What challenges has Bain Capital faced in sports investments?

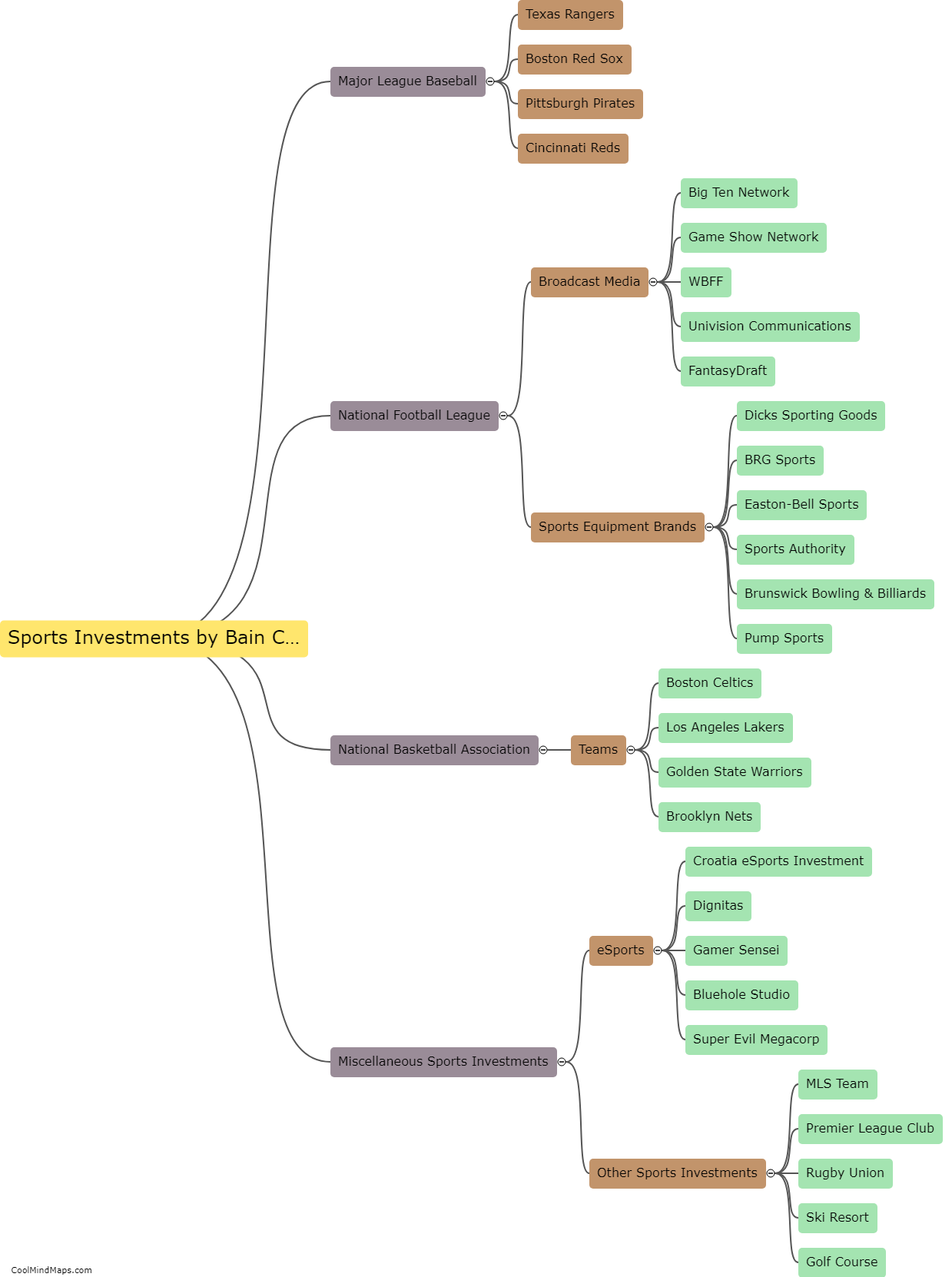

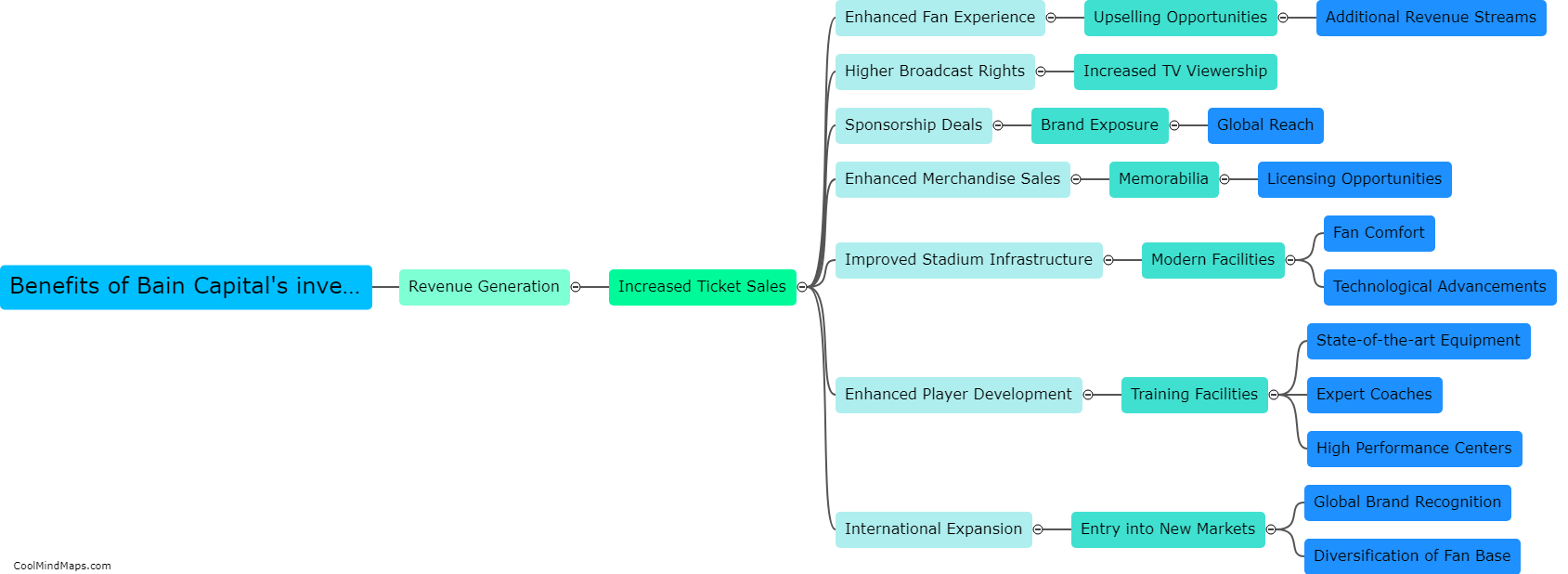

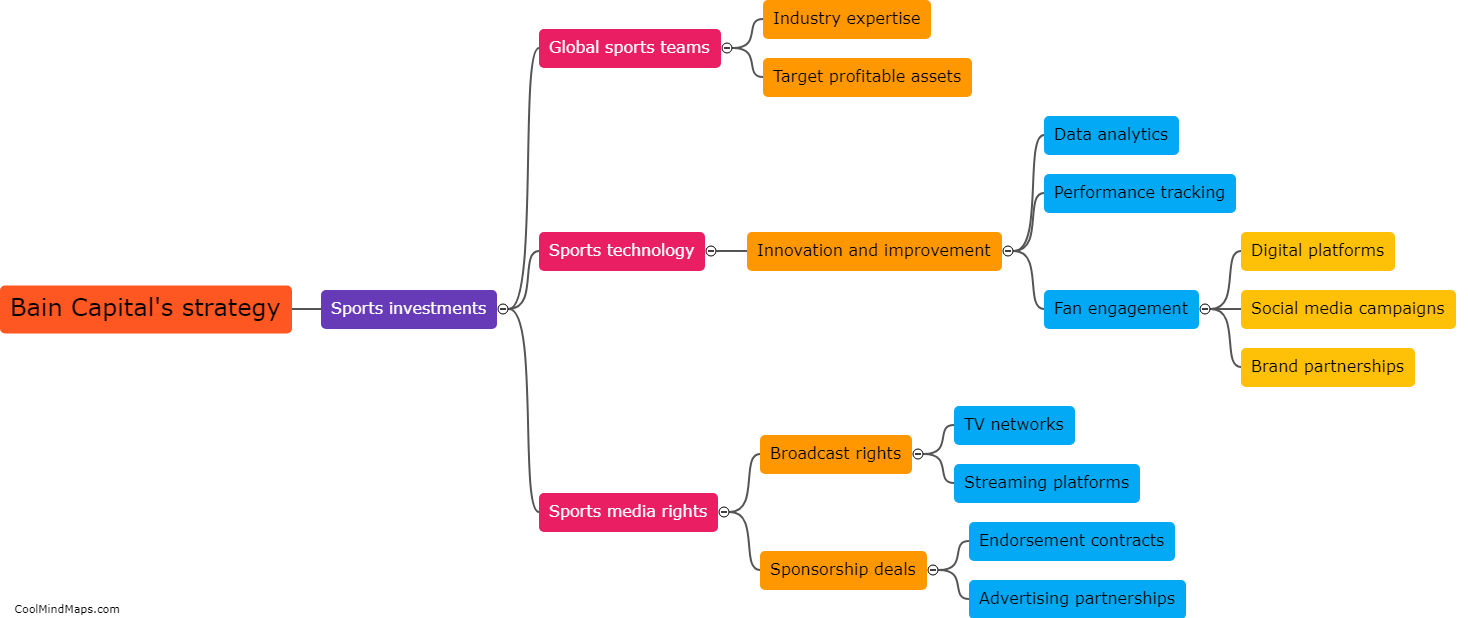

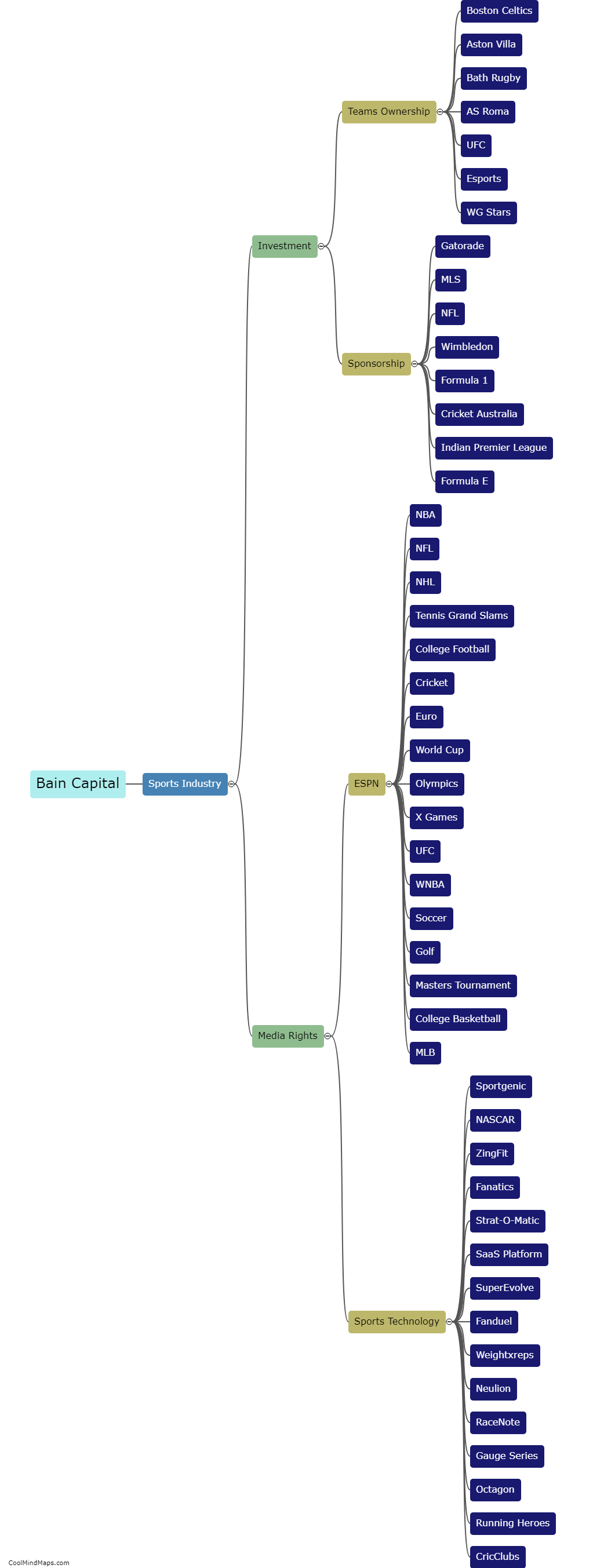

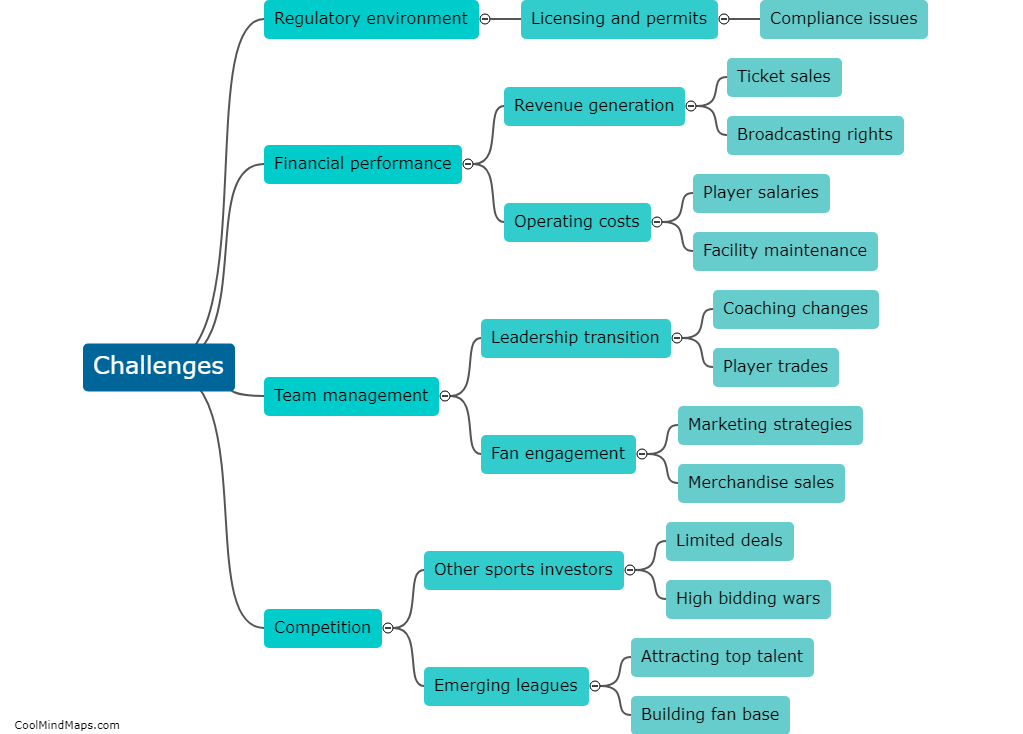

Bain Capital, a leading private equity firm, has encountered various challenges in its sports investments. One notable challenge has been the unpredictable nature of the sports industry, making it difficult to guarantee returns on investments. The outcomes of games, market demand for sports events, and factors influencing fan engagement can significantly impact profitability. Additionally, the high costs associated with acquiring sports franchises or investing in sports teams pose a challenge. These acquisitions require significant capital investments, making it essential for Bain Capital to carefully assess the potential risks and rewards of such investments. Furthermore, managing the complex dynamics within the sports ecosystem, including player contracts, labor negotiations, and league regulations, can present unique challenges. Bain Capital must navigate through these challenges to ensure successful investments in the highly competitive and ever-evolving sports sector.

This mind map was published on 4 November 2023 and has been viewed 93 times.