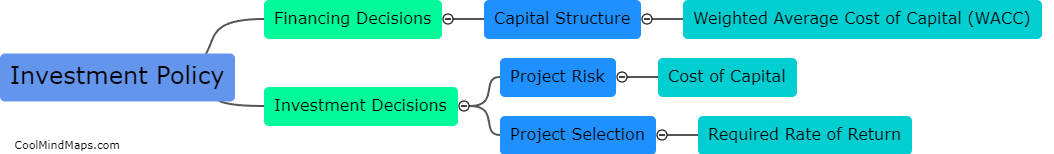

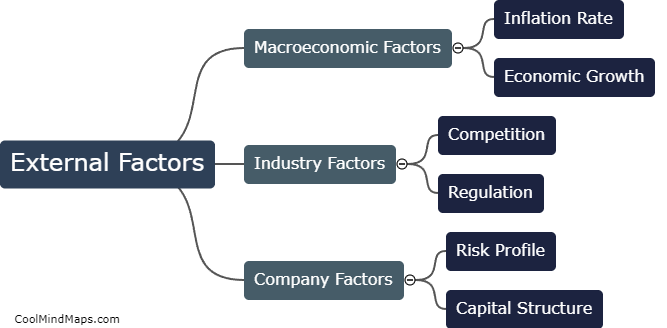

What are external factors influencing WACC?

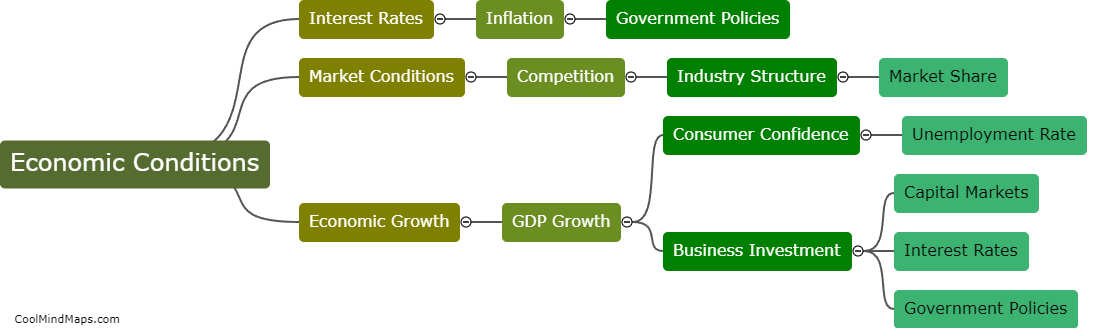

The Weighted Average Cost of Capital (WACC) is a key financial metric that helps determine the cost of financing for a company. Several external factors influence the WACC calculation. One significant factor is the prevailing interest rates in the economy, as changes in rates can impact the cost of debt. Another crucial external element is the overall risk level of the market. When the market experiences higher levels of risk, investors demand higher returns, which can raise the cost of equity and subsequently increase the WACC. Other external factors that can affect WACC include the company's industry dynamics, country-specific factors such as political stability, inflation rates, and tax policies, as well as the overall state of the economy. These external factors constantly fluctuate and require careful monitoring and analysis of their impact on a company's WACC.

This mind map was published on 12 December 2023 and has been viewed 94 times.