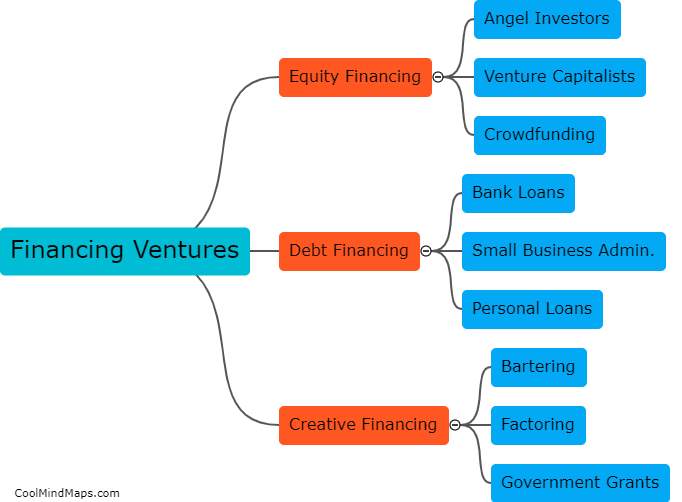

How do entrepreneurs finance their ventures?

Entrepreneurs can finance their ventures through a variety of methods, such as personal savings, bank loans, venture capitalists, angel investors, crowdfunding, and government grants. Each option has its own advantages, disadvantages, and requirements, and the choice depends on the entrepreneur's goals, risk tolerance, stage of development, and industry. For example, personal savings may be suitable for small or low-risk ventures, but not for large or high-risk ventures that require significant capital. Bank loans may require collateral or credit history, but can provide lower interest rates and longer repayment periods than other options. Venture capitalists and angel investors can offer not only financing, but also expertise, networks, and mentorship, but usually expect equity or control of the venture. Crowdfunding can leverage social media and online platforms to reach a large pool of backers, but may require a compelling story, rewards, or a competitive product. Government grants may be available for certain sectors or purposes, but may require compliance with regulations or reporting. Ultimately, entrepreneurs need to assess their financing options carefully and strategically, and balance their financial needs, expectations, and values.

This mind map was published on 18 April 2023 and has been viewed 99 times.