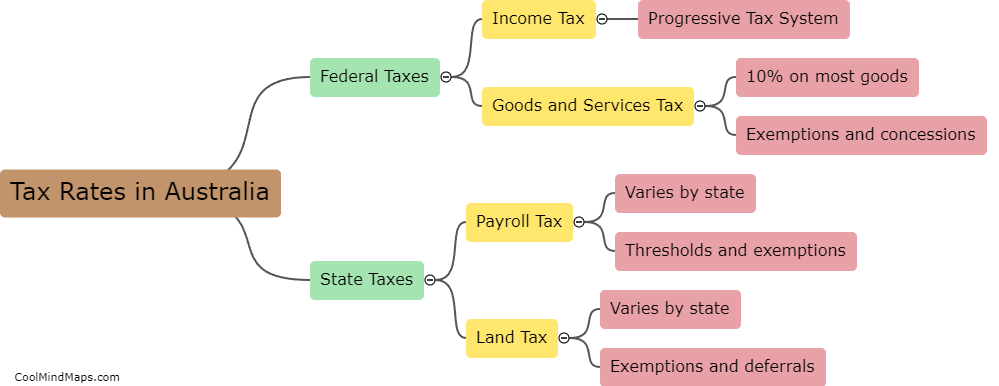

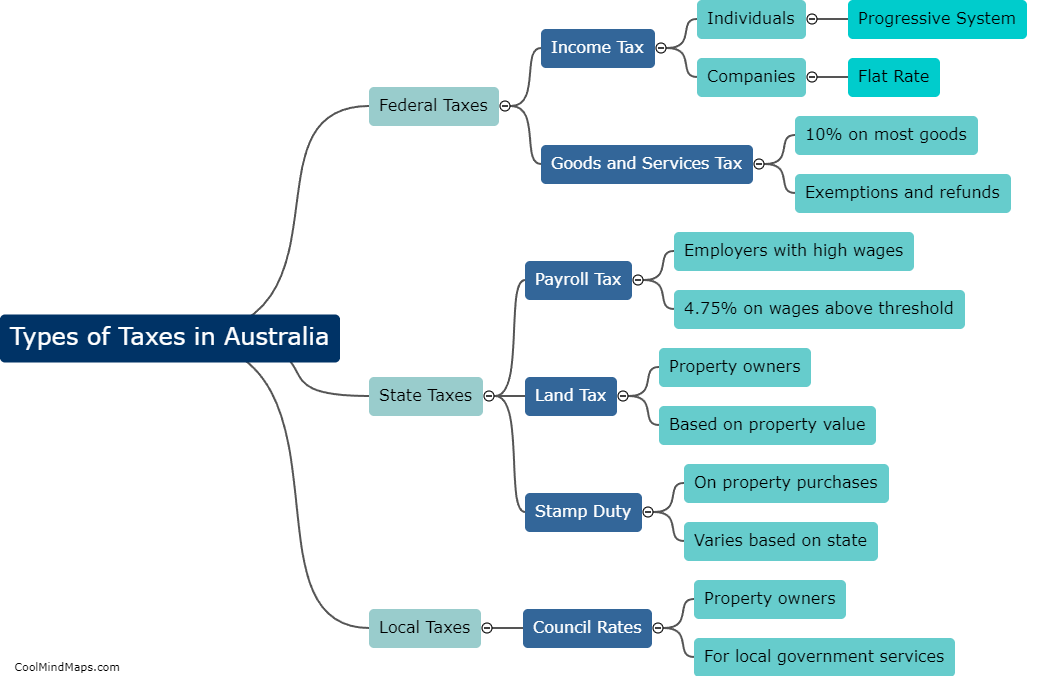

What is the Australian taxation system?

