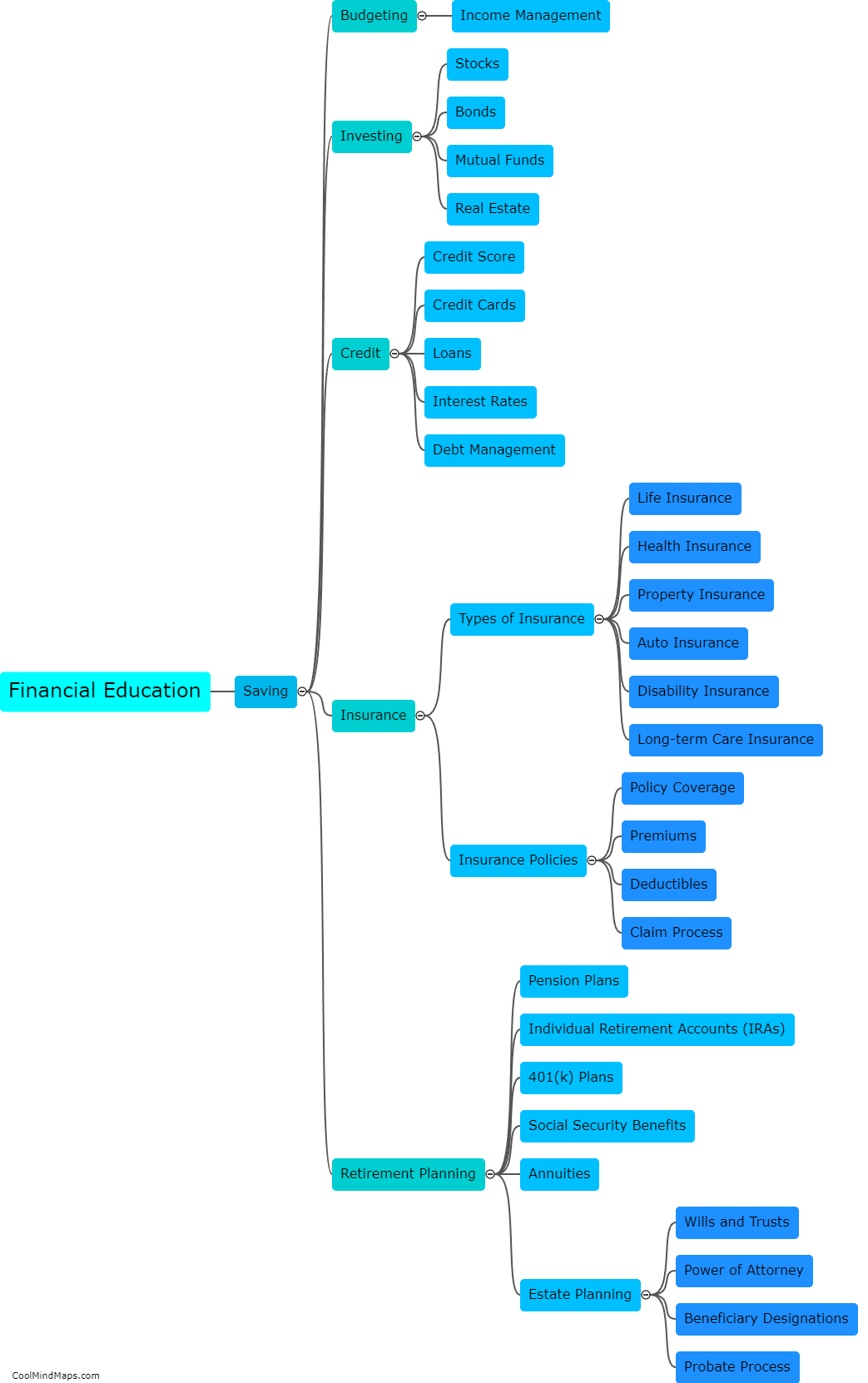

What are the key concepts in financial education?

Financial education encompasses a range of key concepts that are crucial for individuals to understand and navigate the complexities of the financial world. A few of the most important concepts include budgeting and saving, which involve managing income and expenses, setting financial goals, and building a rainy-day fund. Understanding debt and credit is another vital concept, as it involves comprehending how loans, credit cards, and interest rates work, and the importance of maintaining a good credit score. Investing is also a fundamental concept in financial education, teaching individuals about different investment options, risk and return, and long-term wealth accumulation. Additionally, financial education emphasizes the importance of financial planning, insurance, taxes, and the importance of making informed decisions to ensure financial security and well-being. Overall, the key concepts in financial education provide individuals with the knowledge and skills necessary to effectively manage their finances and achieve future financial goals.

This mind map was published on 19 September 2023 and has been viewed 105 times.