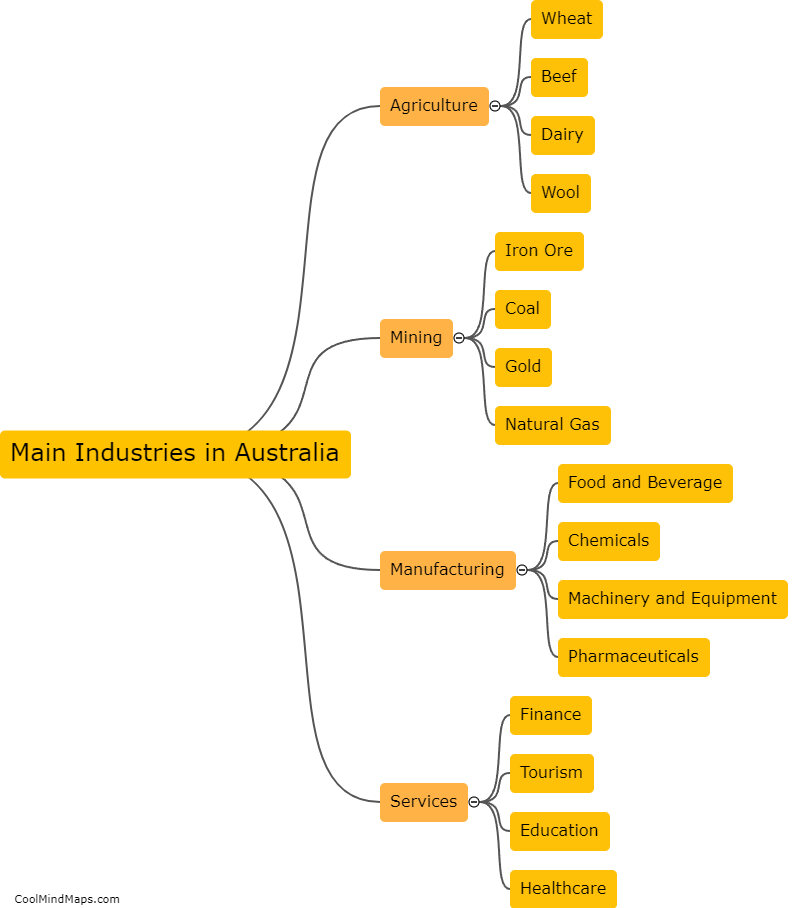

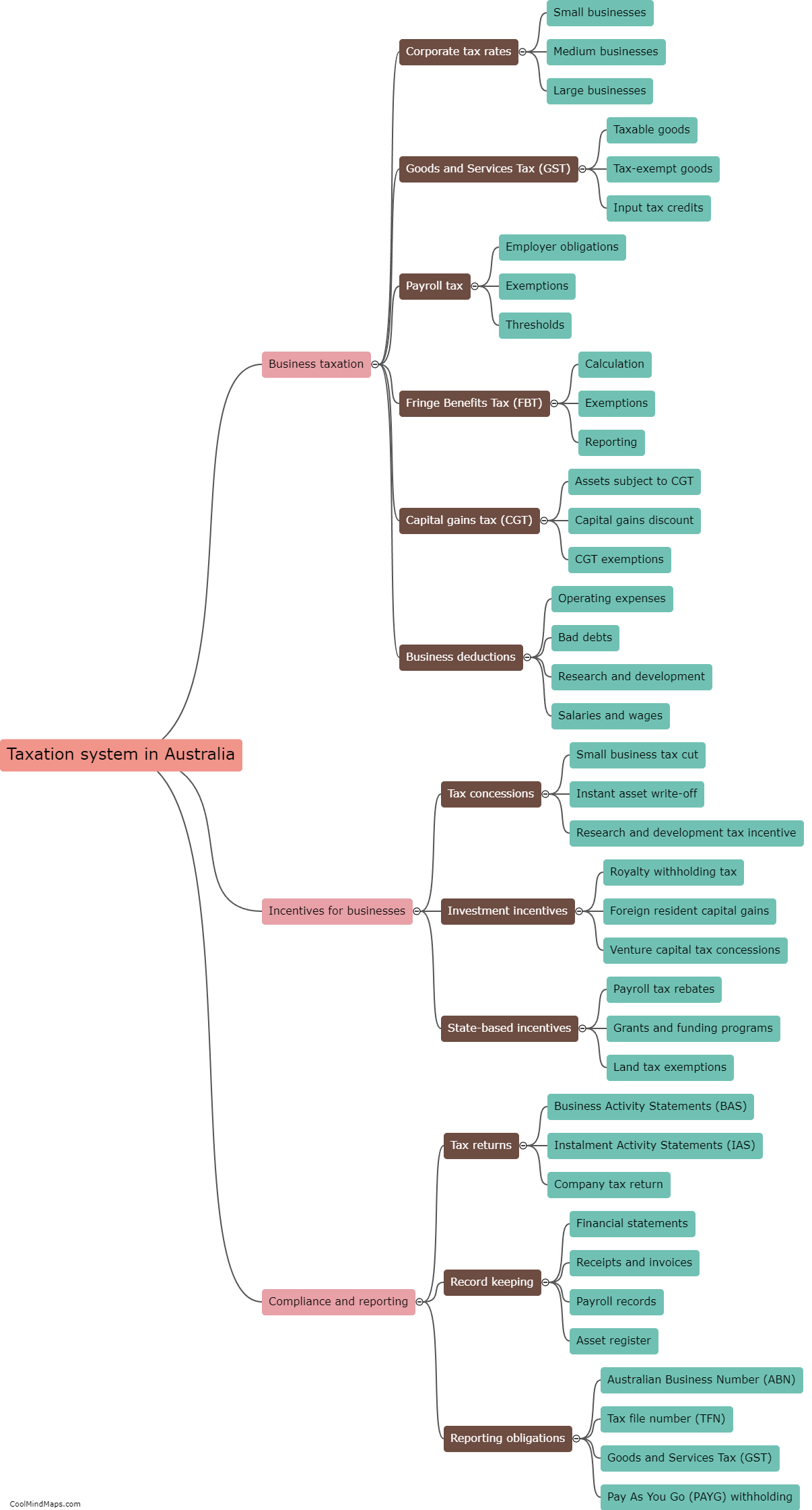

How does the taxation system in Australia affect businesses?

