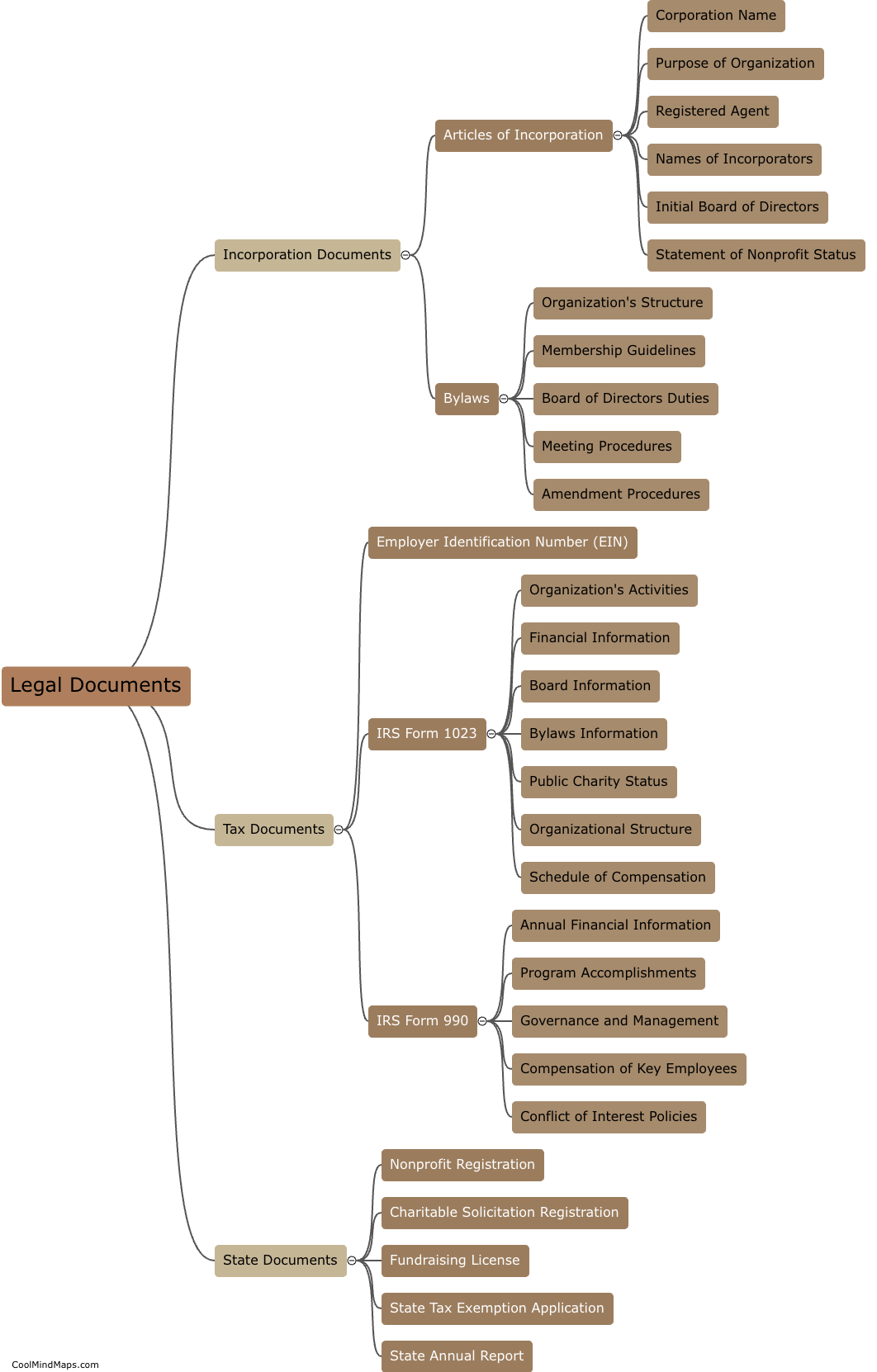

What are the necessary legal documents for a non-profit?

