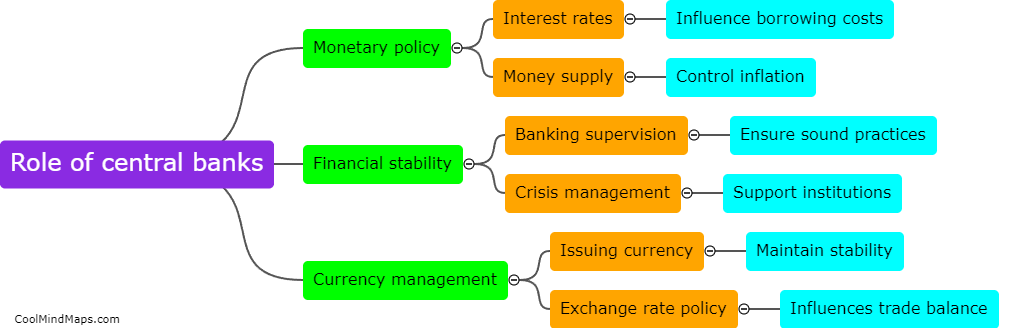

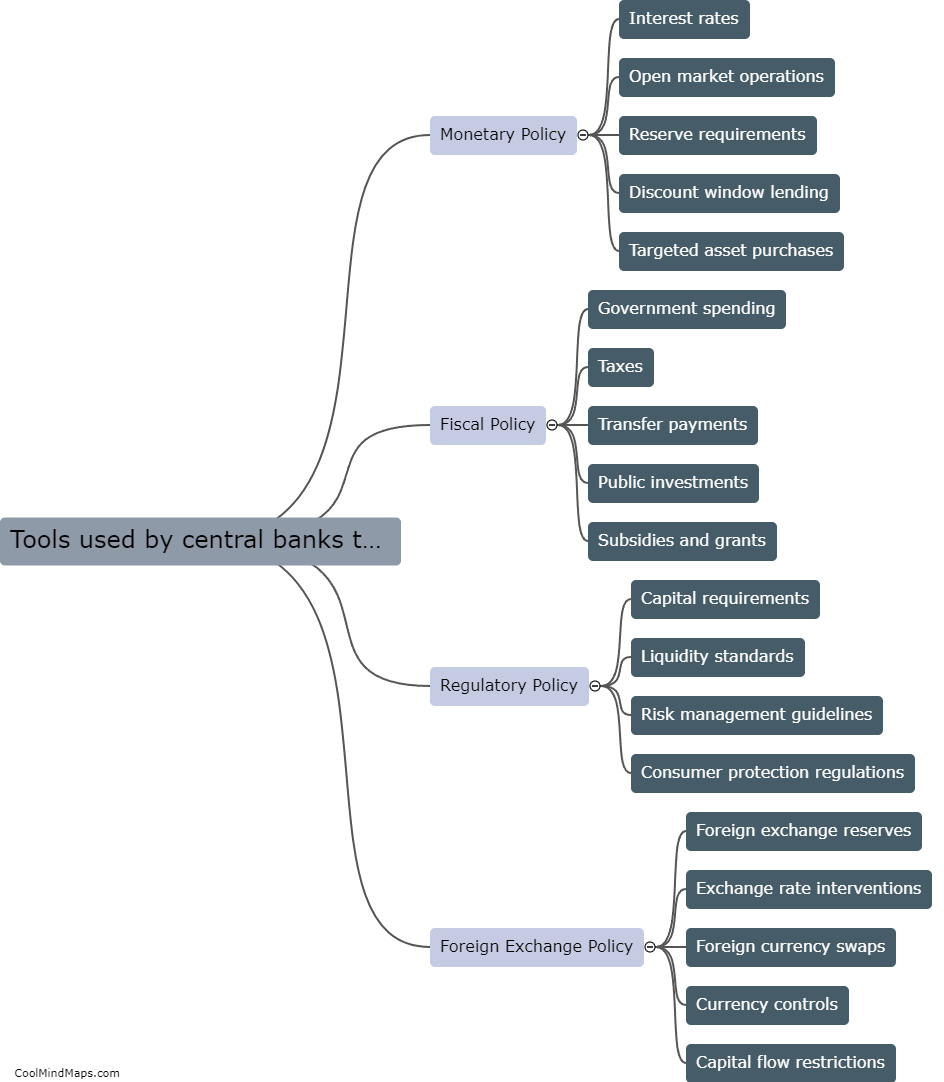

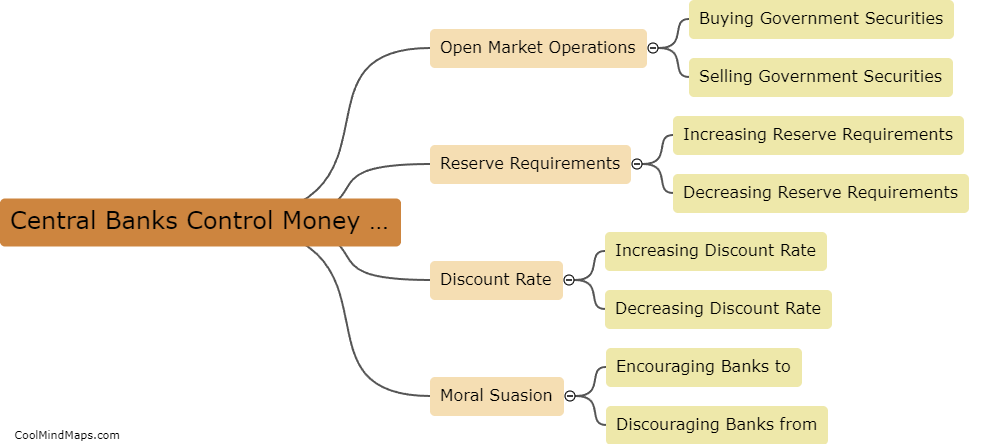

How do central banks control the money supply?

Central banks control the money supply through various tools and actions. One key method is open market operations, through which the central bank buys or sells government bonds, thereby influencing the amount of money in circulation. When the central bank buys bonds, it injects money into the economy, increasing the money supply. Conversely, selling bonds decreases the money supply. Another tool is reserve requirements, which obligate commercial banks to hold a certain percentage of customer deposits as reserves. By adjusting these requirements, central banks can impact the ability of banks to create new loans and influence the money supply. Lastly, central banks can also influence the money supply by adjusting interest rates. Lowering interest rates encourages borrowing and spending, increasing the money supply, while raising rates has the opposite effect. Through these mechanisms, central banks are able to regulate and control the money supply in an economy.

This mind map was published on 19 September 2023 and has been viewed 116 times.