such as pensions, Social Security benefits, or part-time work. It is crucial to have a clear understanding of the expected income streams and assess their adequacy to cover expenses during retirement. Moreover, managing debt and ensuring it is paid off prior to retirement is essential to reduce financial burdens and allow for a more comfortable retirement. Lastly, it is wise to consider healthcare costs, as medical expenses tend to increase with age. Therefore, including healthcare costs in retirement planning and exploring options like long-term care insurance can provide peace of mind and financial stability in the later years of life. Overall, having a comprehensive understanding of one's financial situation, income sources, debt management, and healthcare costs are key considerations when planning for a secure retirement.

This mind map was published on 30 August 2023 and has been viewed 166 times.