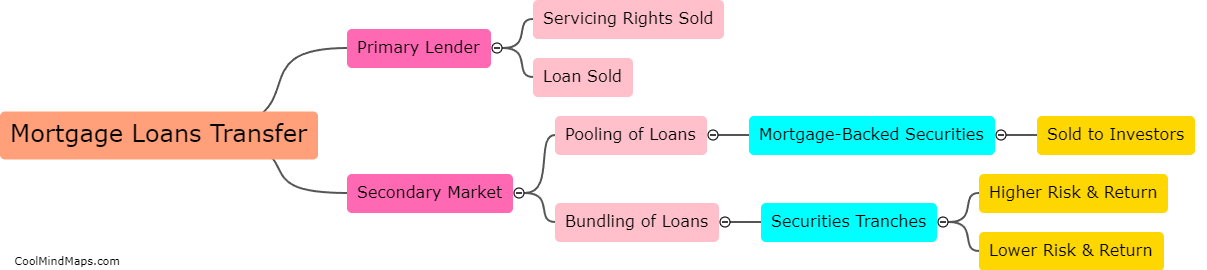

How are mortgage loans transferred on secondary market?

When a mortgage loan is originated, it is typically sold to an investor on the secondary market. The transfer of the loan is accomplished through a process called securitization, where a pool of mortgages is packaged together and sold as a bond to investors. The mortgages are serviced by a third-party servicer, who collects and distributes payments to the investors. The process of transferring mortgages on the secondary market allows lenders to access additional funds to make new loans, while investors can earn a return on their investment. It also allows for the efficient distribution of risk among a large number of investors.

This mind map was published on 28 May 2023 and has been viewed 125 times.