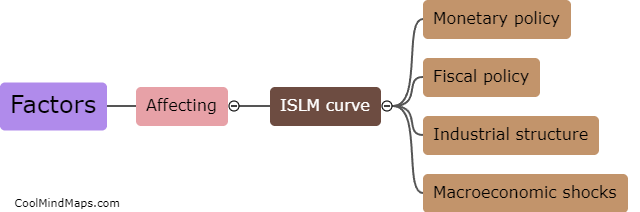

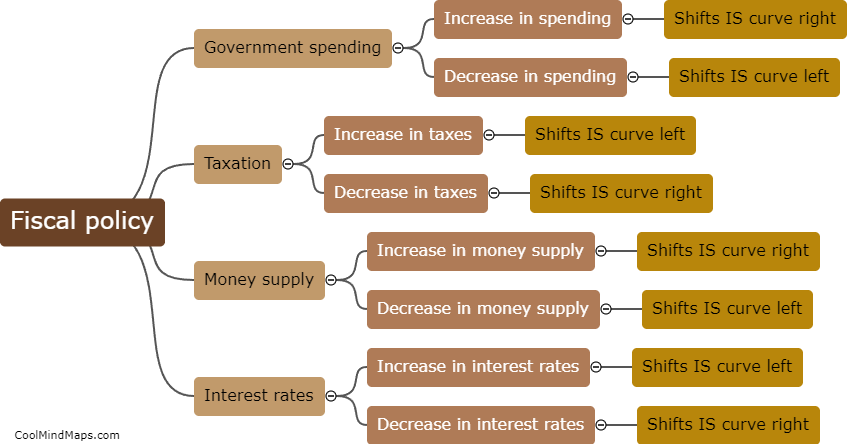

What factors cause a shift in the IS curve?

