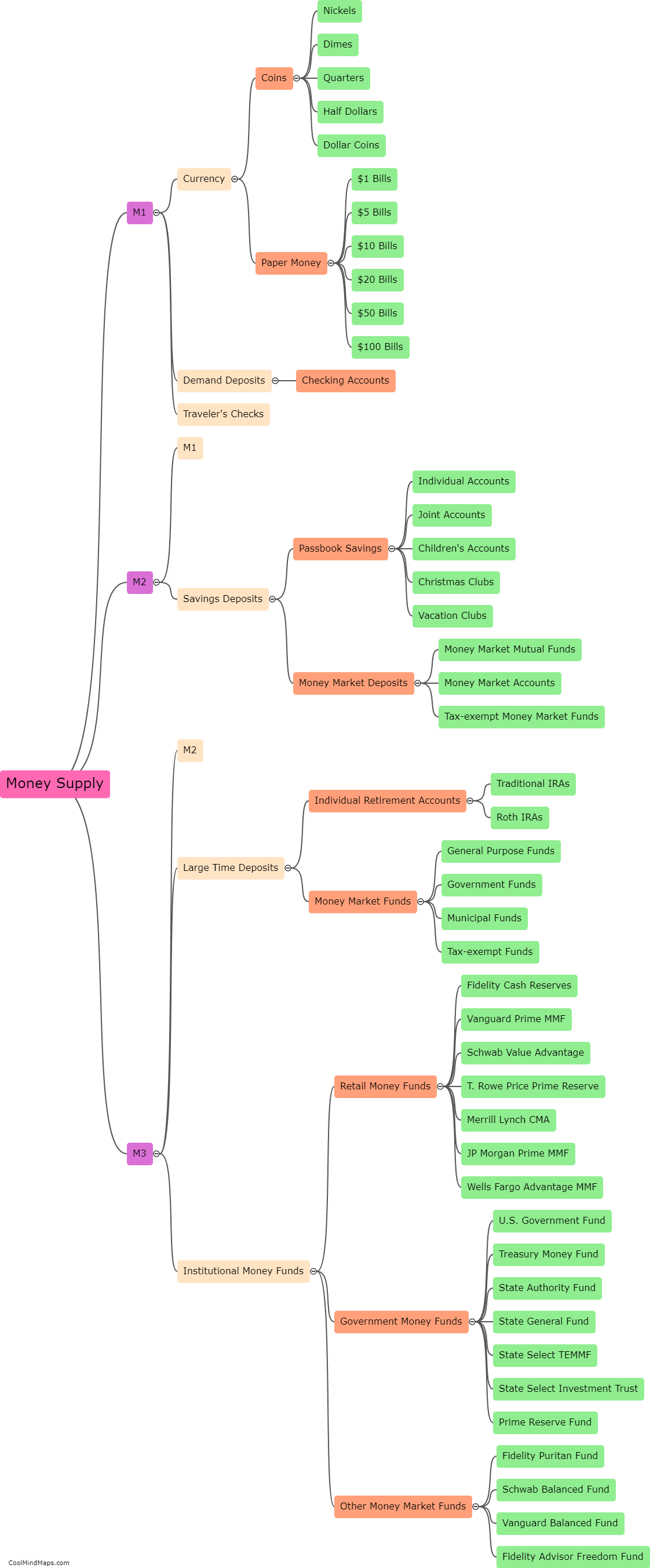

What are the different components of money supply?

Money supply refers to the total amount of money circulating in an economy at a given point in time. There are several components that make up the money supply. The most widely recognized component is M1, which includes currency in circulation (physical notes and coins) and demand deposits held by individuals and businesses. Another component is M2, which includes M1 along with less liquid forms of money such as savings deposits, time deposits, and money market mutual funds. Additionally, there is M3, which includes M2 along with larger time deposits, institutional money market funds, and other forms of less liquid financial assets. Each component of the money supply plays a key role in the functioning of the economy and is monitored by central banks to regulate monetary policy.

This mind map was published on 19 September 2023 and has been viewed 85 times.