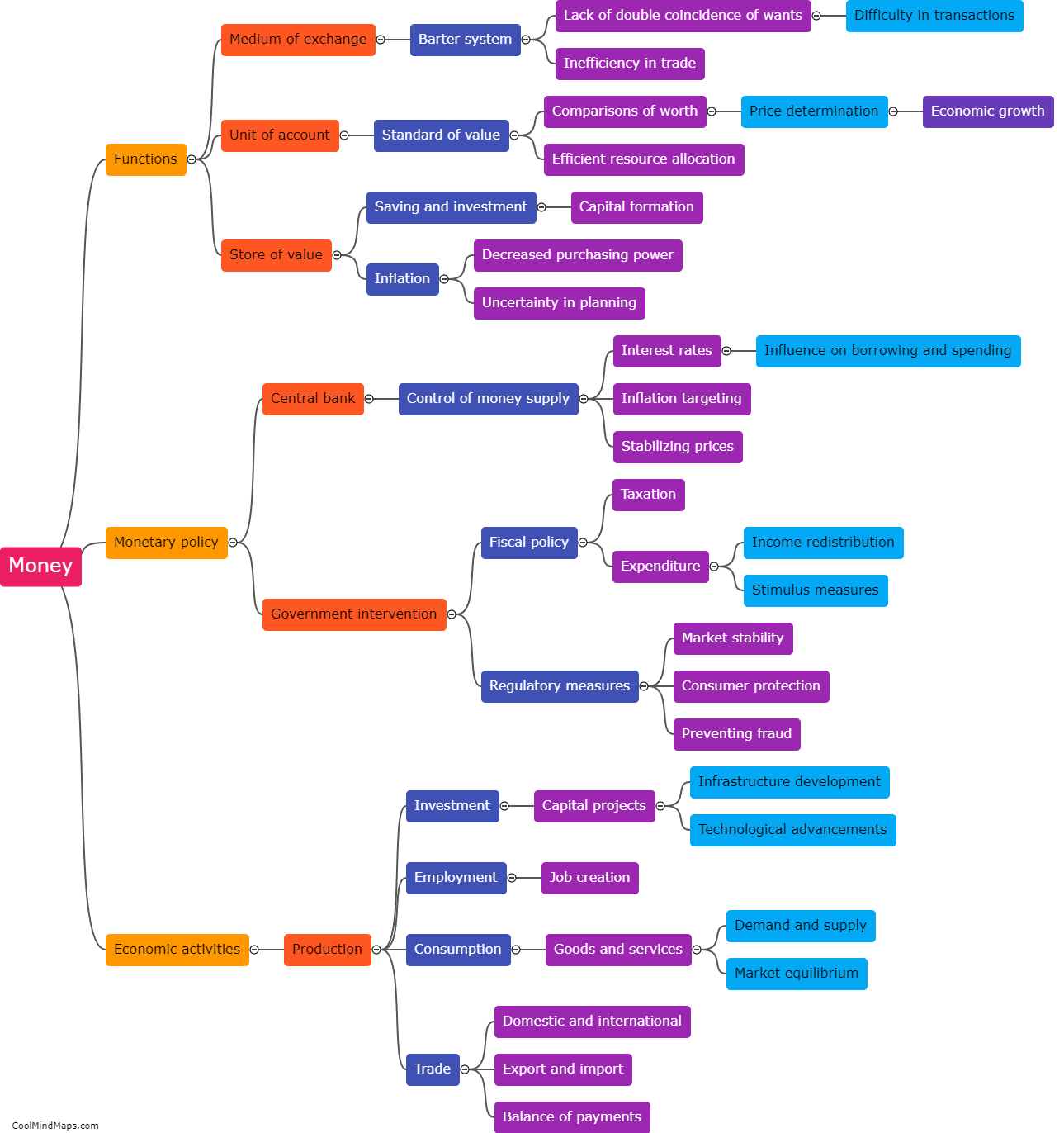

What are the functions of money?

