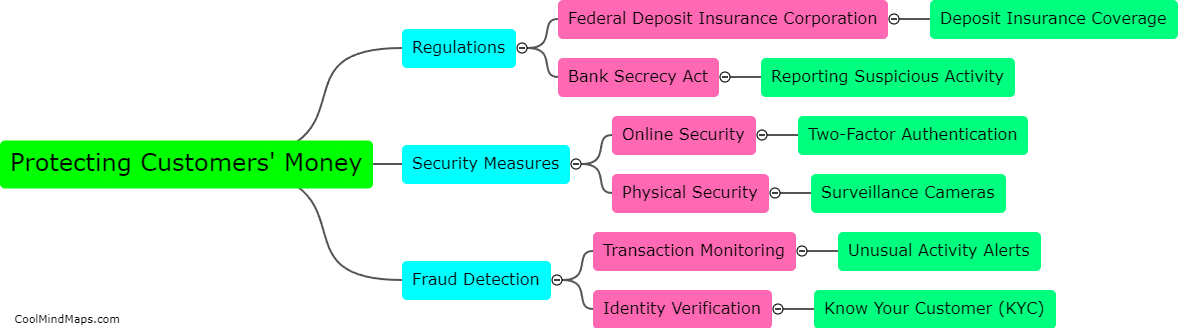

How do banks protect customers' money?

Banks protect customers' money in a number of ways. One of the most basic protections is through federal deposit insurance, which guarantees that depositors' funds are insured up to a certain amount if the bank fails. Additionally, banks employ a variety of security measures to prevent fraud and theft, including encryption and firewalls for online banking, physical security measures like cameras and security checkpoints, and constant monitoring of customer accounts for suspicious activity. Banks also perform rigorous background and credit checks on employees and contractors to ensure that they are trustworthy and reliable. Overall, banks take a comprehensive approach to protecting customer money, with multiple layers of security and safeguards in place to mitigate risk and ensure peace of mind for their clients.

This mind map was published on 16 May 2023 and has been viewed 103 times.