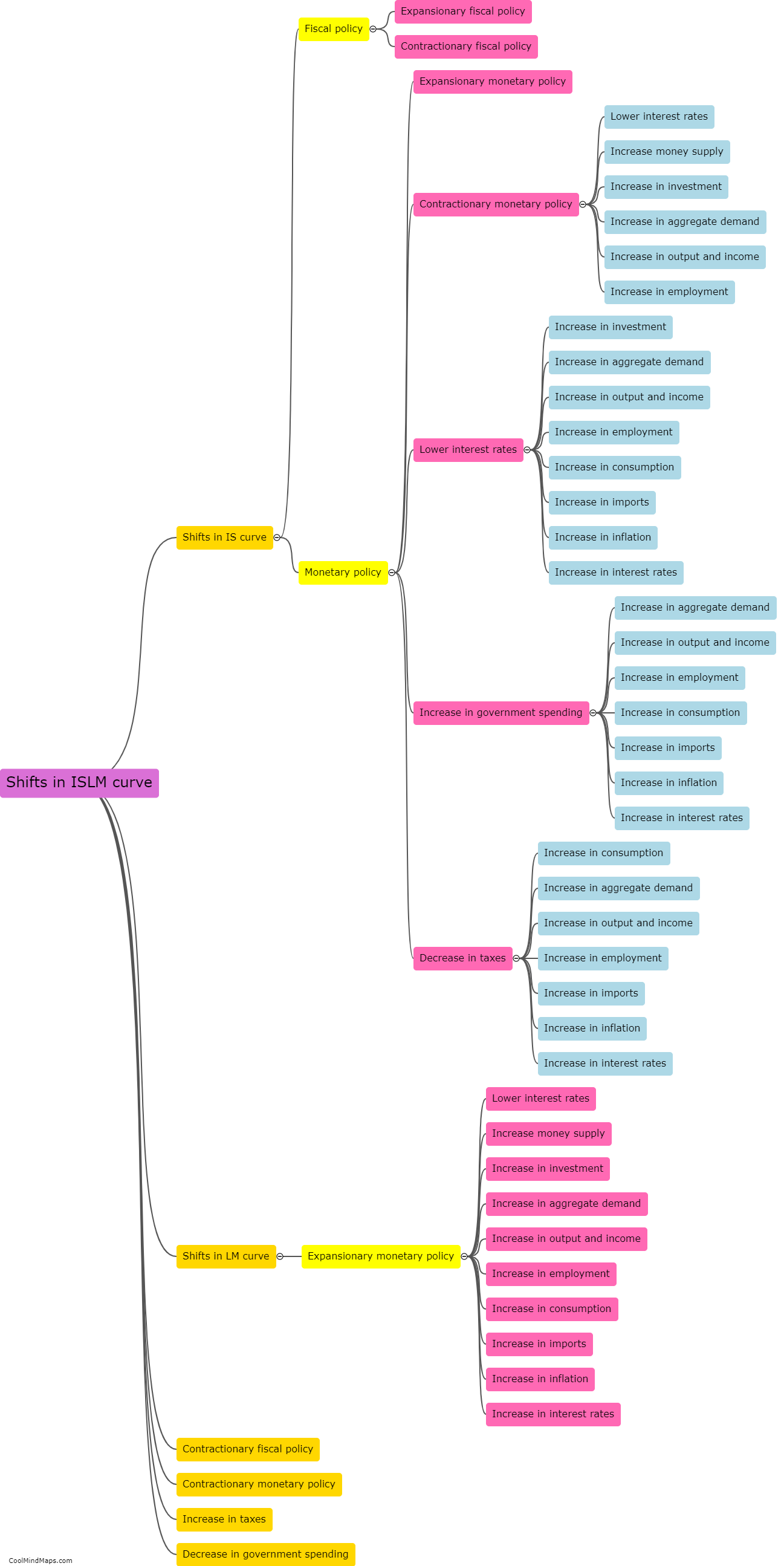

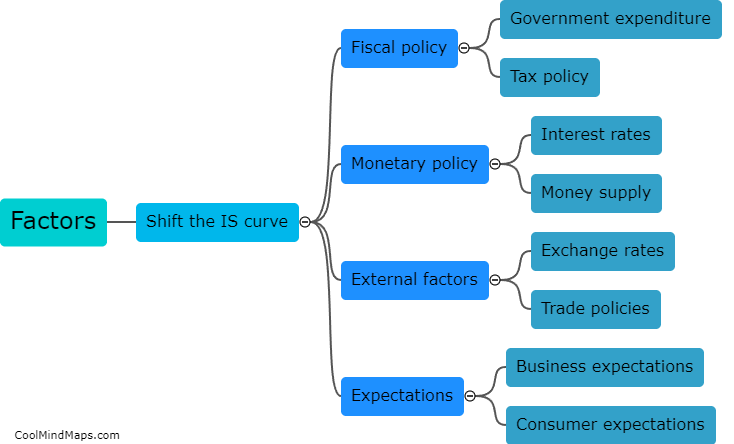

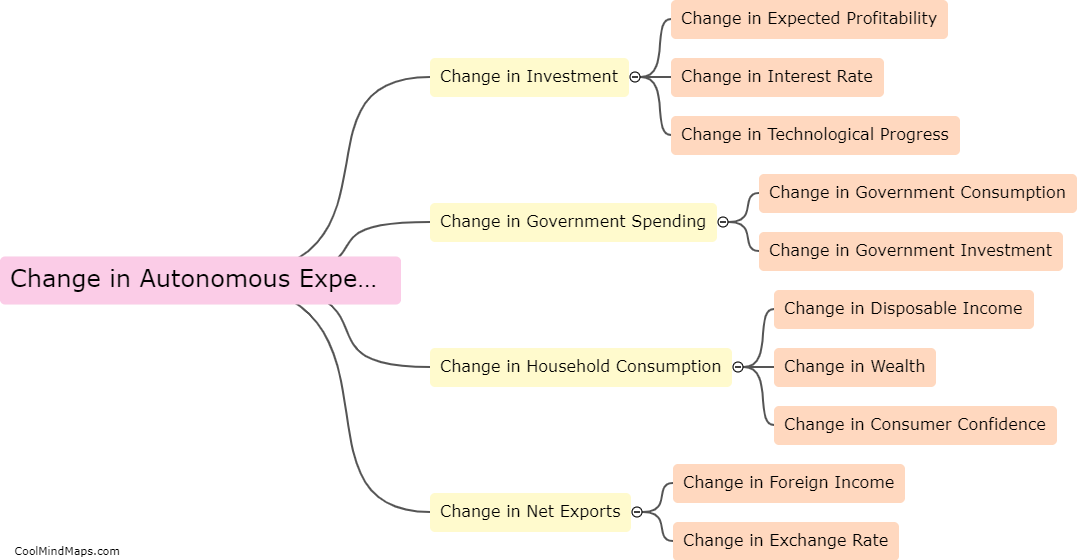

The IS curve represents the relationship between the aggregate level of income and the real interest rate in an economy. Various factors can cause a shift in the IS curve, leading to changes in the overall level of output and income in an economy. One significant factor is changes in investment spending. If there is an increase in investment spending, it will result in a positive shift in the IS curve, as it leads to higher aggregate demand and output. Conversely, a decrease in investment spending will cause a negative shift in the IS curve. Other factors that can shift the IS curve include changes in government spending or taxes, shifts in consumer confidence and spending, changes in net exports (exports minus imports) due to factors such as exchange rate movements or changes in foreign demand, and adjustments in fiscal or monetary policies implemented by the government or central bank.

This mind map was published on 26 September 2023 and has been viewed 99 times.