How to form a holding company LLC?

To form a holding company LLC, you must first choose a name for your company and check its availability with the state's business registrar. Next, you will need to file articles of organization with the state, outlining the structure and purpose of your holding company. It is also important to draft an operating agreement that specifies the responsibilities and rights of the members. Additionally, obtain any necessary licenses and permits, and apply for an Employer Identification Number (EIN) from the IRS. Finally, maintain proper records and comply with all tax and regulatory requirements to ensure the success and legality of your holding company LLC.

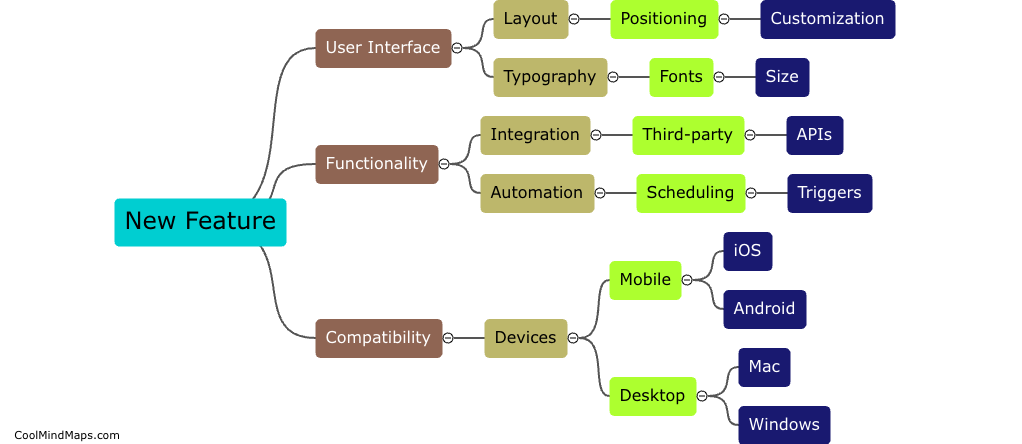

This mind map was published on 11 April 2024 and has been viewed 155 times.