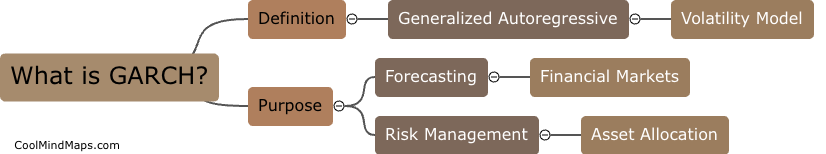

What is GARCH?

GARCH, or Generalized Autoregressive Conditional Heteroskedasticity, is a statistical model used to analyze and predict volatility in financial markets. It is an extension of the ARCH (Autoregressive Conditional Heteroskedasticity) model, which accounts for the clustering of high and low volatility in time series data. GARCH models are frequently used in finance to measure and forecast risk and volatility, making them valuable tools for investors and analysts.

This mind map was published on 7 November 2024 and has been viewed 20 times.