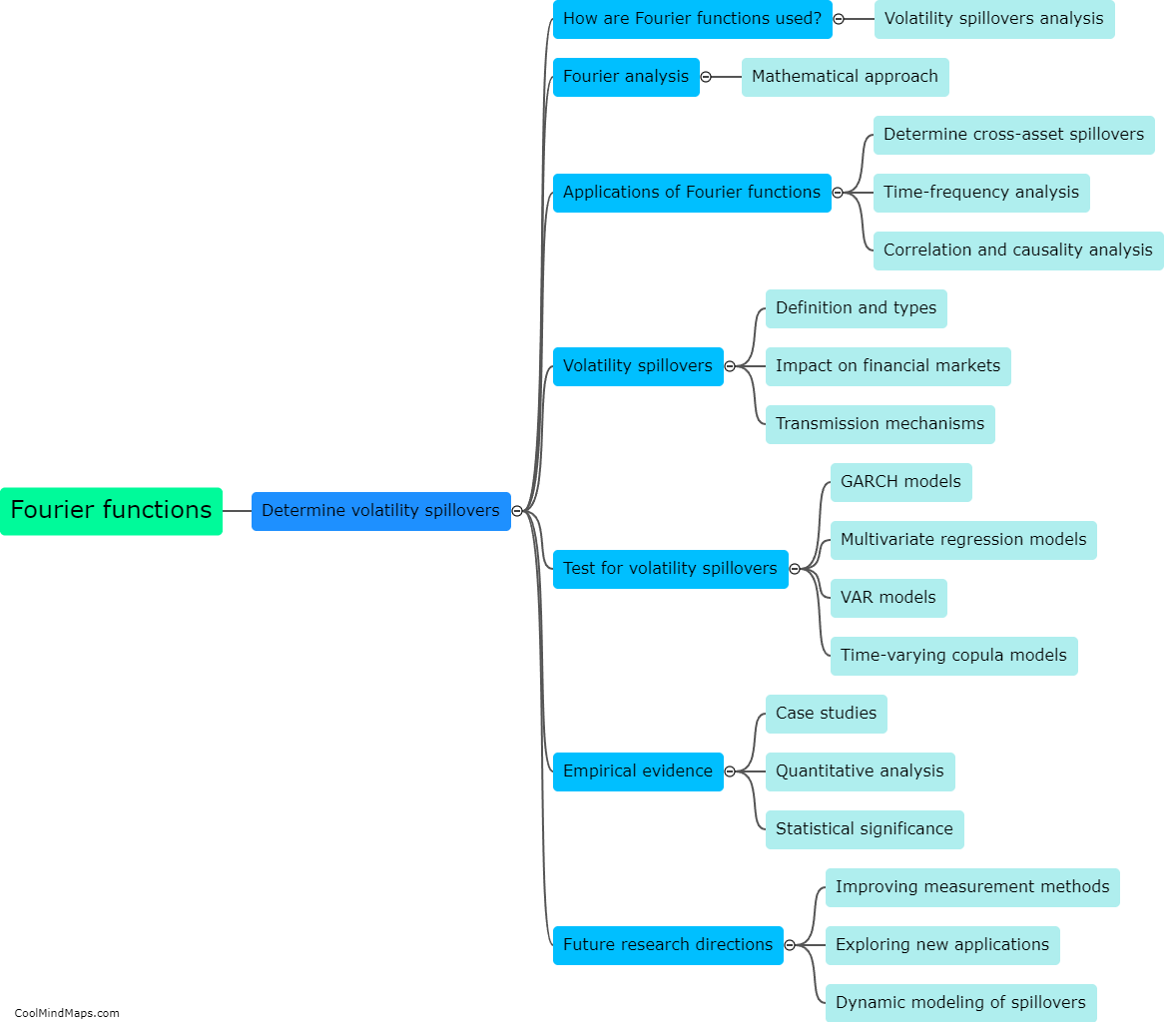

Why should Fourier functions be considered in volatility spillovers analysis?

Fourier functions should be considered in volatility spillovers analysis for several reasons. Firstly, Fourier analysis provides a flexible framework to decompose time series data into different frequency components, allowing for a deeper understanding of volatility dynamics in financial markets. By decomposing the data into various frequency components, it becomes possible to identify specific periodic patterns and understand how they contribute to volatility spillovers. Additionally, Fourier functions offer a non-parametric approach, which avoids assumptions about the specific functional form of the volatility spillovers and allows for a more robust analysis. This is particularly important in the presence of non-linear relationships and irregular patterns in financial data. Therefore, the inclusion of Fourier functions in volatility spillovers analysis provides a valuable tool to capture and investigate the complex dynamics of volatility transmission in financial markets.

This mind map was published on 27 November 2023 and has been viewed 93 times.