What are the benefits of using artificial intelligence in banking?

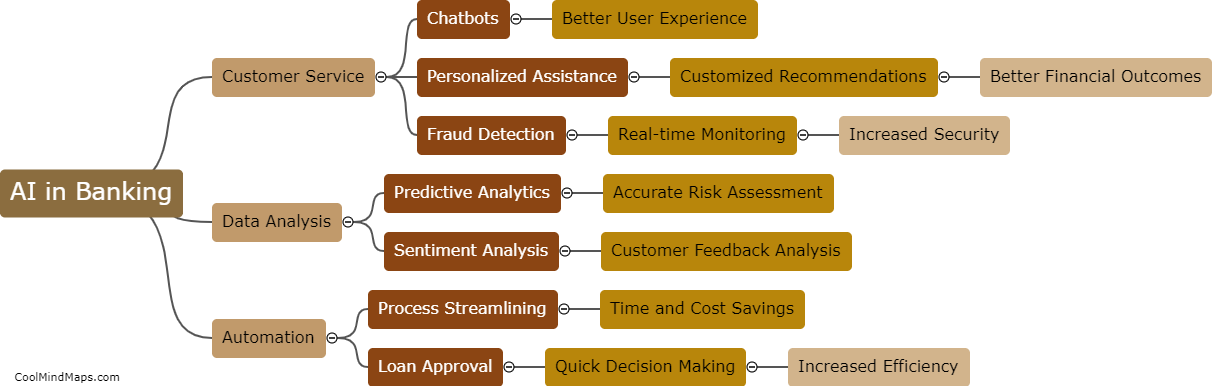

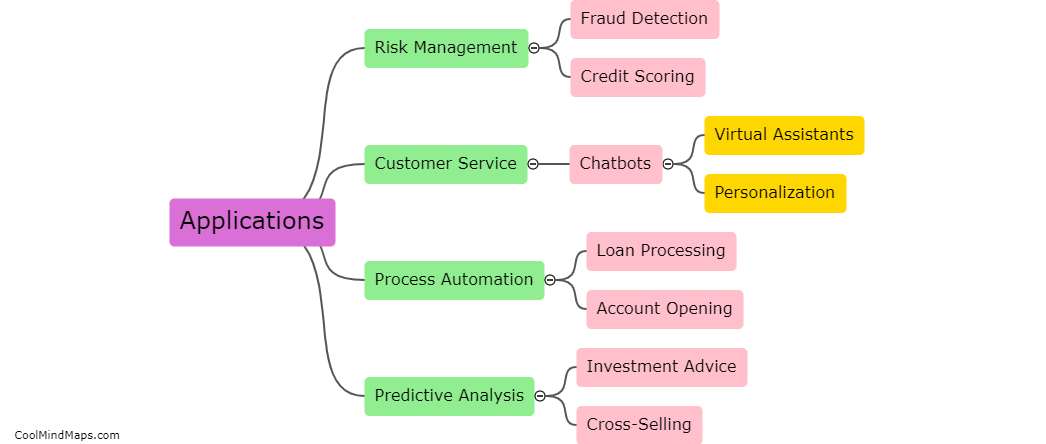

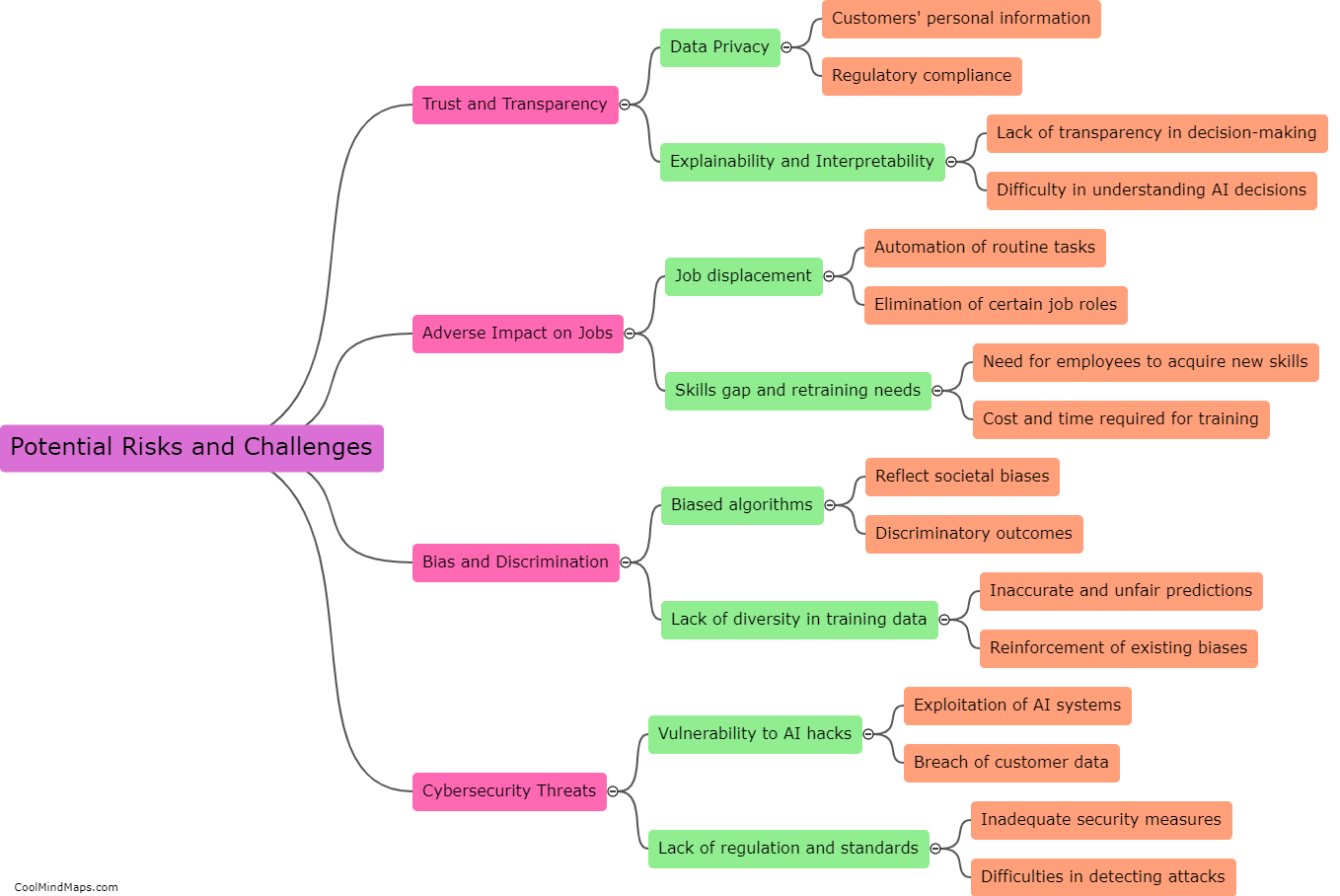

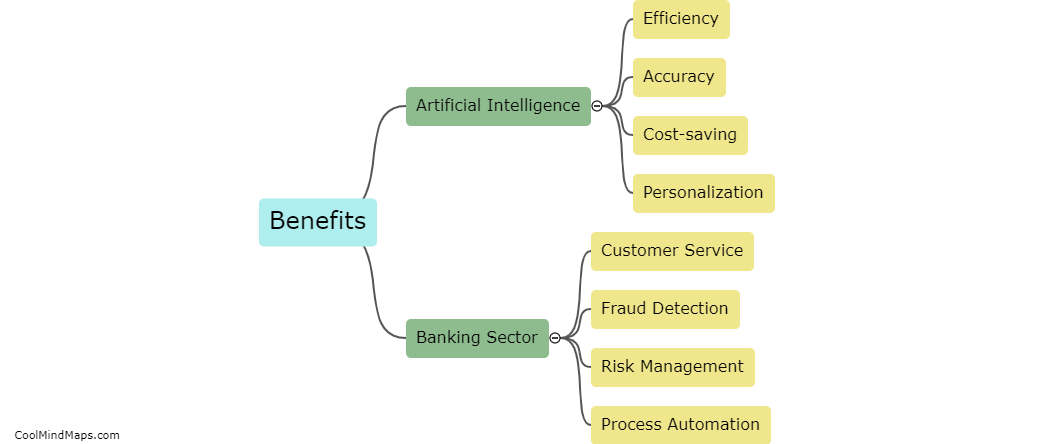

Artificial intelligence (AI) has significantly transformed the banking industry by revolutionizing operations, enhancing customer experiences, and improving efficiency. One of the primary benefits of AI in banking is its ability to analyze vast amounts of data quickly and accurately, enabling banks to gain valuable insights and make informed decisions. AI-powered chatbots and virtual assistants allow for personalized customer interactions, providing round-the-clock support, answering queries, and even assisting with financial planning. Fraud detection and prevention have also greatly benefitted from AI, as machine learning algorithms can identify patterns and anomalies in real-time, minimizing risks. By automating manual tasks, AI optimizes operational efficiency, reduces costs, and frees up staff to focus on more complex and value-added activities. In summary, AI integration in banking empowers institutions to deliver enhanced services, increase customer satisfaction, and drive digital transformation.

This mind map was published on 24 September 2023 and has been viewed 84 times.