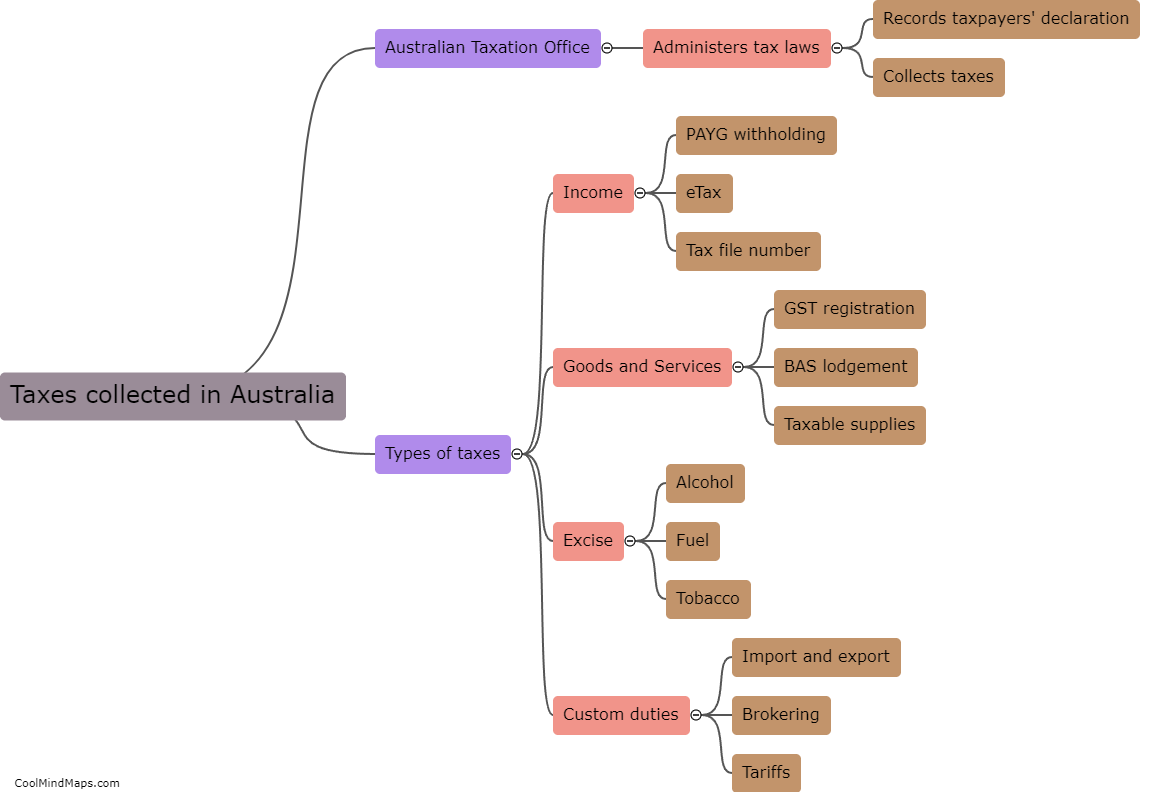

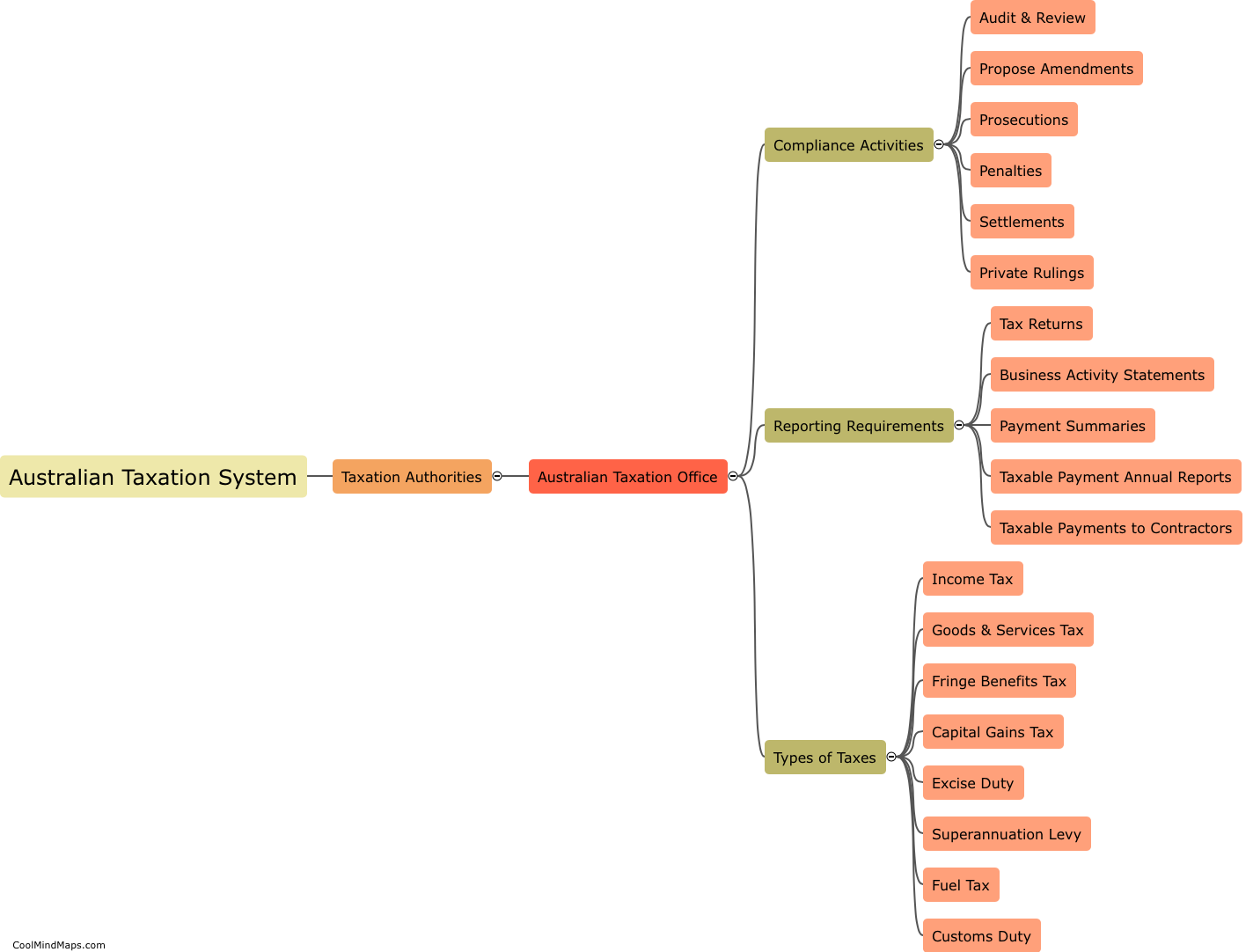

The Australian taxation system is a complex system of financial regulations and rules that govern the collection and distribution of income tax and other taxes such as goods and services tax (GST), customs and excise duty, and stamp duty. The Australian Taxation Office (ATO) is responsible for administering the country's tax system, which includes managing the collection of taxes, processing tax returns, and enforcing compliance with tax laws and regulations. The taxation system is designed to ensure that individuals and businesses pay their fair share of taxes, which funds essential government services, including healthcare, education, and infrastructure development. Taxes are levied on a progressive scale, meaning that higher earners pay a greater proportion of their income in taxes.

This mind map was published on 21 May 2023 and has been viewed 114 times.