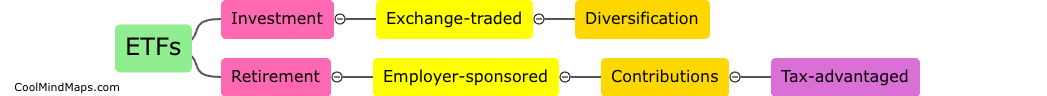

What are the differences between ETFs and pension plans?

ETFs (Exchange Traded Funds) and pension plans are two distinct investment options with different characteristics. ETFs are essentially a type of mutual fund that is traded on stock exchanges, whereas pension plans are retirement savings plans that are provided by employers to their employees. ETFs provide investors with the ability to buy and sell shares throughout the day, with the price often fluctuating based on market conditions. Pension plans, on the other hand, are typically designed as long-term savings vehicles with specific rules around contributions, withdrawals, and investment options. Additionally, pension plans are often subject to government regulations, such as required minimum distributions, while ETFs are not. While both offer investment opportunities, ETFs provide more flexibility while pension plans offer more stability as a long-term savings vehicle.

This mind map was published on 20 April 2023 and has been viewed 101 times.