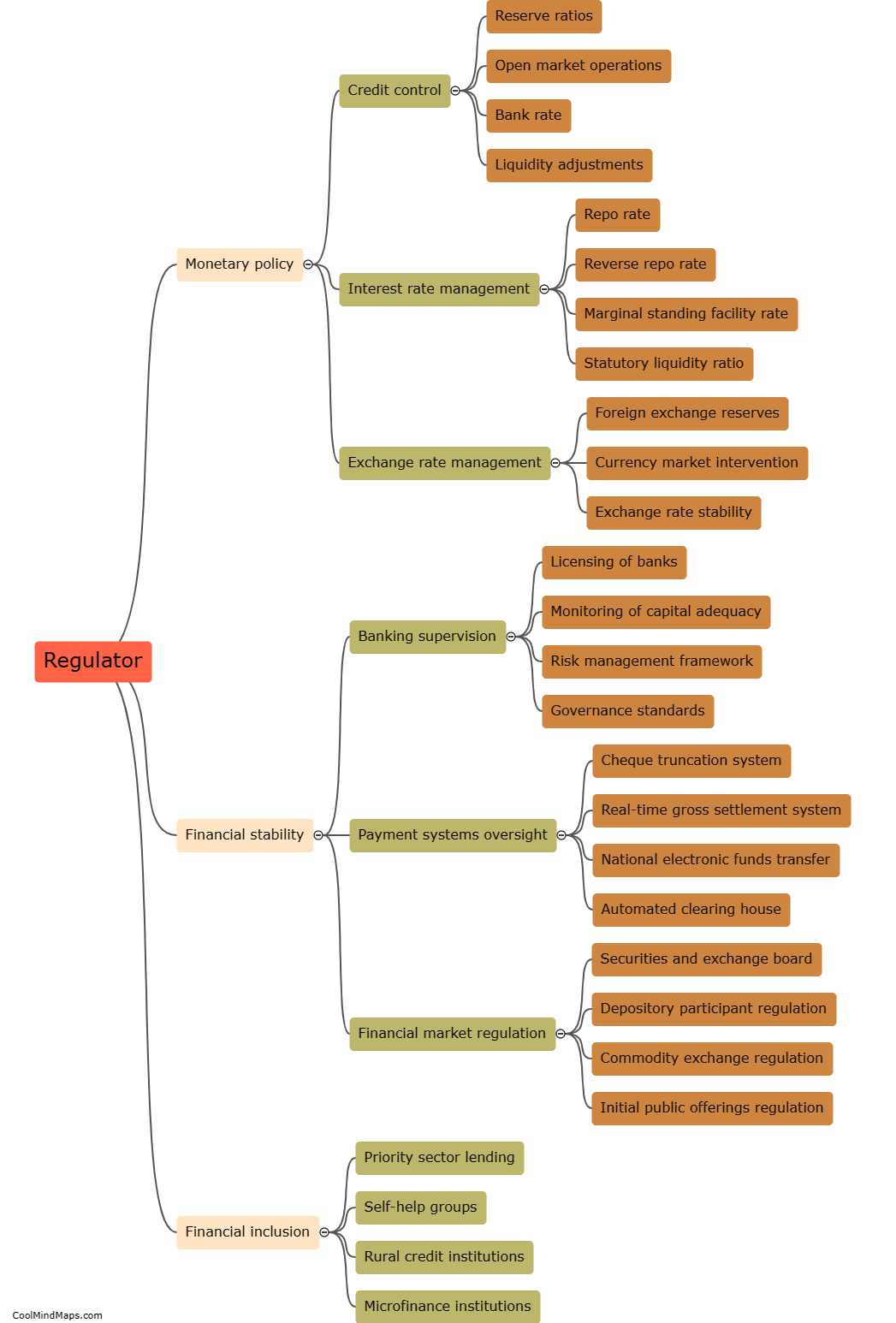

What are the functions performed by Reserve Bank of India?