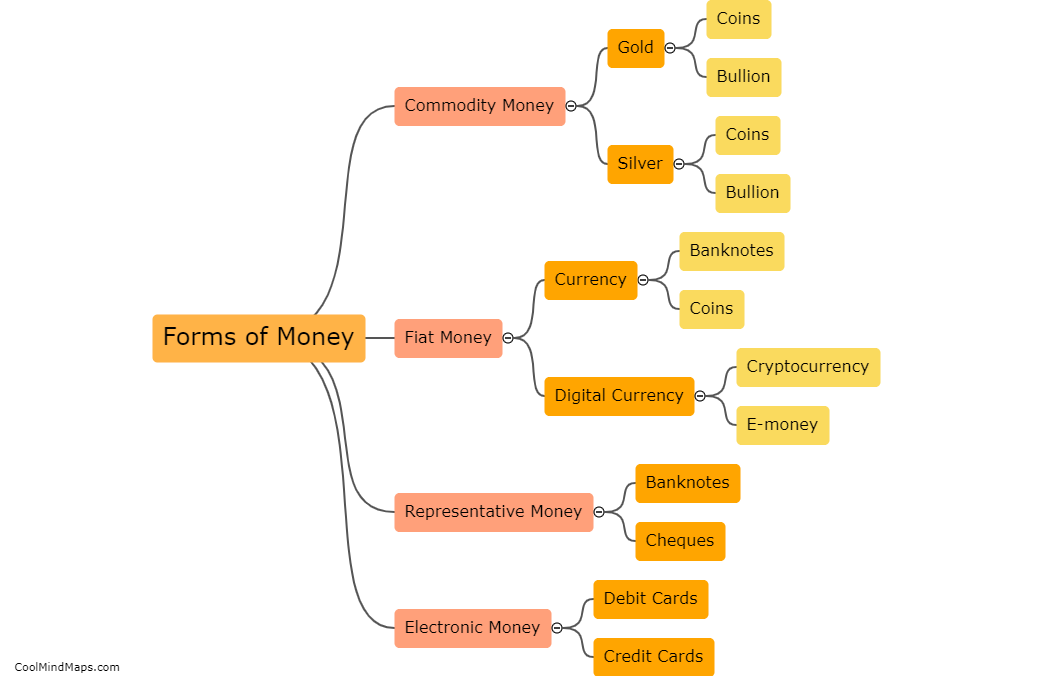

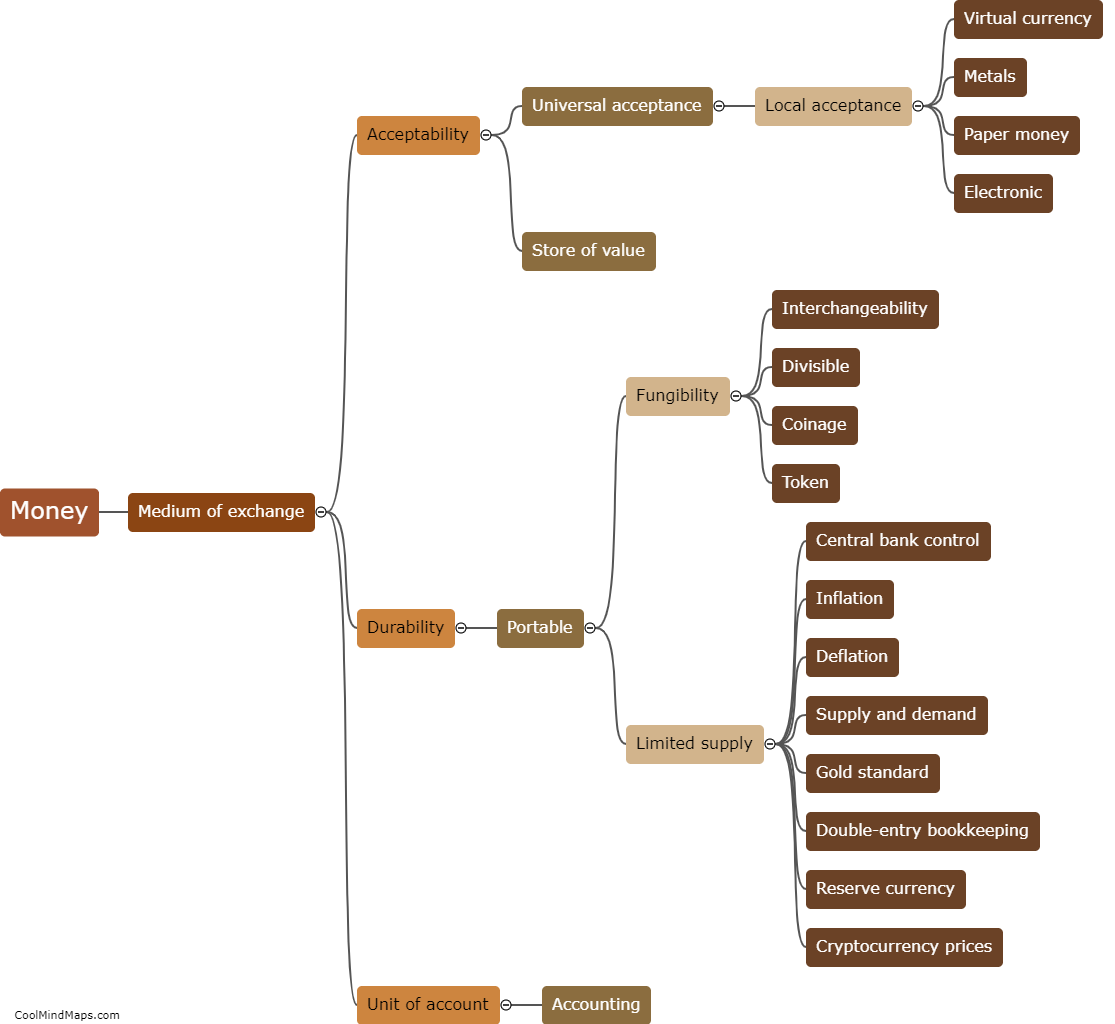

The functions of money refer to the various roles that money plays in an economy. First and foremost, money acts as a medium of exchange, enabling goods and services to be bought and sold with ease. It eliminates the need for barter and facilitates transactions by serving as a universally accepted form of payment. Money also functions as a unit of account, providing a common measure of value for goods and services. It enables individuals and businesses to compare prices, calculate profits, and make informed economic decisions. In addition, money serves as a store of value, allowing individuals to save and accumulate wealth over time. Lastly, money acts as a standard of deferred payment, allowing debts to be repaid in the future, providing a mechanism for borrowing and lending. These functions of money contribute to the overall efficiency and stability of an economy.

This mind map was published on 4 October 2023 and has been viewed 87 times.