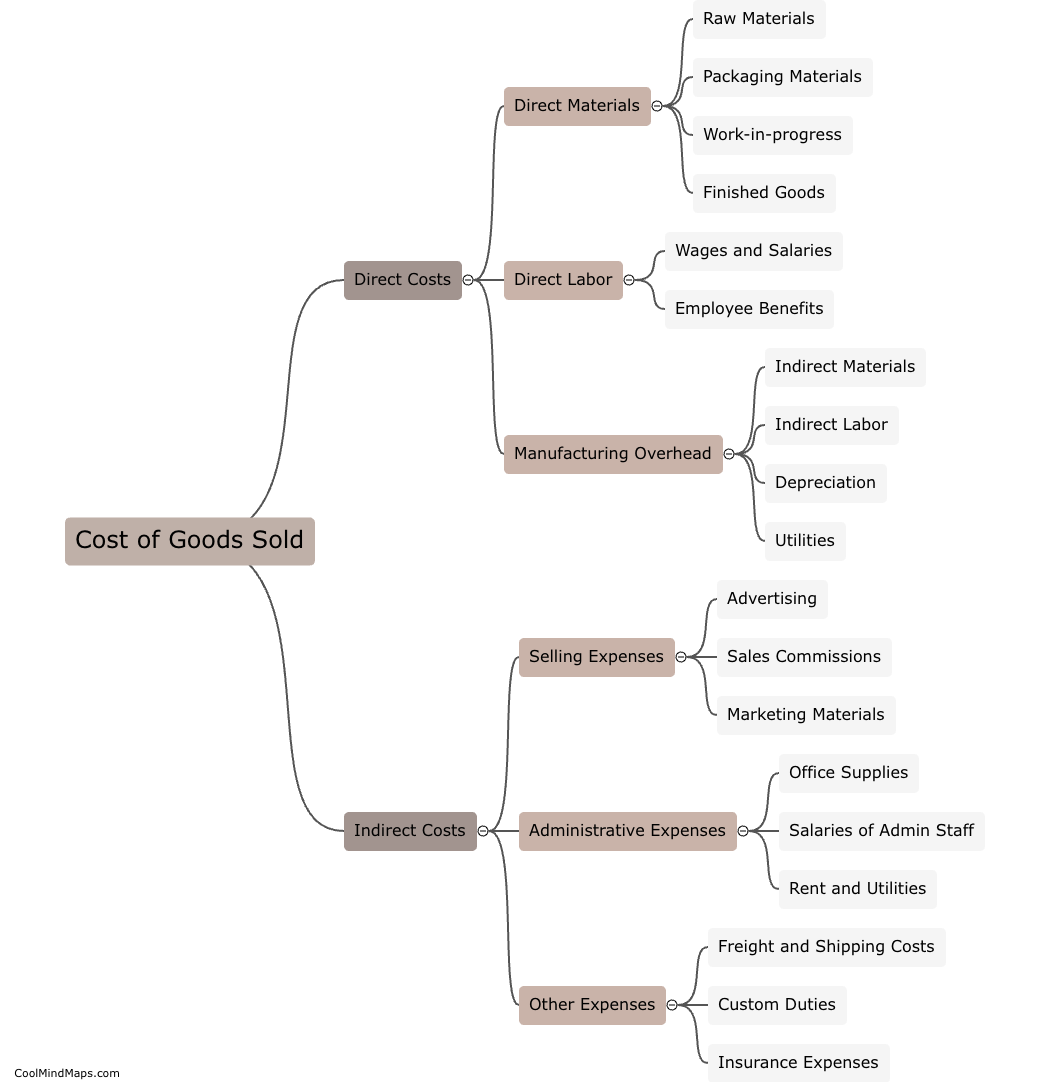

What is included in the cost of goods sold?

The cost of goods sold (COGS) refers to the direct expenses associated with the production or purchase of goods that are sold to customers. It includes the cost of acquiring raw materials, direct labor expenses, and any other costs directly incurred in the manufacturing or purchase of the goods. Additionally, the cost of goods sold may include indirect expenses such as factory overheads, shipping and handling charges, and customs duties. Essentially, it comprises all the costs directly tied to the production or procurement of the goods that are ultimately sold by a business. Tracking and properly accounting for COGS is crucial for determining the gross profit margin and accurately assessing the profitability of a business.

This mind map was published on 12 July 2023 and has been viewed 111 times.