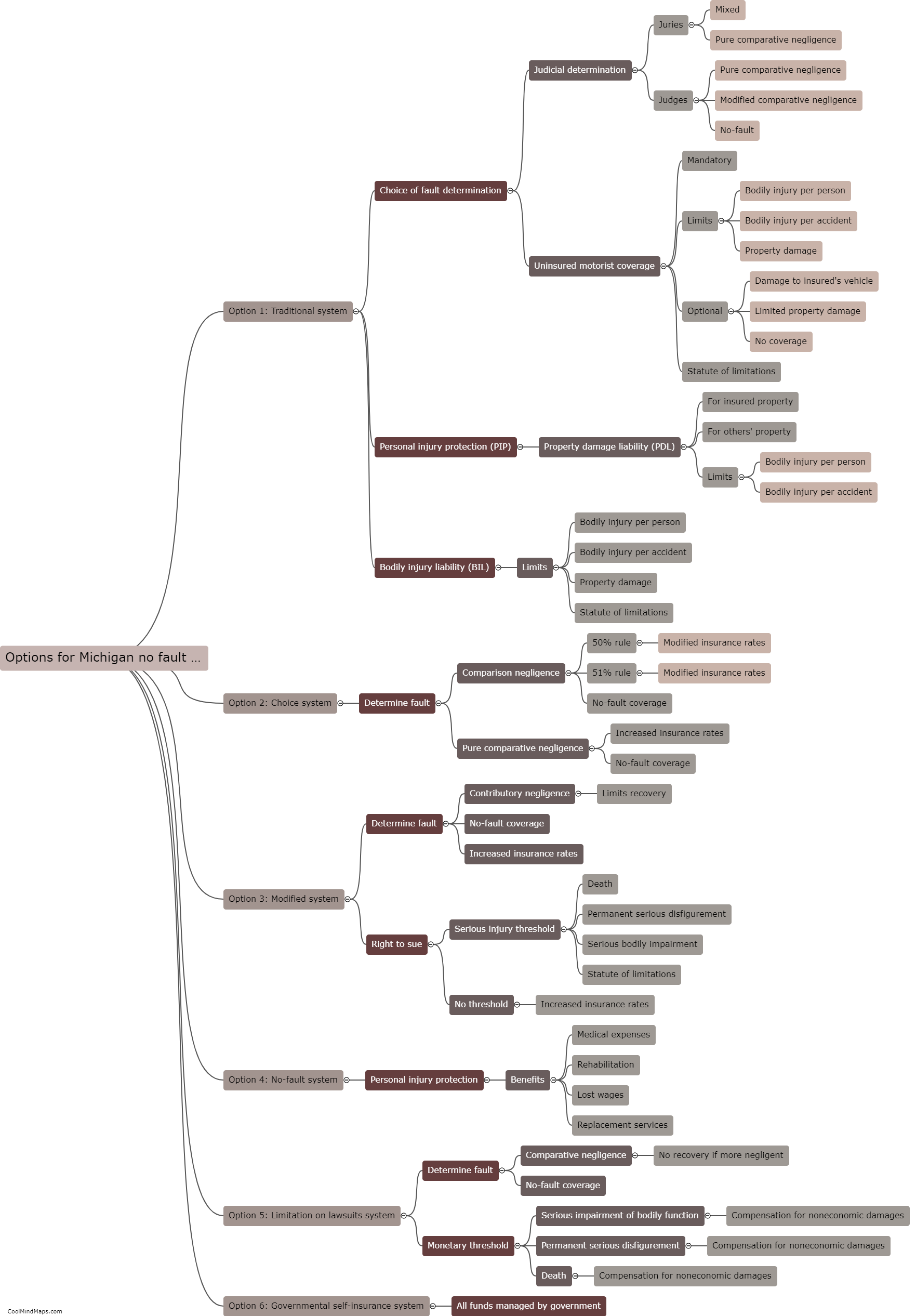

How do the different options (1-6) for Michigan no fault insurance differ?

Michigan's no-fault insurance system offers policyholders six different options to customize their coverage. Option 1, also known as unlimited personal injury protection (PIP), provides unlimited coverage for medical expenses, rehabilitation costs, lost wages, and attendant care services. Option 2 offers a reduced PIP coverage amount while allowing policyholders to opt-out of PIP if they have Medicare or other qualifying health insurance. Option 3 provides a $500,000 PIP limit and allows individuals with qualifying health insurance to opt-out completely. Options 4 and 5 offer PIP limits of $250,000 and $50,000 respectively. Finally, Option 6 allows policyholders to completely opt-out of PIP but requires them to have health insurance with at least a $50,000 coverage limit. These different options provide Michiganders the flexibility to choose the level of coverage based on their needs and resources.

This mind map was published on 30 December 2023 and has been viewed 108 times.