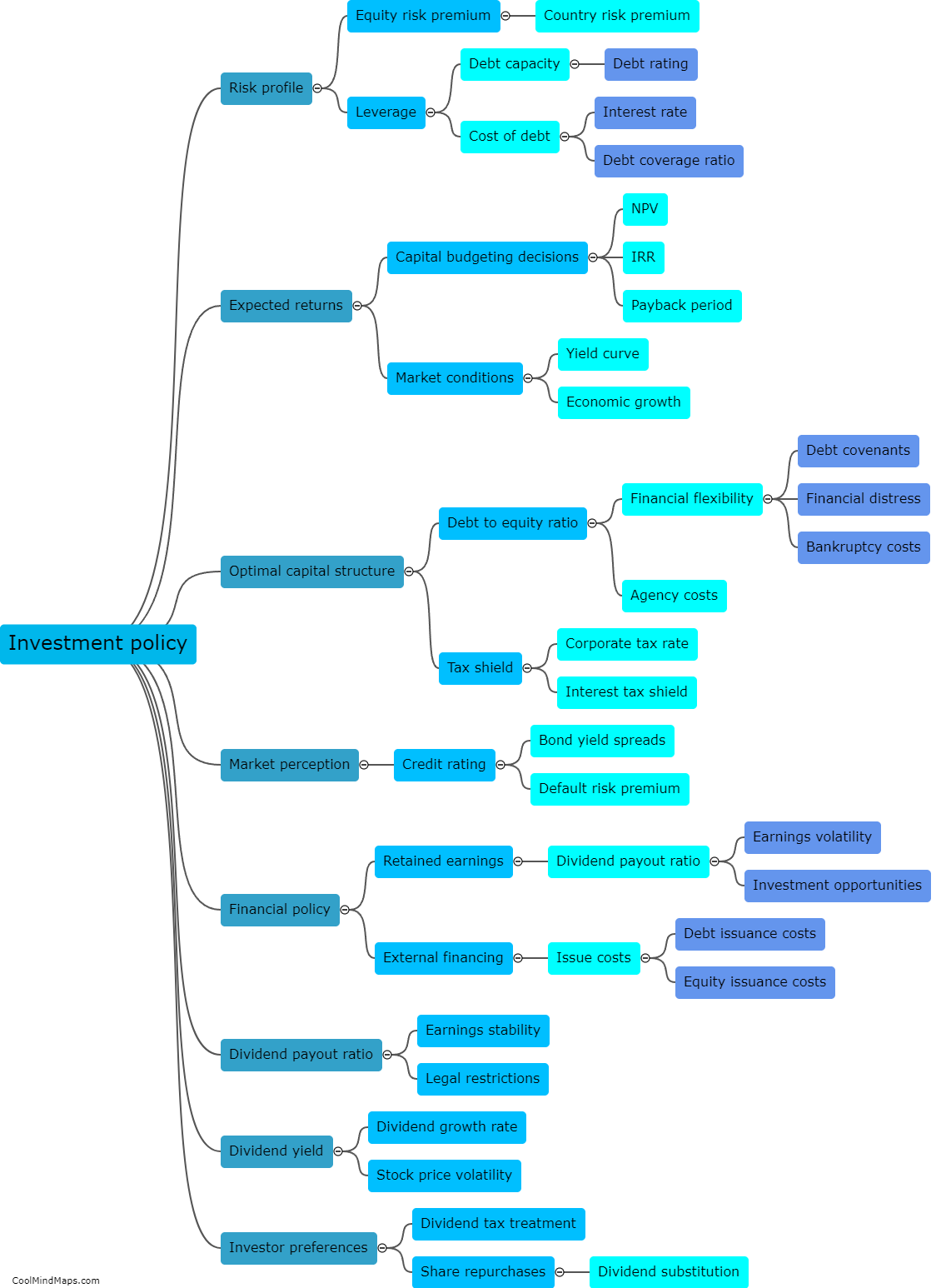

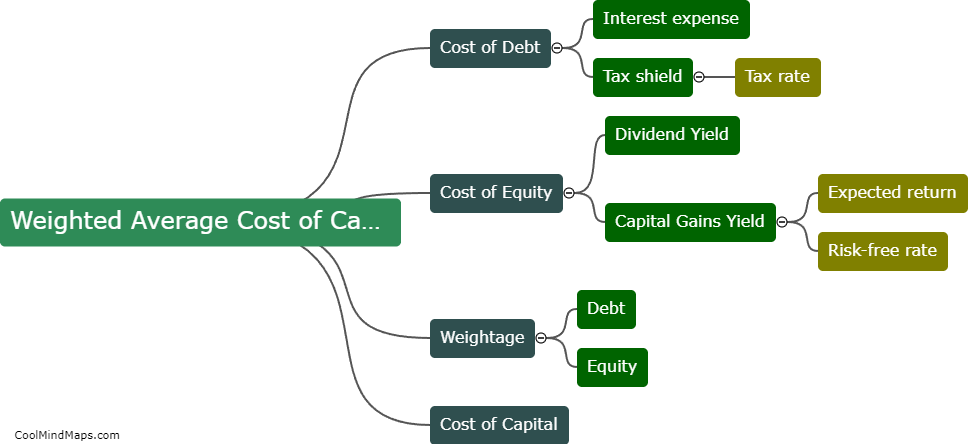

What is the weighted average cost of capital?

The weighted average cost of capital (WACC) is a financial metric used to determine the average rate of return a company needs to generate in order to cover its cost of capital. It is calculated by taking into account the proportion of each source of financing, such as debt and equity, and their associated costs. WACC serves as a crucial tool for evaluating investment decisions as it represents the hurdle rate that an investment project must exceed in order to create value for shareholders. By incorporating the costs of different funding sources in proportion to their weights, WACC provides a comprehensive measure of the overall cost of capital for a company, which is valuable for assessing the profitability and feasibility of potential projects.

This mind map was published on 12 December 2023 and has been viewed 82 times.