What is start-up valuation?

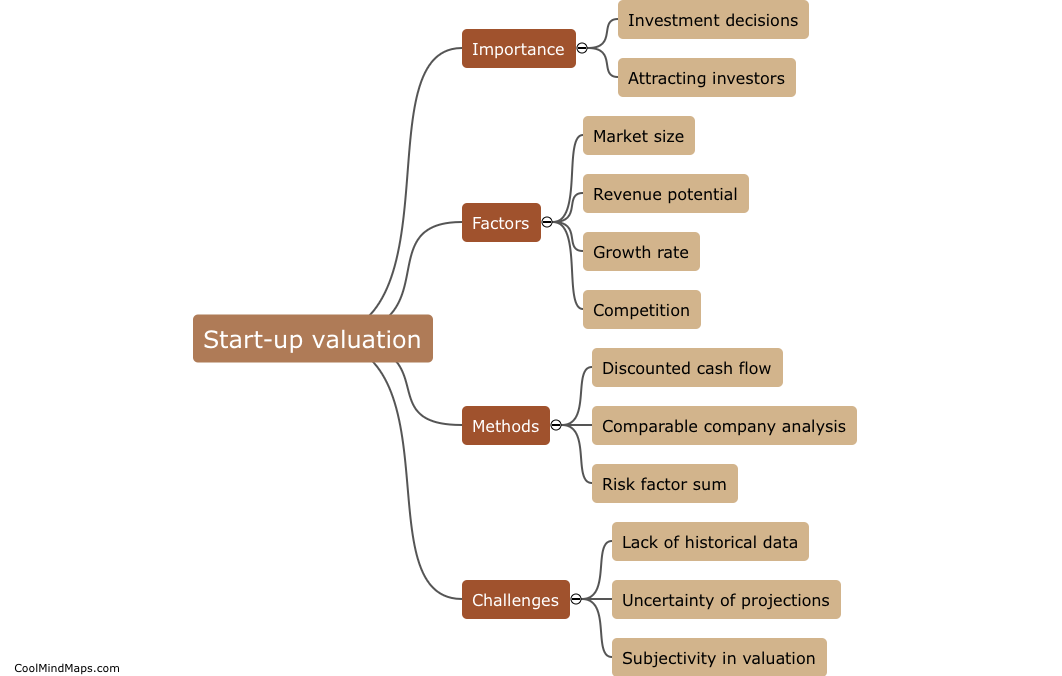

Start-up valuation refers to the process of determining the value of a company at its early stages of development. It involves considering various factors such as the company's product or service, market potential, competition, team strength, and projected future financial performance. The valuation helps entrepreneurs attract investors by demonstrating the company's potential for growth and return on investment. Accurately valuing a start-up is crucial for both the business and investors, as an over- or under-valued start-up can lead to financial losses or missed opportunities for growth. Therefore, it is essential to employ valuation methods and techniques that are reliable and appropriate for the particular start-up in question.

This mind map was published on 17 May 2023 and has been viewed 109 times.