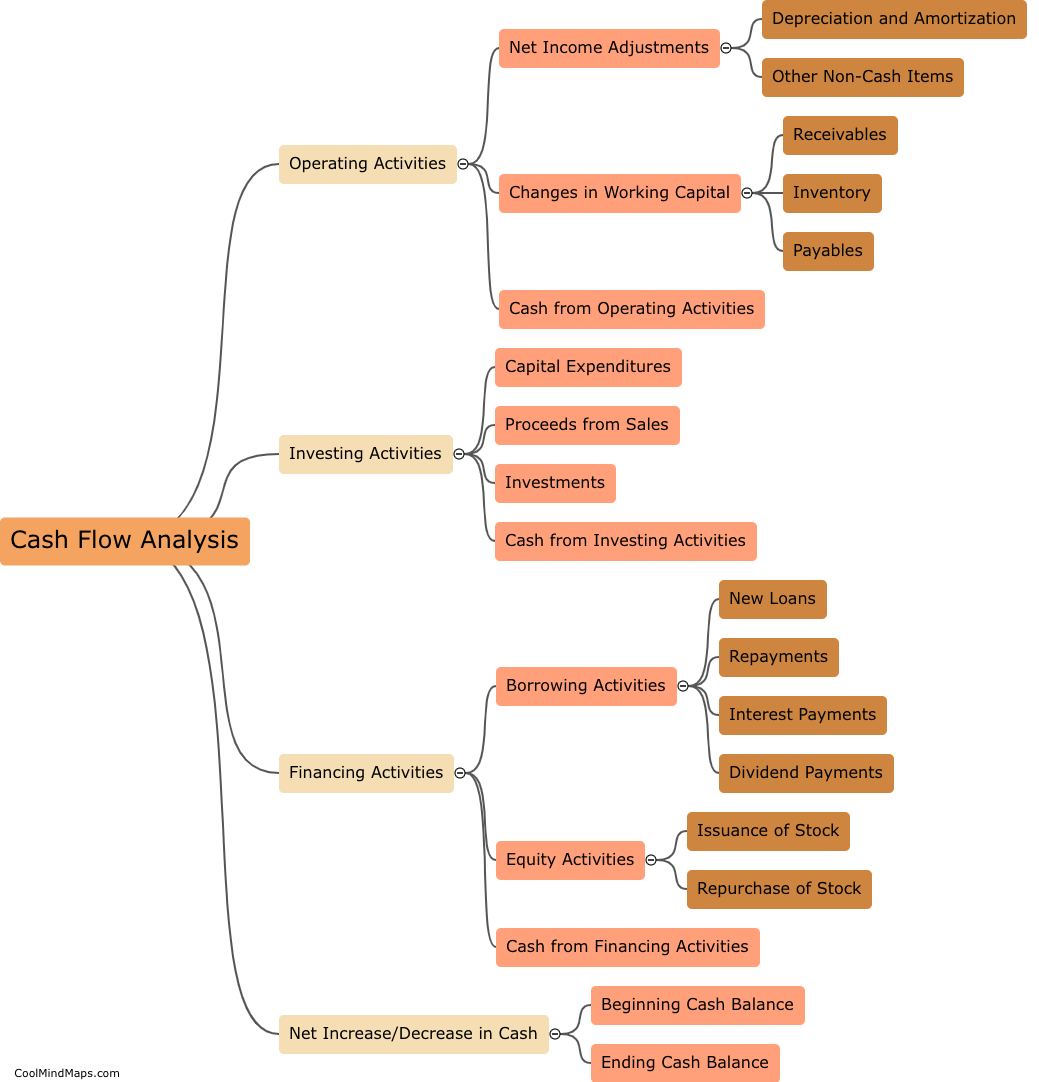

What are the best practices for managing accounts receivable?

