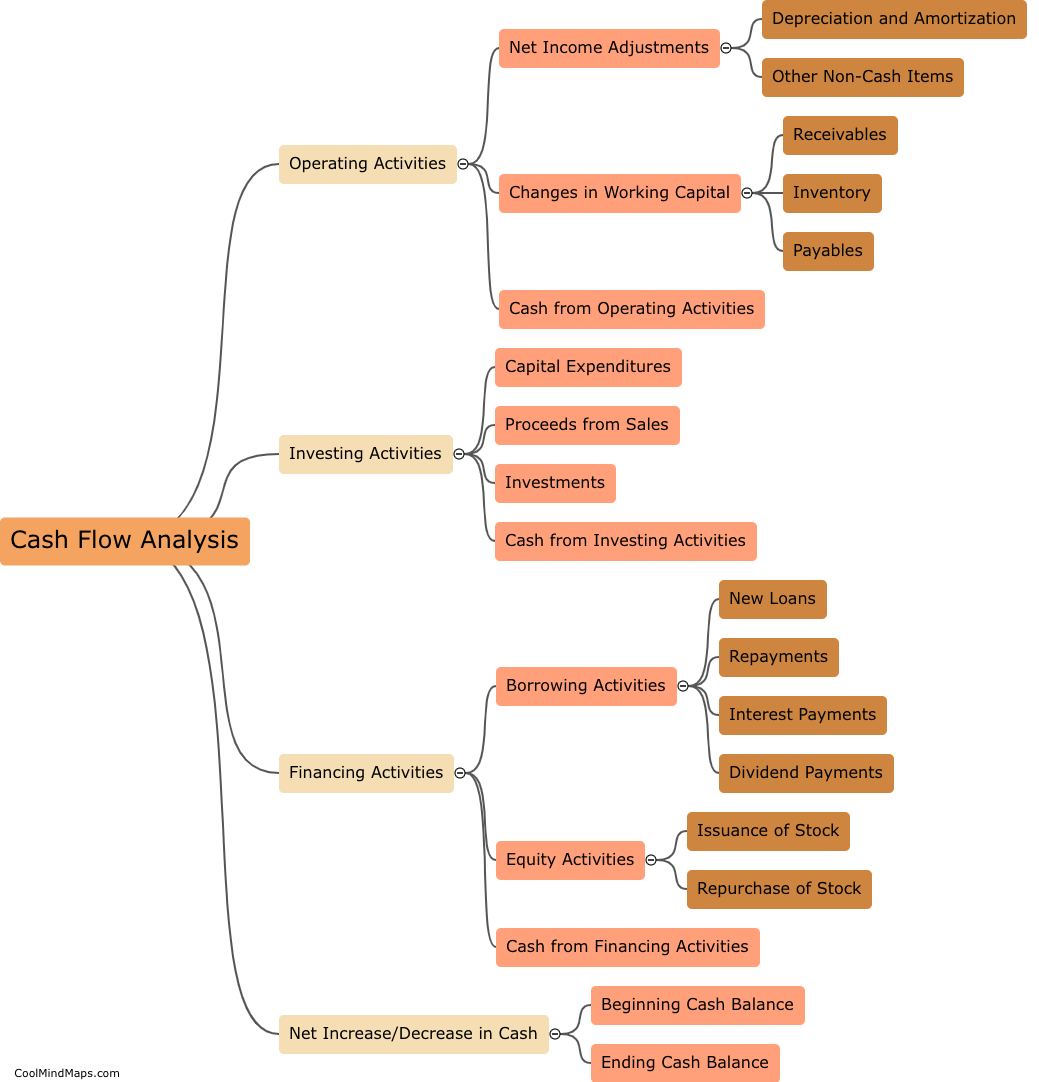

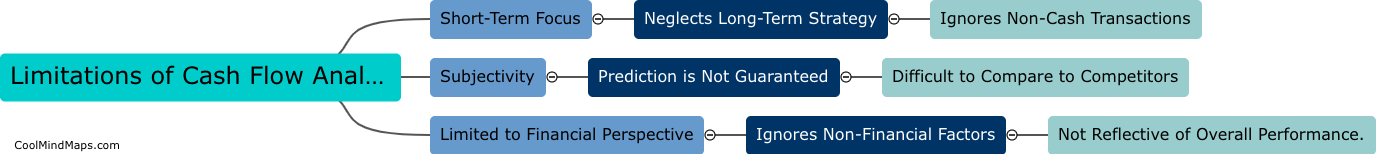

Limitations of Cash Flow Analysis

Although cash flow analysis is a common tool for evaluating financial performance and viability, it does have certain limitations. Firstly, it focuses only on cash transactions, which may not necessarily provide a complete picture of an organization's financial health. Secondly, it relies on past data and historical trends, which may not always accurately predict future cash flows. Additionally, it does not take into account non-cash expenses or revenue, such as depreciation or goodwill. Furthermore, it fails to consider external factors, such as changes in the economic climate or competitive landscape, that may impact an organization's cash flow. Therefore, while cash flow analysis is a useful tool, it should be used in conjunction with other financial metrics to provide a more comprehensive evaluation of financial performance.

This mind map was published on 24 April 2023 and has been viewed 103 times.