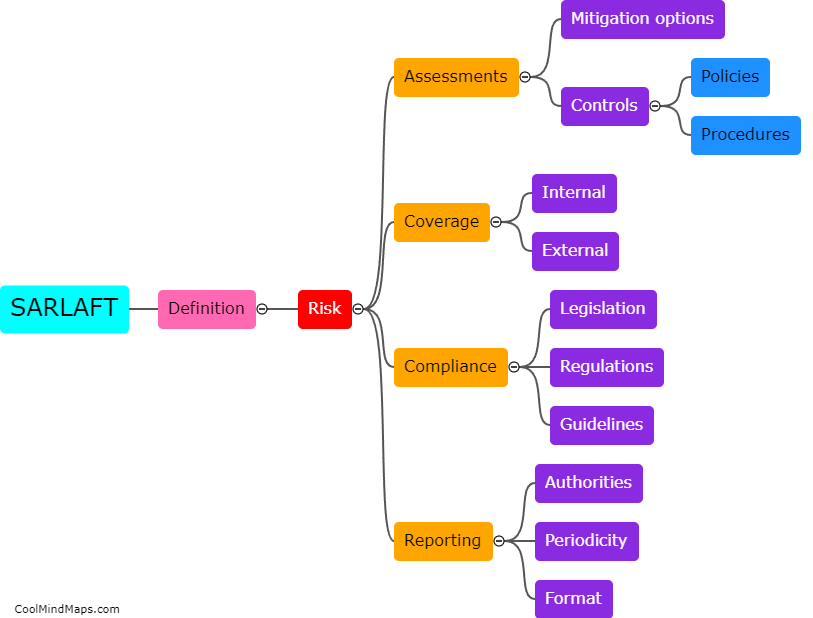

Definition of SARLAFT

SARLAFT, which stands for Sistema de Administración del Riesgo de Lavado de Activos y de la Financiación del Terrorismo (Risk Management System against Money Laundering and Terrorism Financing), is a framework established by financial regulatory bodies to prevent and detect money laundering and terrorism financing activities. It encompasses a set of policies, procedures, and controls implemented by financial institutions to identify and assess potential risks, establish customer due diligence measures, monitor transactions, and report suspicious activities to relevant authorities. SARLAFT aims to safeguard the integrity of the financial system, protect it from illicit activities, and promote transparency and accountability within the financial sector.

This mind map was published on 4 October 2023 and has been viewed 105 times.