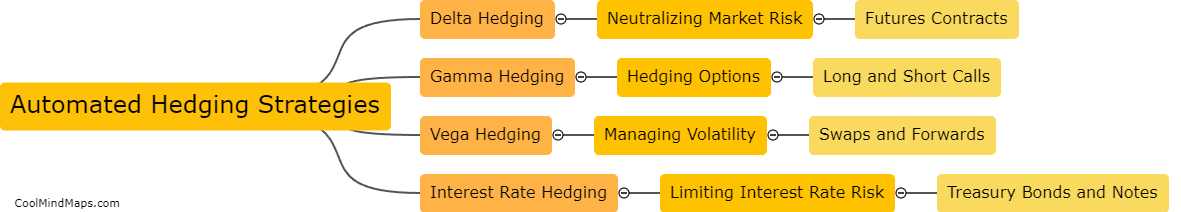

What are the common automated hedging strategies?

Automated hedging strategies are typically used by financial institutions to manage their risk exposure. One common automated hedging strategy is delta hedging, which involves adjusting an options portfolio to ensure that it remains neutral to small changes in the underlying asset's price. Another common strategy is gamma hedging, which involves adjusting an options portfolio as the price of the underlying asset changes, in order to maintain the intended hedge ratio. Other automated hedging strategies include variance and volatility swaps, which enable market participants to trade on expected levels of volatility, and correlation trading, which involves taking positions based on the observed relationship between different assets.

This mind map was published on 7 June 2023 and has been viewed 107 times.