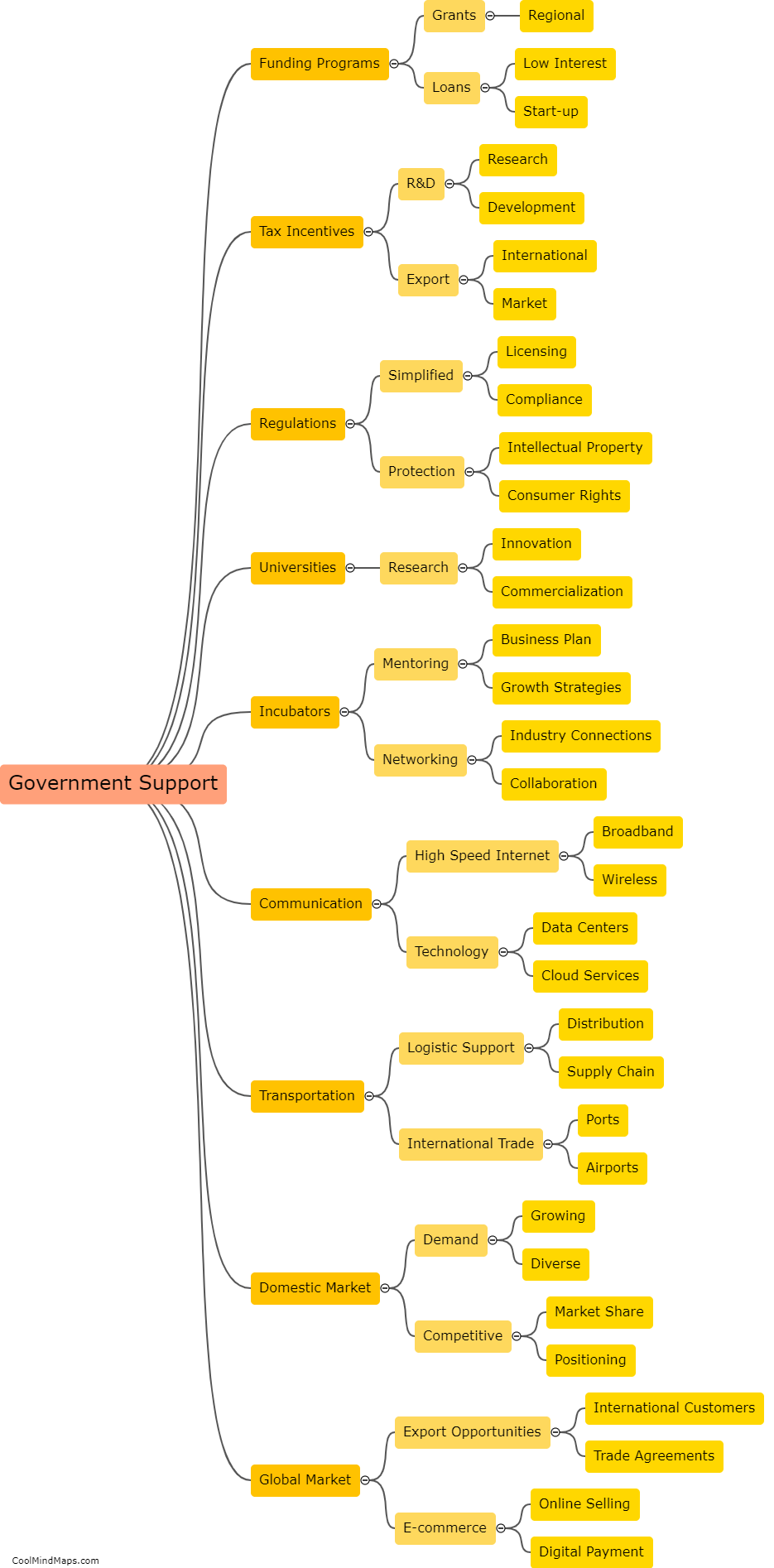

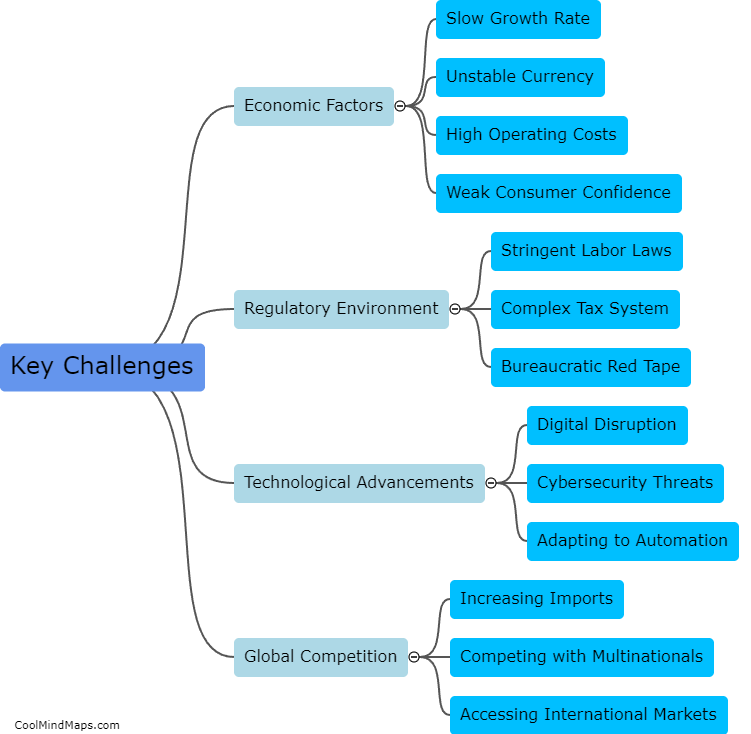

The taxation system in Australia has a significant impact on businesses. One key aspect is the corporate tax rate, which can influence the profitability and competitiveness of companies operating in the country. The current rate stands at 30%, one of the highest among developed nations. This can deter foreign investments and make it challenging for companies to expand and reinvest profits into their businesses. Additionally, the Goods and Services Tax (GST) places a burden on businesses by requiring them to collect and remit this consumption tax to the government. Compliance with complex tax regulations and reporting requirements can be time-consuming and costly for businesses, especially small and medium-sized enterprises. On the other hand, the Australian taxation system also offers various incentives and concessions such as research and development tax credits, which can encourage innovation and stimulate economic growth. Overall, the taxation system in Australia both shapes and influences business decisions and performance, impacting their ability to thrive and contribute to the economy.

This mind map was published on 5 October 2023 and has been viewed 86 times.