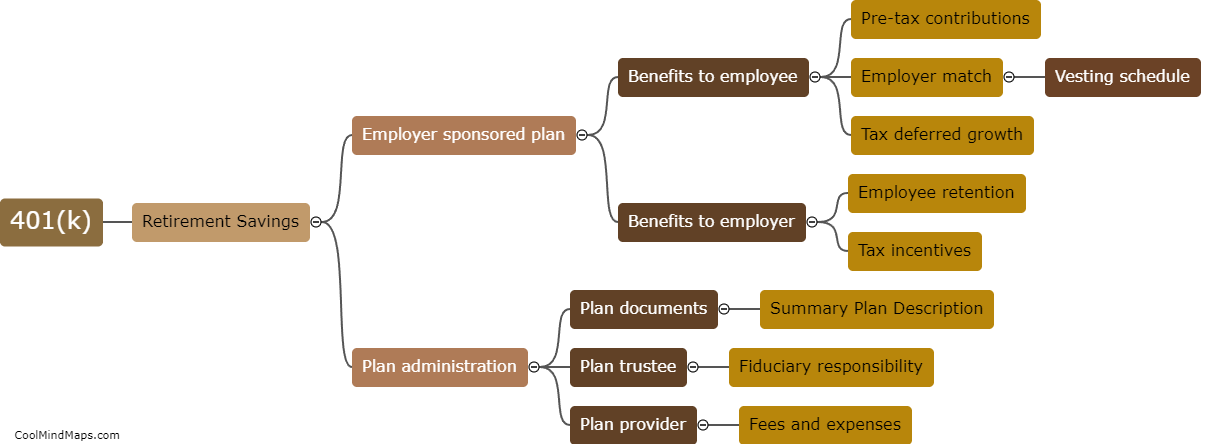

What is a 401(k)?

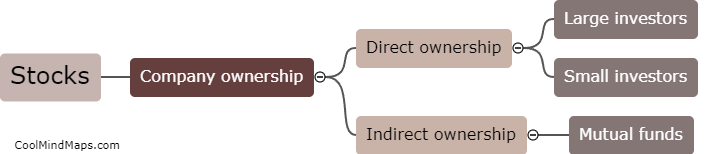

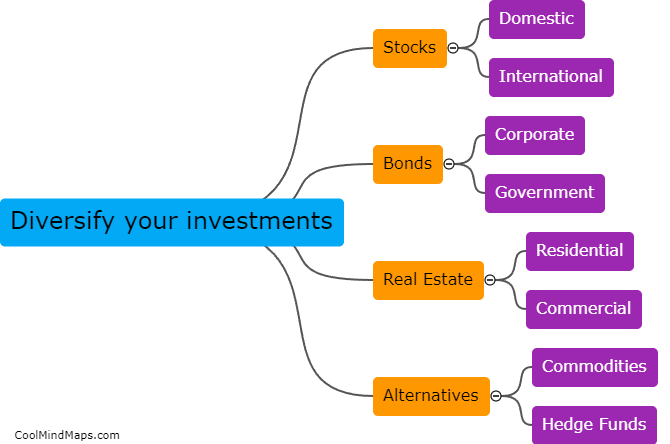

A 401(k) is an employer-sponsored retirement savings plan that allows employees to contribute a portion of their salary on a pre-tax or after-tax basis. The contributions grow tax-free until withdrawn at retirement age, and the funds can be invested in a variety of investment options such as stocks, bonds, and mutual funds. Many employers offer matching contributions to encourage participation in the plan, and the contribution limit is set annually by the IRS. Withdrawing funds from a 401(k) before retirement age may result in penalties and taxes.

This mind map was published on 19 April 2023 and has been viewed 101 times.