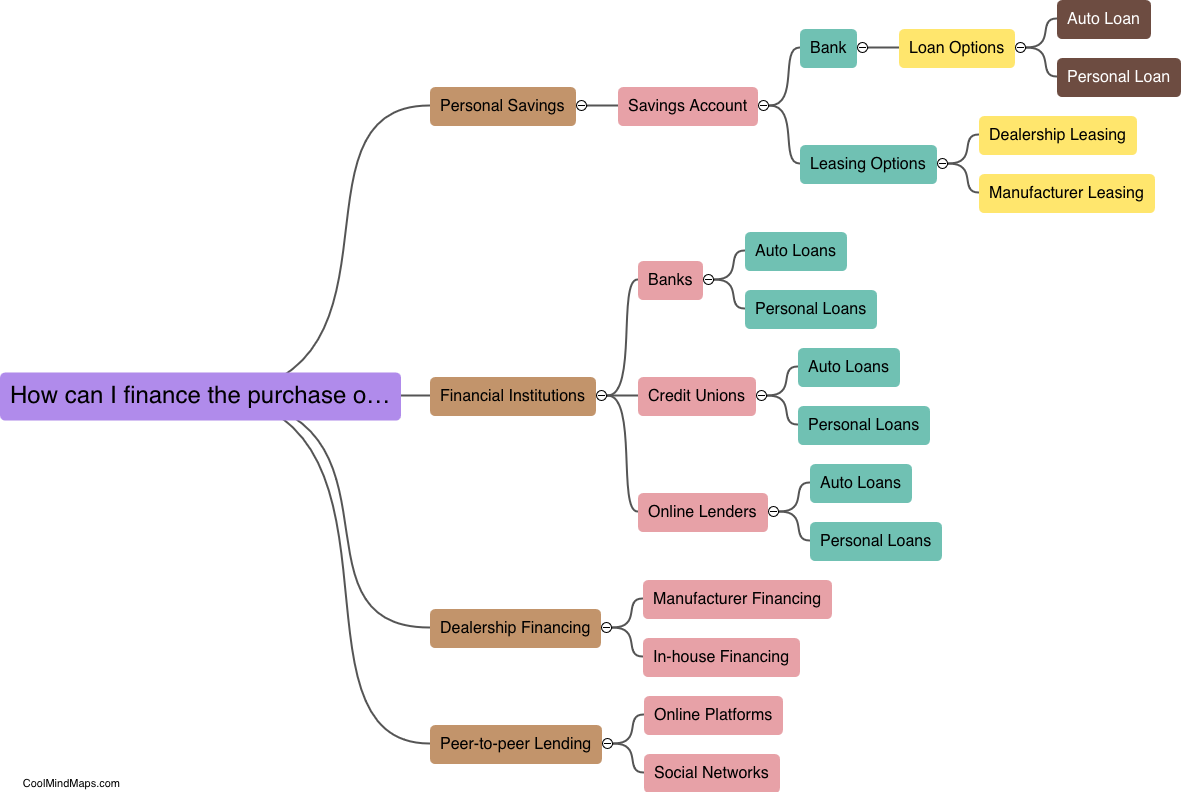

How can I finance the purchase of a car?

Financing the purchase of a car can be done through various options based on individual circumstances. One common method is to secure an auto loan from a bank or a credit union. This involves borrowing a specific amount of money, usually with a fixed interest rate, and repaying it over an agreed-upon period of time. Another option is dealer financing, where the car dealership acts as the lender and provides the financing directly to the buyer. This option often comes with additional incentives or promotional offers. Additionally, individuals can opt for lease financing, which allows them to essentially rent the car for a predetermined period. This requires regular lease payments and the return of the vehicle at the end of the lease term. Exploring the various financing options, comparing interest rates, and understanding the terms and conditions are crucial steps in finding the most suitable method to finance a car purchase.

This mind map was published on 3 January 2024 and has been viewed 89 times.