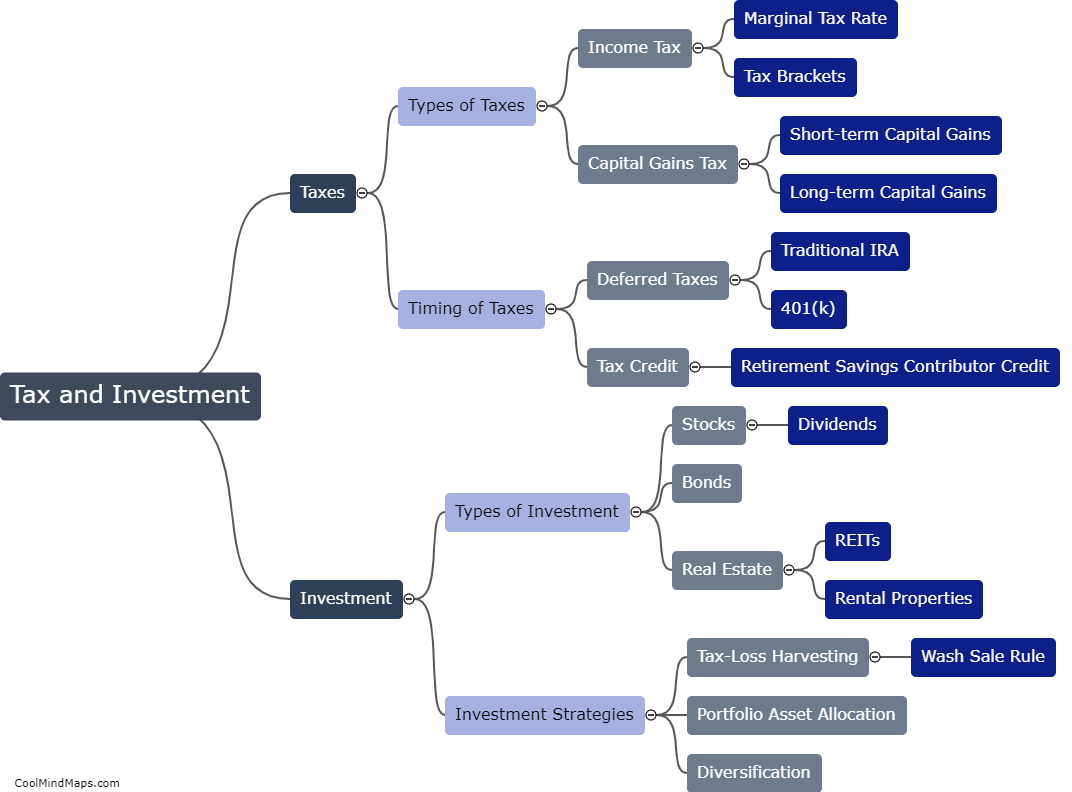

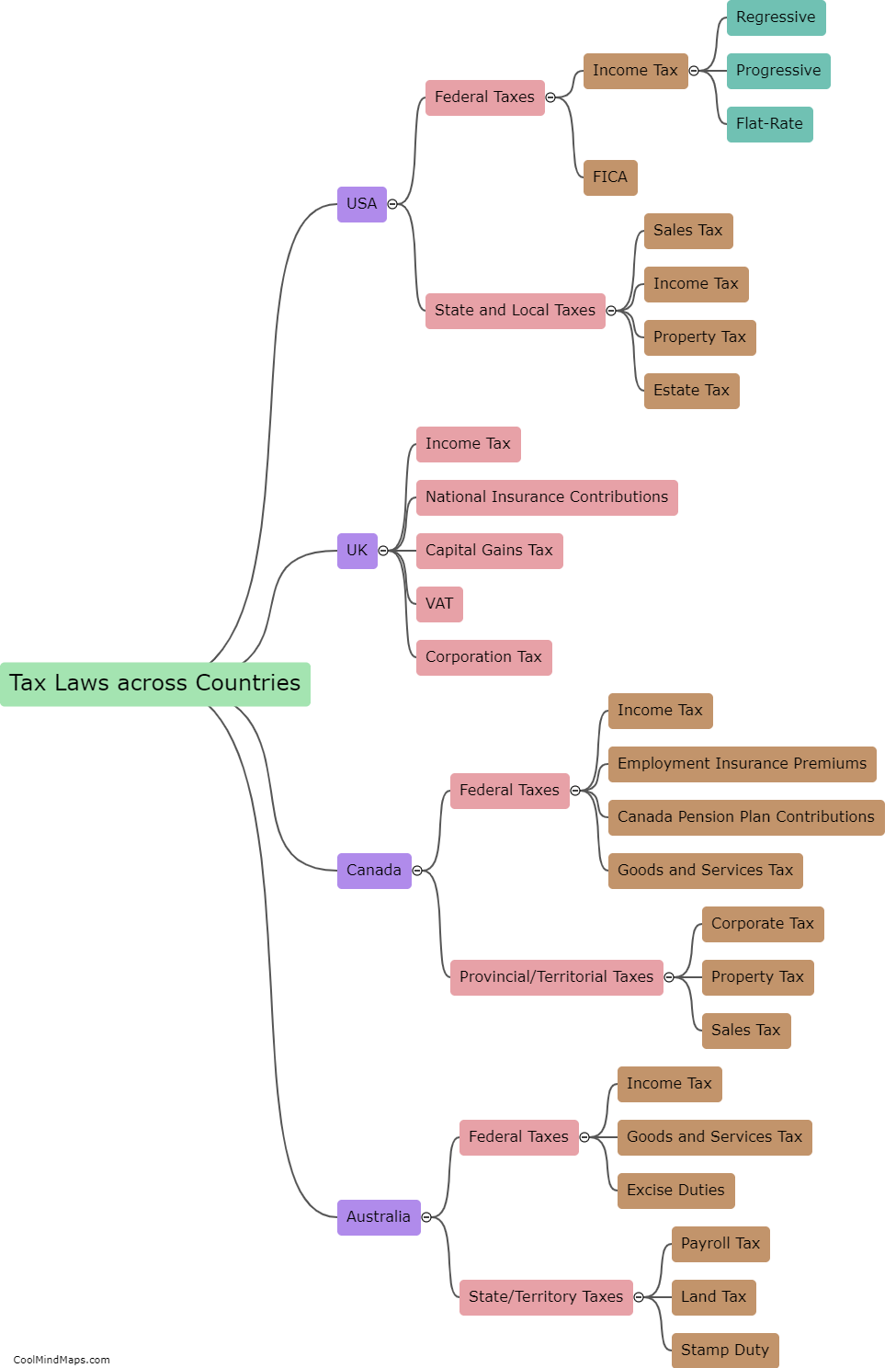

How do tax laws vary across different countries?

Tax laws vary widely across different countries depending on factors such as the tax system, the country's economic structure, and its political ideology. For example, some countries have high tax rates and offer more social services, while others have lower tax rates and emphasize personal responsibility. Additionally, the tax laws in one country may be more complex than in another, requiring individuals and businesses to engage in more detailed tax planning and compliance activities. Understanding the differences in tax laws across countries is important for individuals and businesses who operate or invest internationally, as compliance with these laws can have significant financial and legal implications.

This mind map was published on 18 April 2023 and has been viewed 103 times.