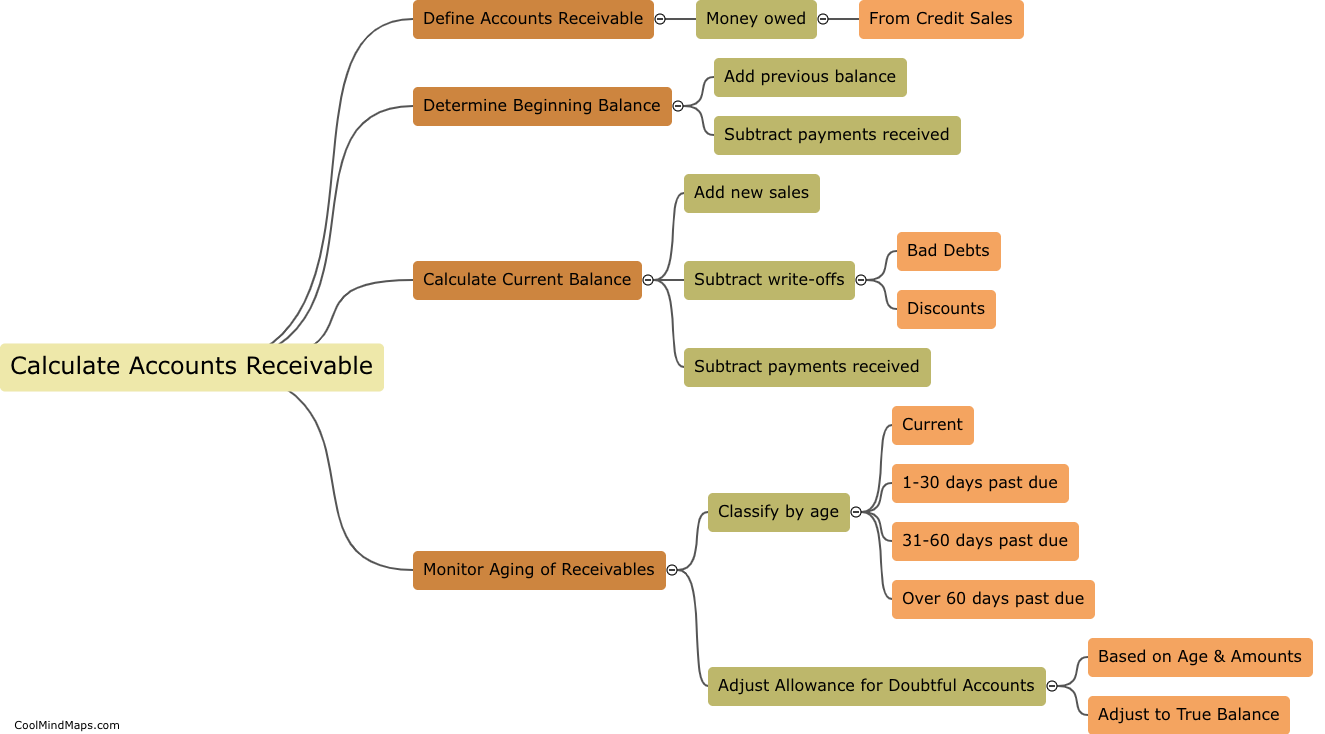

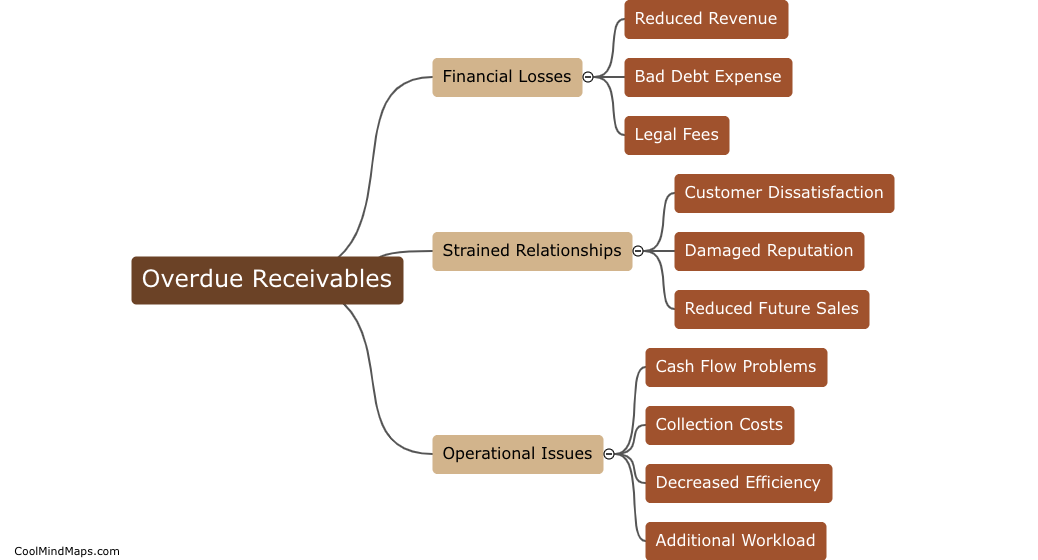

Managing accounts receivable is an integral part of managing a business's cash flow. The best practices for managing accounts receivable involve clear communication and documentation with customers, establishing credit terms and payment policies, timely invoicing and follow-up of overdue payments, and efficient collection techniques. It is