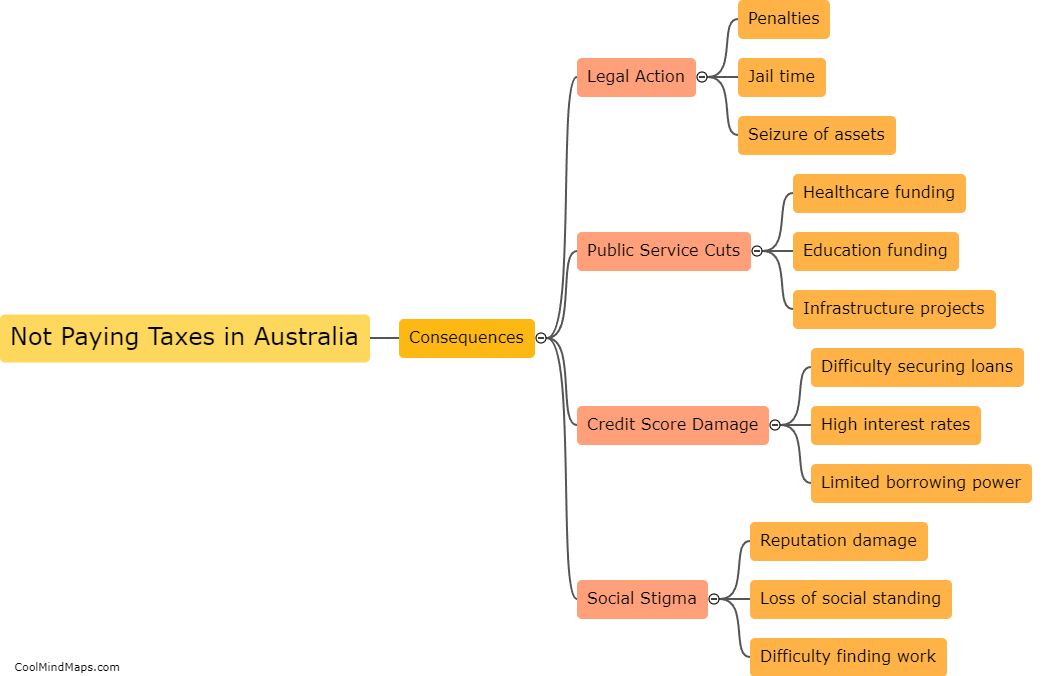

What are the consequences of not paying taxes in Australia?

The consequences of not paying taxes in Australia can be severe. The government has various measures in place to ensure that taxpayers fulfill their obligations, and when they don't, they face penalties and legal action. Penalties can include interest on overdue amounts, fines, and even imprisonment. The Australian Tax Office (ATO) employs a range of enforcement measures such as garnishing wages and bank accounts or seizing assets to recover unpaid taxes. Not paying taxes can also impact an individual's credit rating and ability to obtain loans or credit in the future. In summary, failing to pay taxes in Australia can have significant financial and legal consequences.

This mind map was published on 22 May 2023 and has been viewed 89 times.