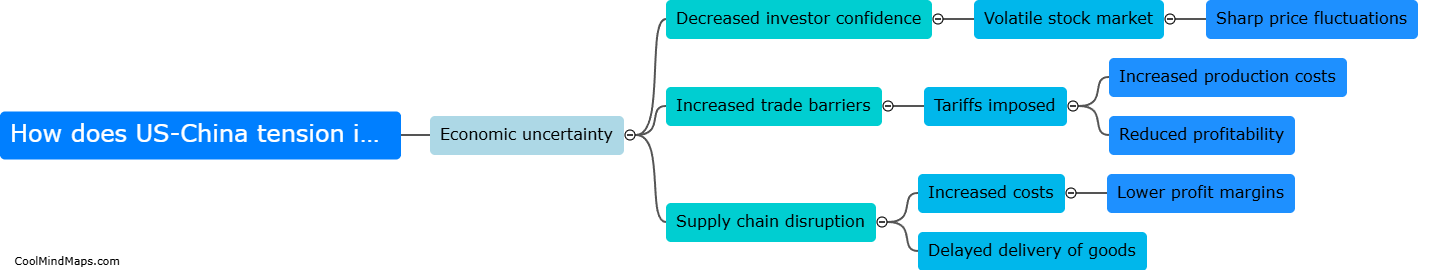

How does US-China tension impact stock prices?

The ongoing tension between the United States and China has significant impacts on stock prices. As the two largest economies in the world, any escalations in trade disputes or geopolitical tensions between the two countries can lead to increased market volatility and uncertainty. Investors may become wary of potential disruptions to supply chains, increased tariffs, or other barriers to trade, which can negatively impact stock prices. Additionally, any signs of potential cooperation or easing of tensions between the US and China can lead to positive movements in the stock market as investors become more optimistic about the future. Overall, the US-China tension can have a profound influence on stock prices as markets react to changes in the relationship between these two global economic powerhouses.

This mind map was published on 17 November 2024 and has been viewed 3 times.