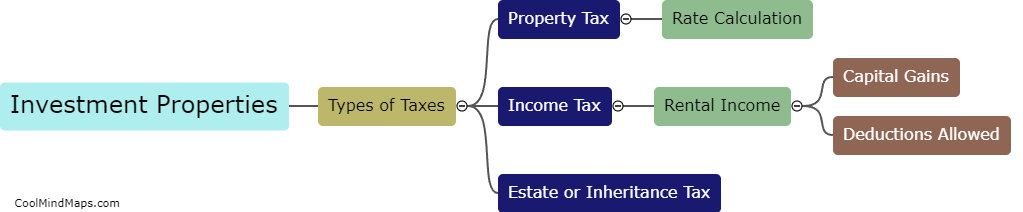

What are the tax implications of owning investment properties?

Owning investment properties can have various tax implications, including potential deductions for mortgage interest, property taxes, repairs, and depreciation. However, any income earned from renting out the property is subject to taxation as rental income. Additionally, profits from the sale of investment properties may be taxed as capital gains. It is important for property owners to keep accurate records of all expenses related to their investment properties and consult with a tax professional to ensure compliance with all tax laws and regulations.

This mind map was published on 19 April 2023 and has been viewed 105 times.