important to regularly review and monitor accounts receivable to identify potential issues and take proactive steps to mitigate them. Maintaining open communication and building strong relationships with customers can also help to reduce late payments and improve the overall management of accounts receivable.

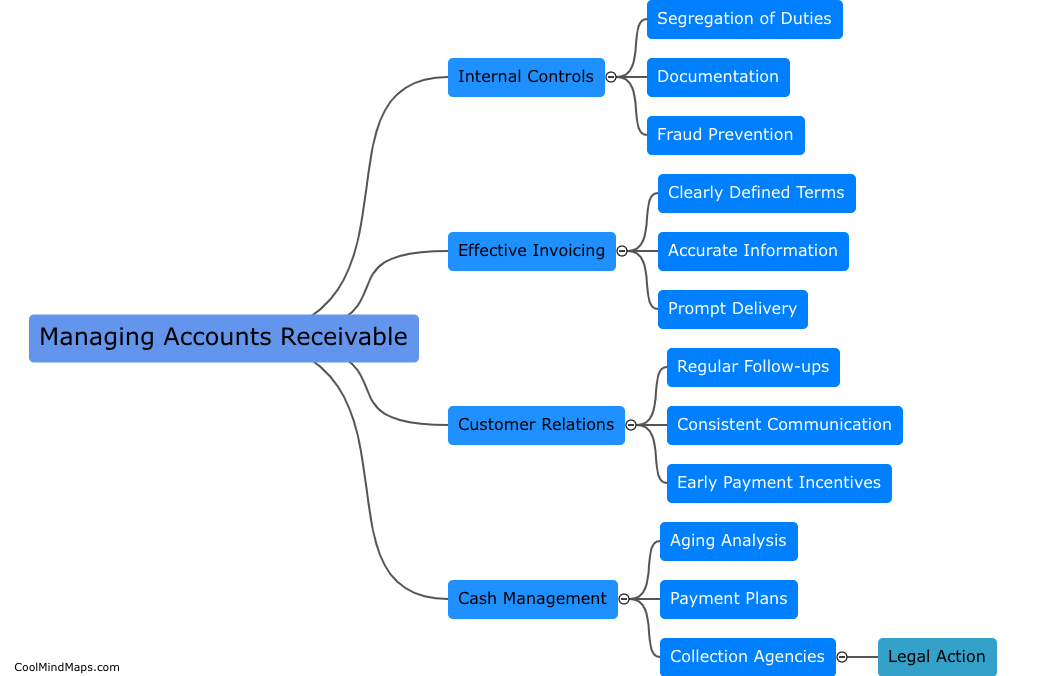

This mind map was published on 24 April 2023 and has been viewed 111 times.