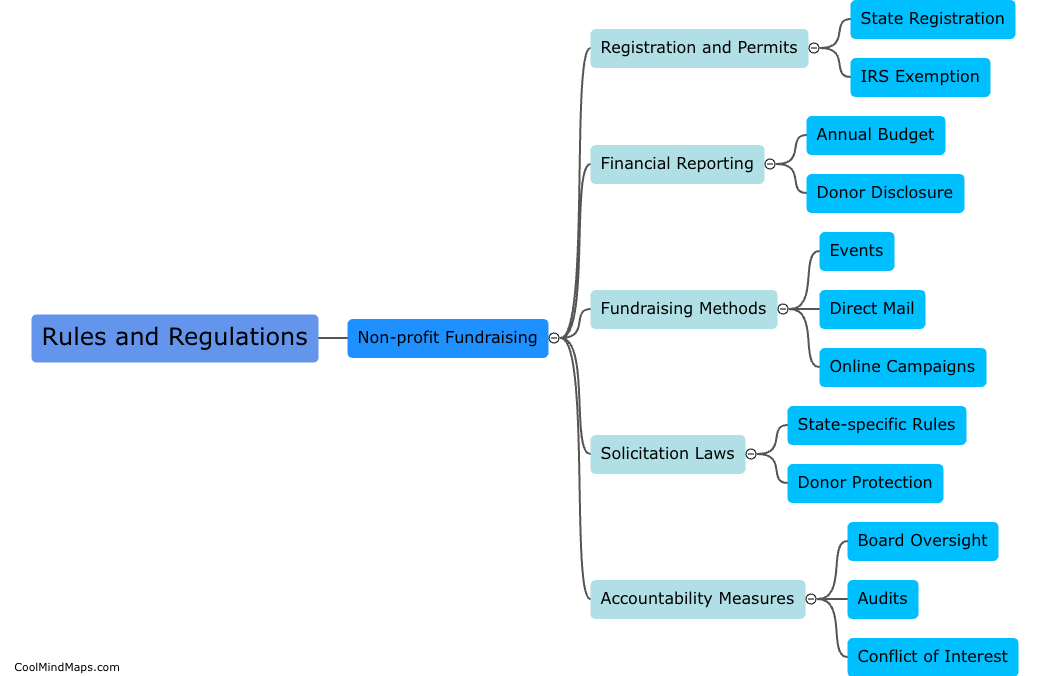

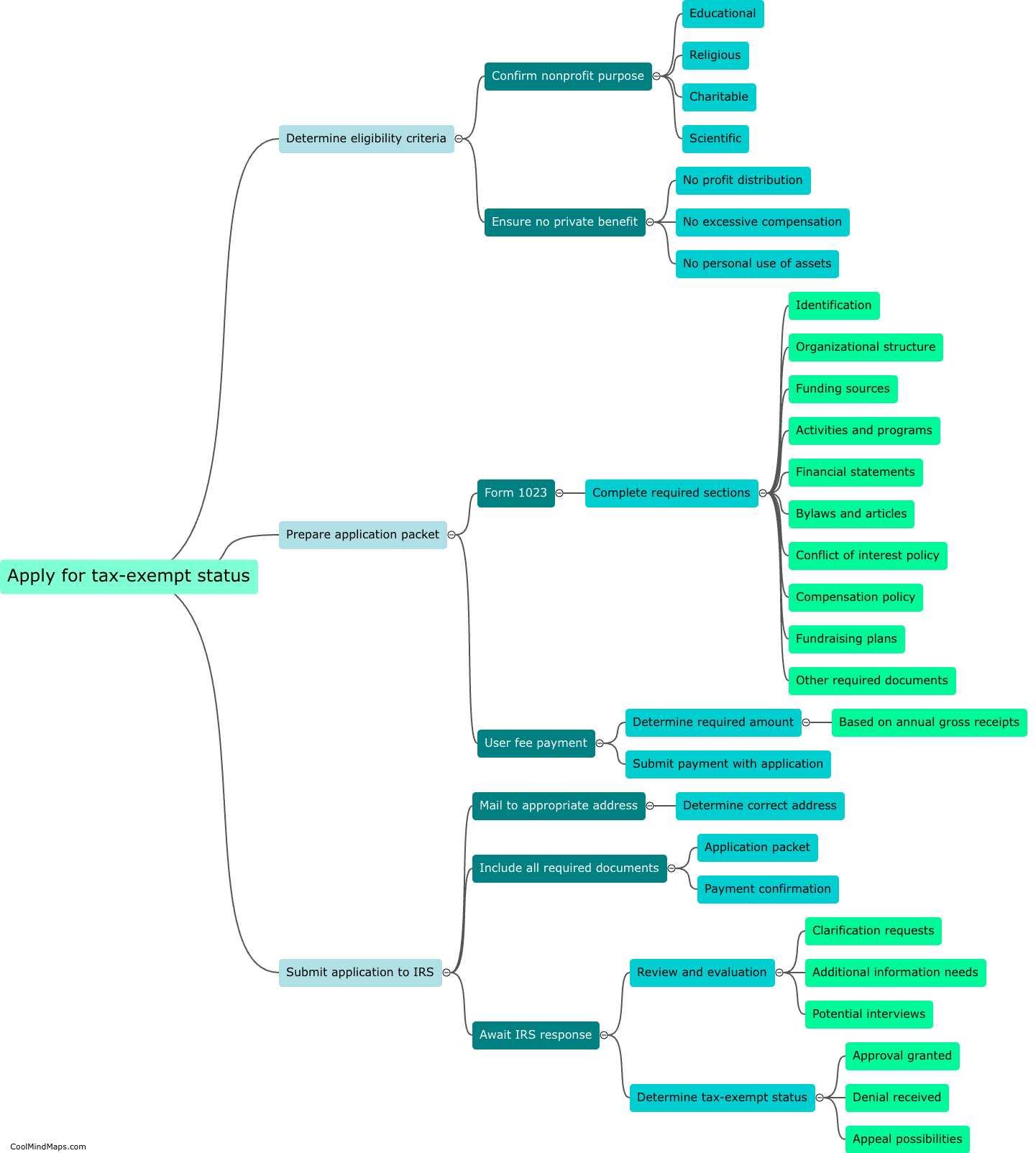

When starting or operating a non-profit organization, there are several necessary legal documents that need to be in place. Firstly, a non-profit organization typically needs to be incorporated, which involves filing Articles of Incorporation with the state government. It is also important to establish bylaws, which are the internal rules and regulations for the organization. Additionally, non-profits often need to apply for tax-exempt status with the IRS by submitting Form 1023 or 1023-EZ to qualify for federal tax exemption. Depending on the state and specific activities of the organization, other documents such as licenses or permits may be required. Finally, non-profits should have proper record-keeping systems in place, including financial statements, board meeting minutes, and annual reports, to demonstrate transparency and compliance with legal requirements. Overall, these legal documents are crucial for maintaining the legal standing, governance, and tax-exempt status of a non-profit organization.

This mind map was published on 19 August 2023 and has been viewed 90 times.