What are the risks in algo trading?

Algorithmic trading, or algo trading, carries several risks that traders should be aware of. One of the main risks is the possibility of technical glitches or bugs in the algorithm, which can result in erroneous trades and significant losses. Additionally, as algorithms are programmed to constantly monitor market data and execute trades automatically, they may cause significant market volatility if they make trading decisions that deviate from traditional trading patterns. Furthermore, there may be legal and ethical risks associated with algo trading, particularly if the algorithm is not transparent and its trading decisions cannot be explained.

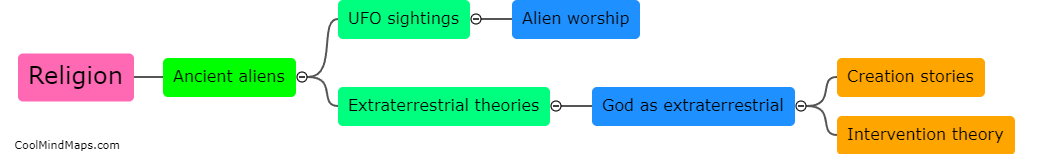

This mind map was published on 5 June 2023 and has been viewed 142 times.