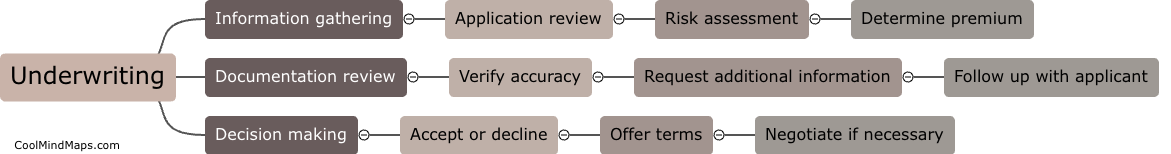

What happens during underwriting?

During underwriting, the insurance company evaluates the risk involved in insuring a particular policyholder. This involves a thorough examination of the policyholder's application, medical history, and any other relevant information. Based on this information, the insurance company may decide to offer coverage, deny coverage, or offer coverage with certain restrictions or conditions. Underwriting is an essential process in determining the financial stability and viability of the insurance company and ensuring that policyholders receive the appropriate level of coverage for the risks involved.

This mind map was published on 28 May 2023 and has been viewed 97 times.