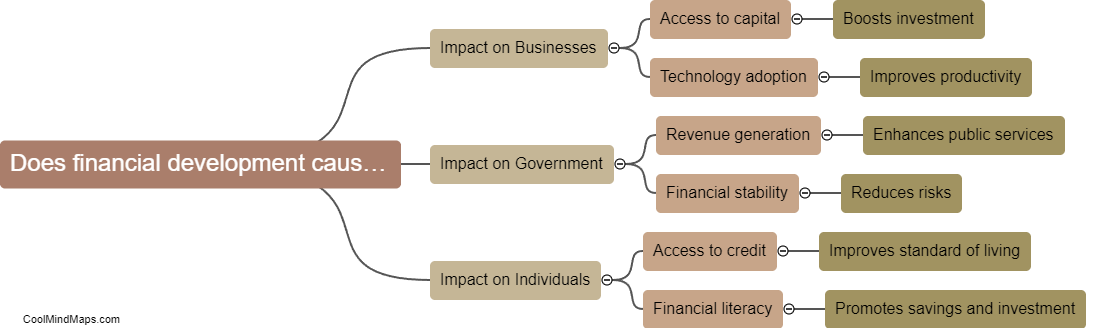

Does financial development cause economic growth?

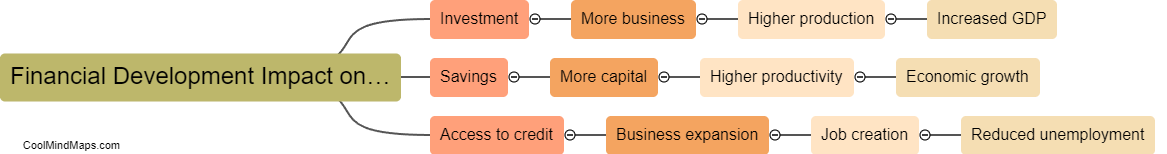

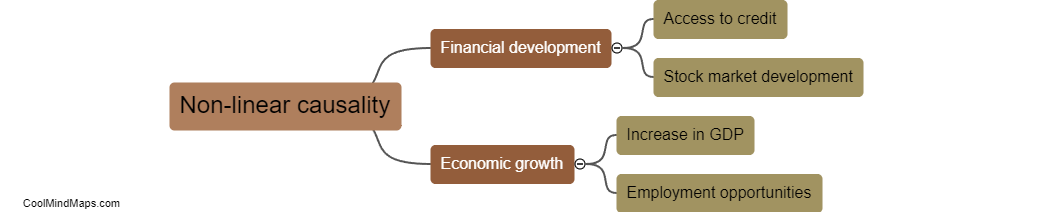

The relationship between financial development and economic growth is complex and multifaceted. While some studies suggest that a well-developed financial system can stimulate economic growth by providing access to credit and facilitating investment, others argue that the direction of causality may go the other way, with economic growth leading to financial development. Additionally, some researchers contend that the relationship between financial development and economic growth is contingent upon other factors such as institutional quality, technological innovation, and human capital. Overall, the consensus in the literature is that while financial development can be an important driver of economic growth, it is not the only factor at play, and its impact may vary depending on the context.

This mind map was published on 21 February 2024 and has been viewed 111 times.