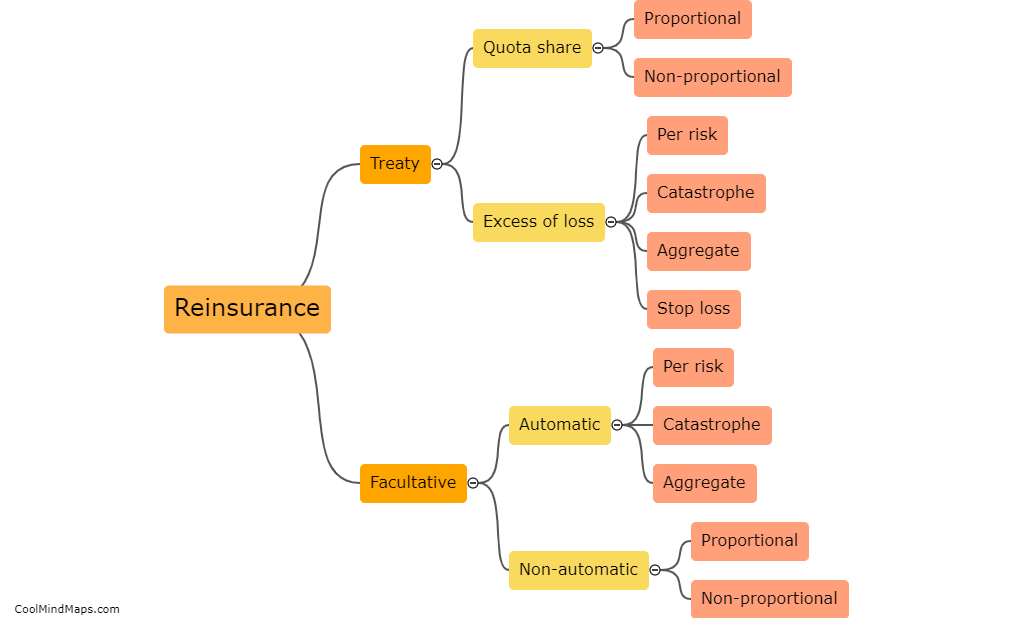

What are the different types of reinsurance?

Reinsurance refers to the practice of insurers transferring a portion of their risk to other insurance companies. There are several types of reinsurance arrangements available. The most common one is called proportional reinsurance, where the insurer cedes a specific percentage of the risk and premium to the reinsurer, who then shares in the underwriting profits and losses. Another type is non-proportional reinsurance, which includes excess of loss and stop-loss arrangements. Excess of loss covers losses that exceed a certain threshold, while stop-loss provides coverage for losses that surpass a pre-determined maximum limit. Additionally, there are specialty forms of reinsurance, such as catastrophe or retrocession reinsurance, which offer coverage for specific risks or for reinsurers themselves. Each type of reinsurance serves a unique purpose in managing and mitigating potential risks faced by insurance companies.

This mind map was published on 3 September 2023 and has been viewed 138 times.