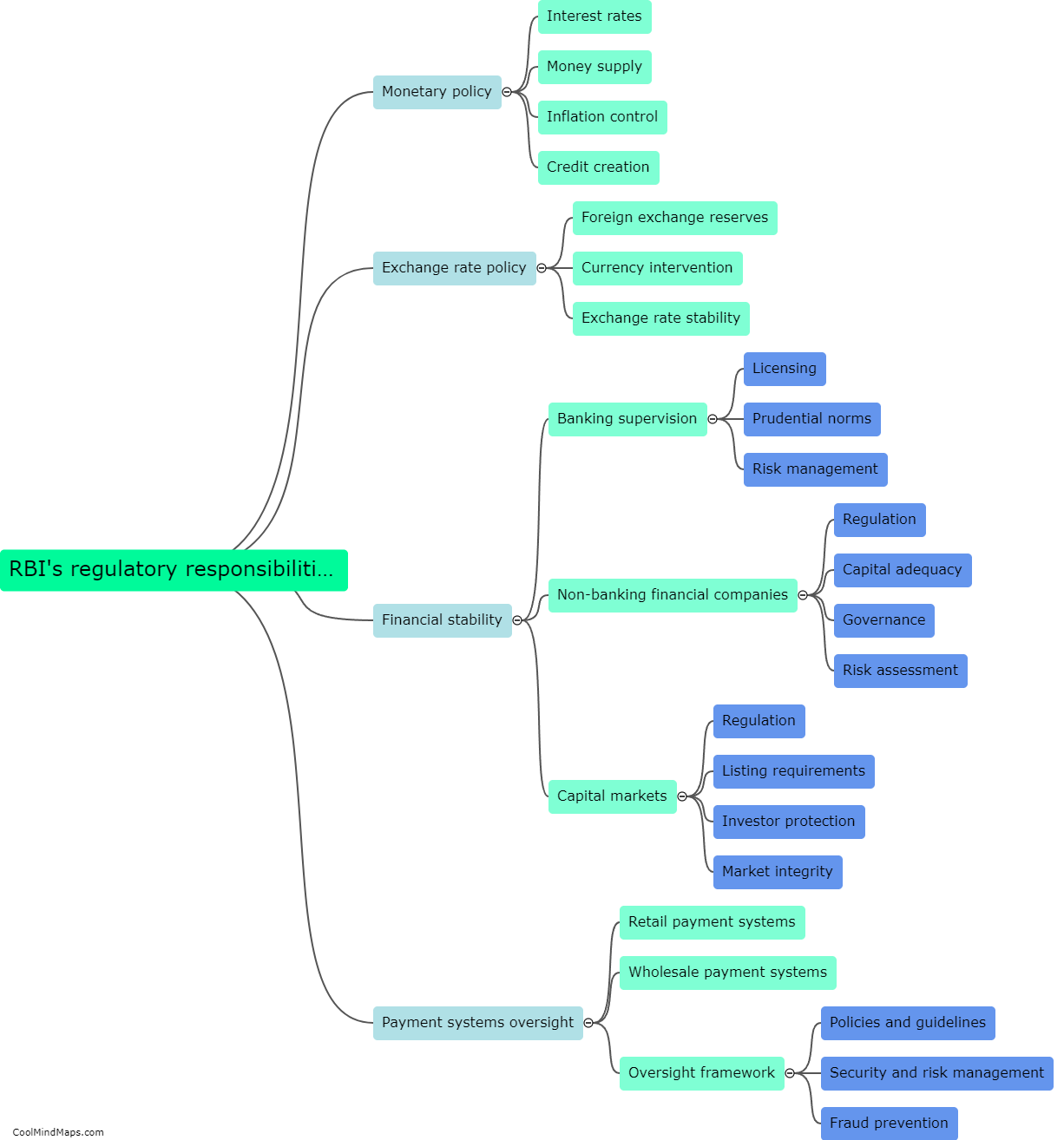

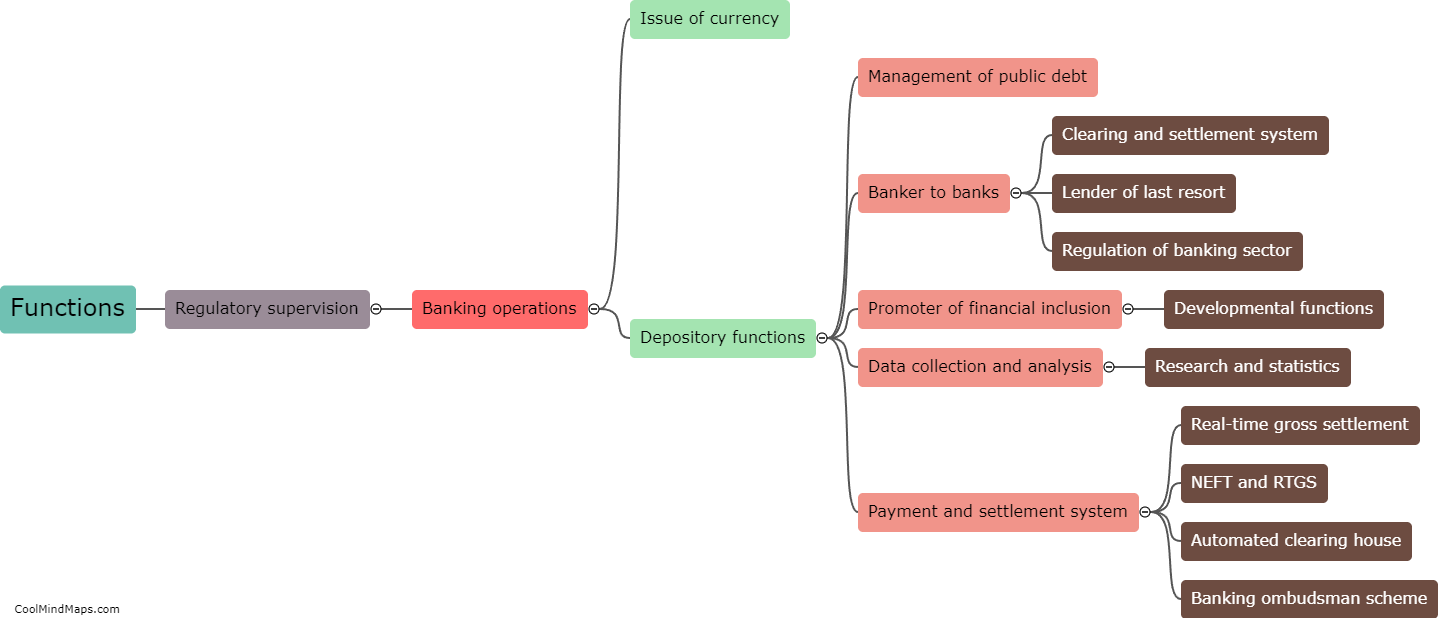

The Reserve Bank of India (RBI) is the central banking institution of India and performs several key functions in the country's financial system. One crucial role of the RBI is to regulate and control the money supply in the economy, aiming to achieve price stability and control inflation. It also acts as the banker and lender of last resort to commercial banks and maintains the overall stability of the banking system through its supervisory and regulatory functions. The RBI is responsible for managing the foreign exchange reserves of the country, which helps maintain stability in the exchange rate. Additionally, it formulates and implements monetary policies to support sustainable economic growth, promotes financial inclusion, and plays a significant role in the issuance and management of government securities. Overall, the RBI's functions contribute to the stability, efficiency, and development of monetary and financial systems in India.

This mind map was published on 9 October 2023 and has been viewed 92 times.