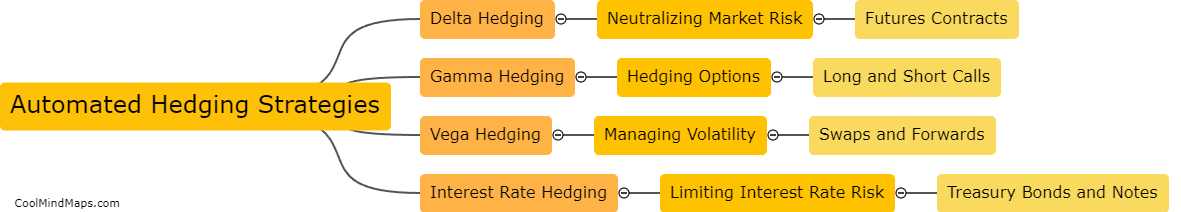

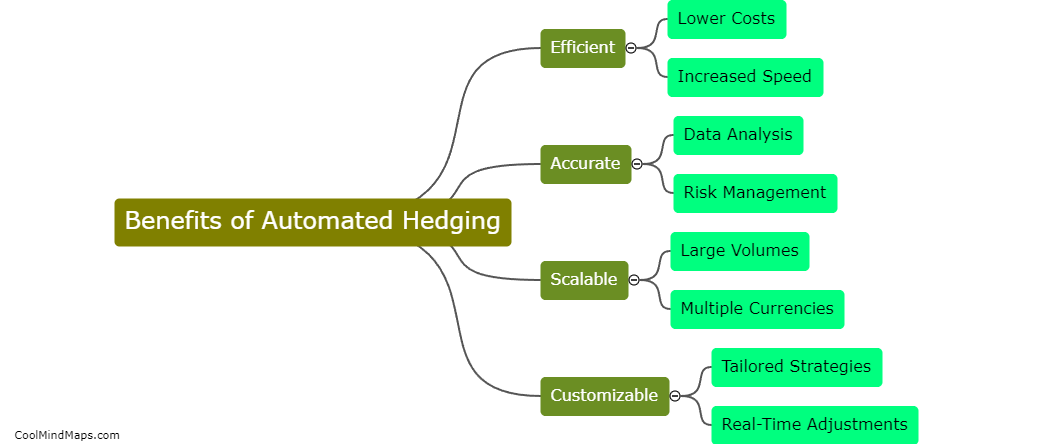

What are the benefits of automated hedging?

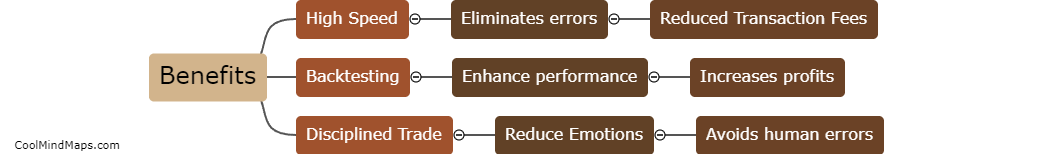

Automated hedging is the process of implementing a pre-defined hedging strategy through the use of technology. The benefits of automated hedging include reduced risk exposure, increased efficiency, and improved accuracy. By removing human involvement, automated hedging reduces the risk of human error and can quickly react to changing market conditions. Additionally, automated hedging can improve operational efficiency by reducing the time needed to manage the hedging process. Improved accuracy is another benefit of automated hedging since it is based on pre-defined rules and algorithms that remove the possibility of emotional decision making. This ultimately leads to better financial outcomes for businesses and investors.

This mind map was published on 7 June 2023 and has been viewed 143 times.